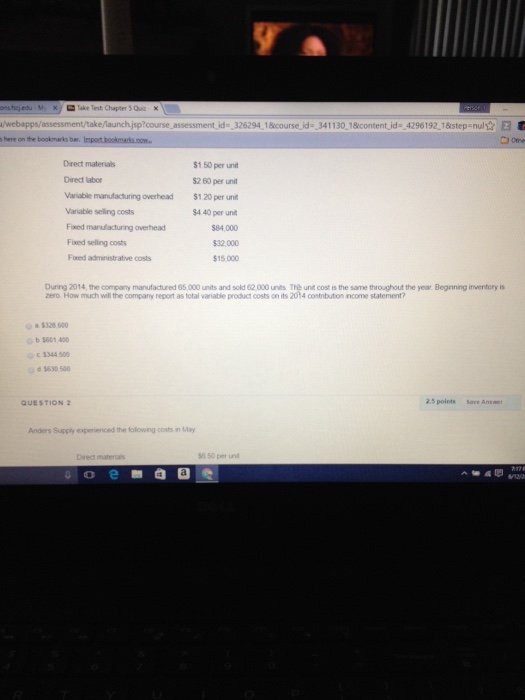

Question: Direct materials $1,50 per unit Direct labor $2,60 per unit Variable manufacturing overhead $1, 20 per unit Variable selling costs $4,40 per unit Fixed manufacturing

Direct materials $1,50 per unit Direct labor $2,60 per unit Variable manufacturing overhead $1, 20 per unit Variable selling costs $4,40 per unit Fixed manufacturing overhead $84,000 Fixed selling costs $32,000 Fixed administrative costs $15,000 During 2014, the company manufactured 65,000 units and sold 62,000 units. The unit cost is the same throughout the year. Beginning inventory is zero. How much will the company report as total variable product costs on its 2014 contribution income statement? 5328,660 5601,400 5344,500 5630,530 Anders Supply experienced the following costs in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts