Question: Direct Computation of Nonoperating Return with Noncontrolling Interest Balance sheets and income statements for Best Buy Co., Inc. follow. PLEASE HELP WITH C,D,E,& F THANK

Direct Computation of Nonoperating Return with Noncontrolling Interest

Balance sheets and income statements for Best Buy Co., Inc. follow.

PLEASE HELP WITH C,D,E,& F

THANK YOU !!

| Consolidated Statements of Earnings | |||

|---|---|---|---|

| For Fiscal Years Ended ($ millions) | February 27, 2010 | February 28, 2009 | March 1, 2008 |

| Revenue | $ 49,694 | $ 45,015 | $ 40,023 |

| Cost of goods sold | 37,534 | 34,017 | 30,477 |

| Restructuring charges - cost of goods sold | -- | -- | -- |

| Gross Profit | 12,160 | 10,998 | 9,546 |

| Selling, general and administrative expenses | 9,873 | 8,984 | 7,385 |

| Restructuring charges | 52 | 78 | -- |

| Goodwill and tradename impairment | -- | 66 | -- |

| Operating income | 2,235 | 1,870 | 2,161 |

| Other income (expense) | |||

| Investment income and other | 54 | 35 | 129 |

| Investment impairment | -- | (111) | -- |

| Interest expense | (94) | (94) | (62) |

| Earnings before income tax expense and equity in income of affiliates | 2,195 | 1,700 | 2,228 |

