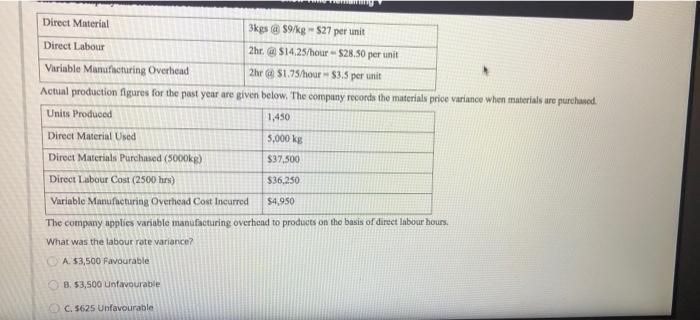

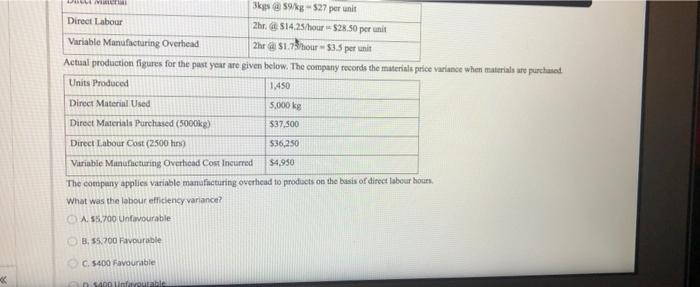

Question: Direct Material 3kgs @ $9/kg - 527 per unit Direct Labour 2hr. $14.25/hour $28.50 per unit Variable Manufacturing Overhead 2hr $1.75/hour $3.5 per unit Actual

Direct Material 3kgs @ $9/kg - 527 per unit Direct Labour 2hr. $14.25/hour $28.50 per unit Variable Manufacturing Overhead 2hr $1.75/hour $3.5 per unit Actual production figures for the past year are given below. The company records the materials price variance when materials are purchased Units Produced 1,450 Direct Material Used 5,000 kg $37,500 Direct Materials Purchased (5000kg) Direct Labour Cost (2500 hrs) $36.250 Variable Manufacturing Overhead Cost Incurred $4,950 The company applies variable manufacturing overhead to products on the basis of direct labour hours What was the labour rate variance? A $3,500 Favourable 8. 53,500 unfavourable C. 5625 Unfavourable LEM 398 $27 per unit Direct Labour 2hr $14.25hour $28.50 per unit Variable Manufacturing Overhead 2h $1.75hour $3.5 per unit Actual production figures for the past your are given below. The company records the materials price variance when materials are purchased Units Produced 1.450 Direct Material Used 5.000 kg Direct Materials Purchased (5000kg) $37,500 Direct Labour Cost (2500 hrs $36,250 Variable Manufacturing Overhead Cost Incurred $4.950 The company applies variable manufacturing overhead to products on the basis of direct labour hours What was the labour efficiency variance? CA 55,700 Unfavourable 3,55,700 Favourable C. 5400 Favourable Linavouable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts