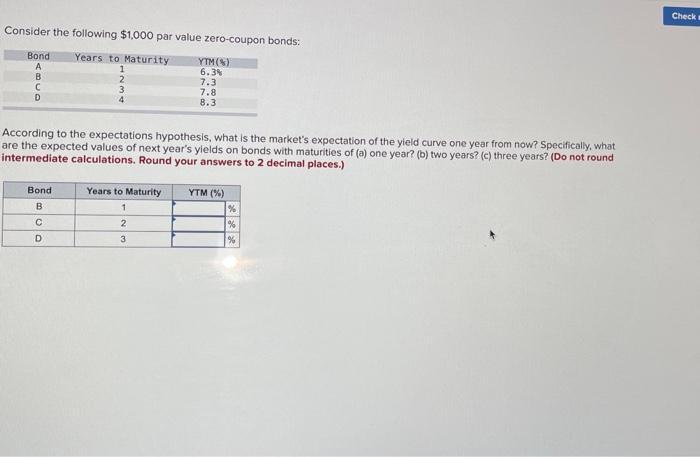

Question: Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity YTM (%) 6.3% A B 7.3 7.8 8.3 OnE: D 1 Bond

Consider the following $1,000 par value zero-coupon bonds: Bond Years to Maturity YTM (%) 6.3% A B 7.3 7.8 8.3 OnE: D 1 Bond B C D 2 3 According to the expectations hypothesis, what is the market's expectation of the yield curve one year from now? Specifically, what are the expected values of next year's yields on bonds with maturities of (a) one year? (b) two years? (c) three years? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Years to Maturity 1 2 3 YTM (%) % % % Check

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

rate on t year bond 1 year from now... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635dafa2188c9_178000.pdf

180 KBs PDF File

635dafa2188c9_178000.docx

120 KBs Word File