| Income tax expense | 802 | 674 | 815 |

| Equity in income of affiliates | 1 | 7 | (3) |

| Net earnings including noncontrolling interest | 1,394 | 1,033 | 1,410 |

| Net income attributable to noncontrolling interest | (77) | (30) | (3) |

| Net income attributable to Best Buy Co., Inc. | $ 1,317 | $ 1,003 | $ 1,407 |

| Consolidated Balance Sheets | ||

|---|---|---|

| ($ millions, except footnotes) | February 27, 2010 | February 28, 2009 |

| Assets | ||

| Current assets | ||

| Cash and cash equivalents | $ 1,826 | $ 498 |

| Short-term investments | 90 | 11 |

| Receivables | 2,020 | 1,868 |

| Merchandise inventories | 5,486 | 4,753 |

| Other current assets | 1,144 | 1,062 |

| Total current assets | 10,566 | 8,192 |

| Property and equipment | ||

| Land and buildings | 757 | 755 |

| Leasehold improvements | 2,154 | 2,013 |

| Fixtures and equipment | 4,447 | 4,060 |

| Property under capital lease | 95 | 112 |

| 7,453 | 6,940 | |

| Less: Accumulated depreciation | 3,383 | 2,766 |

| Property and equipment, net | 4,070 | 4,174 |

| Goodwill | 2,452 | 2,203 |

| Tradenames, net | 159 | 173 |

| Customer relationships, net | 279 | 322 |

| Equity and other investments | 324 | 395 |

| Other noncurrent assets | 452 | 367 |

| Total assets | $ 18,302 | $ 15,826 |

| Liabilities and equity | ||

| Current liabilities | ||

| Accounts payable | $ 5,276 | $ 4,997 |

| Unredeemed gift card liabilities | 463 | 479 |

| Accrued compensation and related expenses | 544 | 459 |

| Accrued liabilities | 1,681 | 1,382 |

| Accrued income taxes | 316 | 281 |

| Short-term debt | 663 | 783 |

| Current portion of long-term debt | 35 | 54 |

| Total current liabilities | 8,978 | 8,435 |

| Long-term liabilities | 1,256 | 1,109 |

| Long-term debt | 1,104 | 1,126 |

| Equity | ||

| Best Buy Co., Inc. Shareholders' equity | ||

| Preferred stock, $1.00 par value | -- | -- |

| Common stock, $0.10 par value | 42 | 41 |

| Additional paid-in capital | 441 | 205 |

| Retained earnings | 5,797 | 4,714 |

| Accumulated other comprehensive income (loss) | 40 | (317) |

| Total Best Buy Co., Inc. shareholders' equity | 6,320 | 4,643 |

| Noncontrolling interest | 644 | 513 |

| Total equity | 6,964 | 5,156 |

| Total liabilities and equity | $ 18,302 | $ 15,826 |

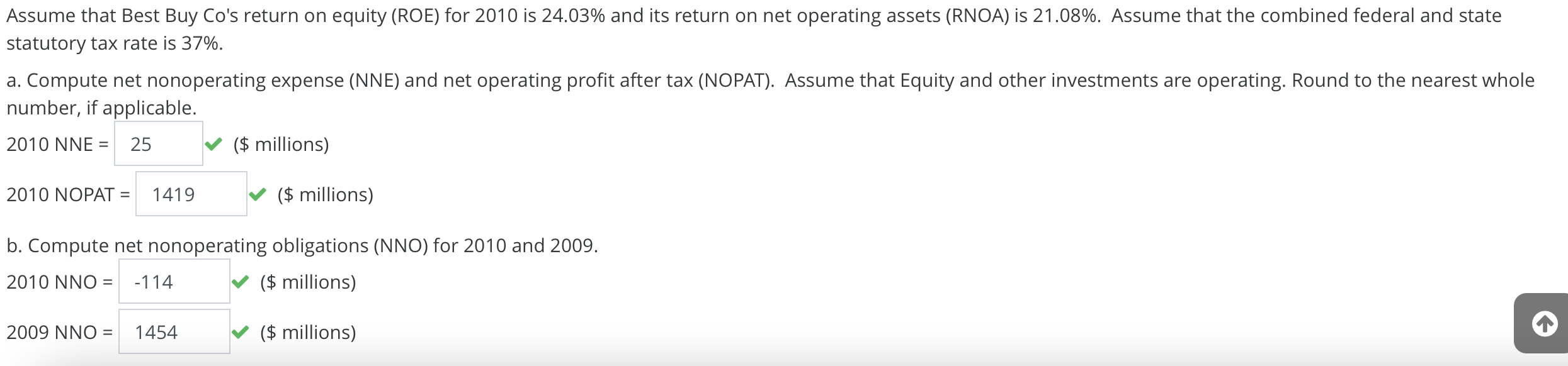

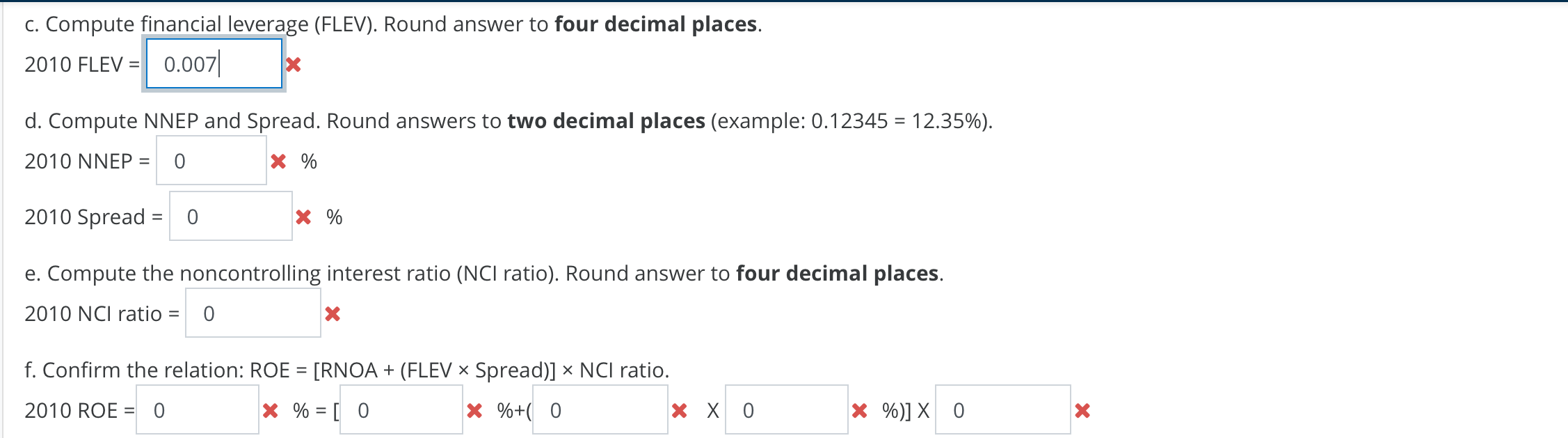

Assume that Best Buy Co's return on equity (ROE) for 2010 is 24.03% and its return on net operating assets (RNOA) is 21.08%. Assume that the combined federal and state statutory tax rate is 37%. a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume that Equity and other investments are operating. Round to the nearest whole number, if applicable. 2010 NNE = 25 ($ millions) 2010 NOPAT = 1419 ($ millions) b. Compute net nonoperating obligations (NNO) for 2010 and 2009. 2010 NNO = -114 ($ millions) 2009 NNO = 1454 ($ millions) C. Compute financial leverage (FLEV). Round answer to four decimal places. 0.007 2010 FLEV = d. Compute NNEP and Spread. Round answers to two decimal places (example: 0.12345 = 12.35%). 2010 NNEP = 0 X % 2010 Spread = 0 * % e. Compute the noncontrolling interest ratio (NCI ratio). Round answer to four decimal places. 2010 NCL ratio = 0 x f. Confirm the relation: ROE = [RNOA + (FLEV * Spread)] NCI ratio. 2010 ROE = 0 X % = [ 0 X %+( 0 X X 0 X %)] X 0 X Assume that Best Buy Co's return on equity (ROE) for 2010 is 24.03% and its return on net operating assets (RNOA) is 21.08%. Assume that the combined federal and state statutory tax rate is 37%. a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Assume that Equity and other investments are operating. Round to the nearest whole number, if applicable. 2010 NNE = 25 ($ millions) 2010 NOPAT = 1419 ($ millions) b. Compute net nonoperating obligations (NNO) for 2010 and 2009. 2010 NNO = -114 ($ millions) 2009 NNO = 1454 ($ millions) C. Compute financial leverage (FLEV). Round answer to four decimal places. 0.007 2010 FLEV = d. Compute NNEP and Spread. Round answers to two decimal places (example: 0.12345 = 12.35%). 2010 NNEP = 0 X % 2010 Spread = 0 * % e. Compute the noncontrolling interest ratio (NCI ratio). Round answer to four decimal places. 2010 NCL ratio = 0 x f. Confirm the relation: ROE = [RNOA + (FLEV * Spread)] NCI ratio. 2010 ROE = 0 X % = [ 0 X %+( 0 X X 0 X %)] X 0 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts