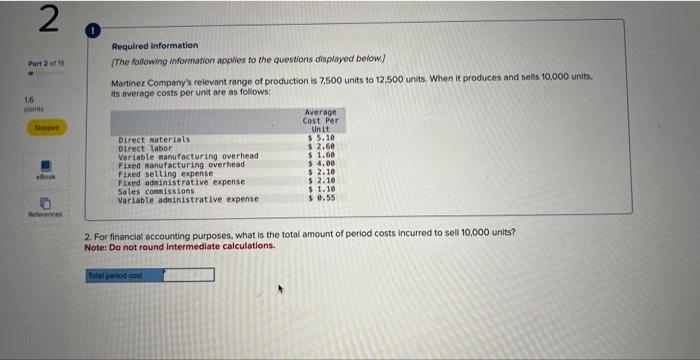

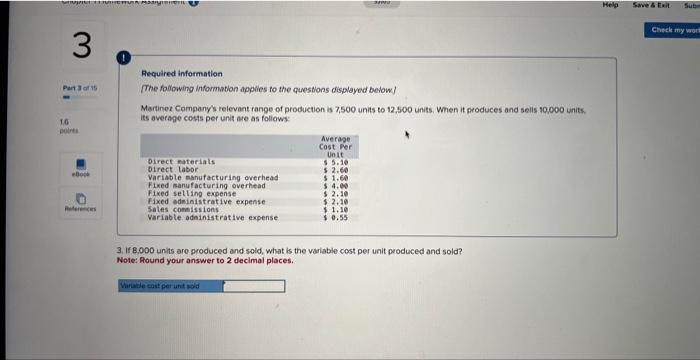

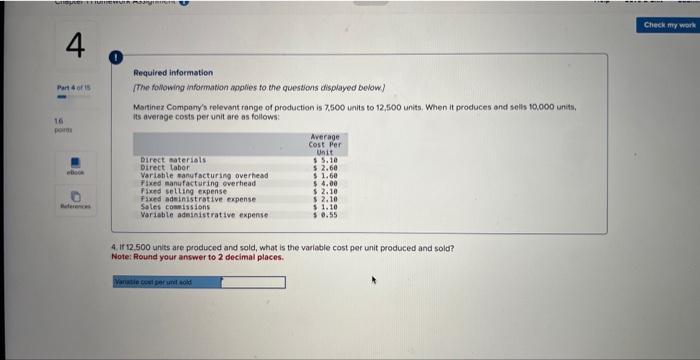

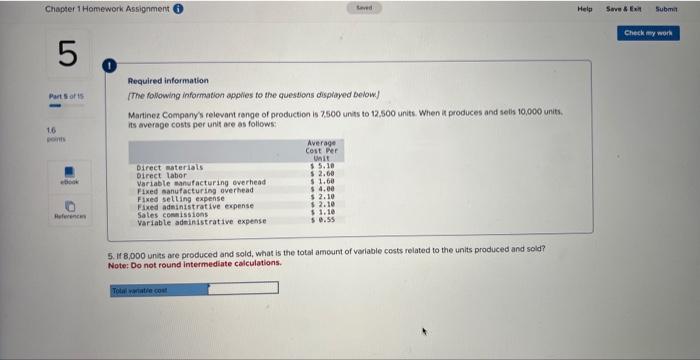

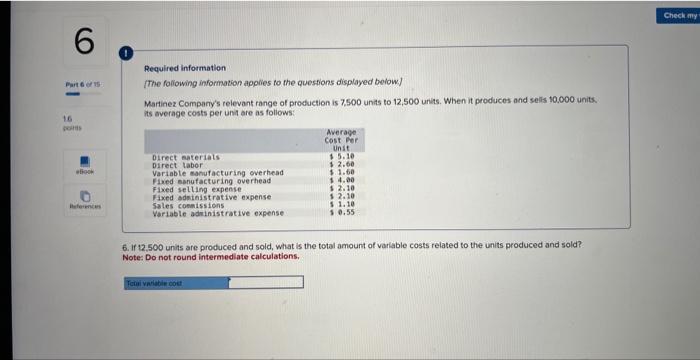

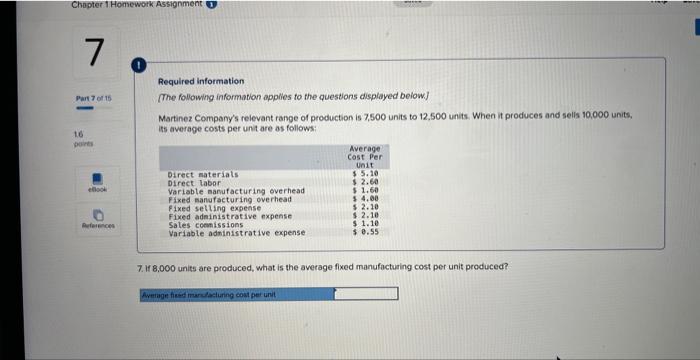

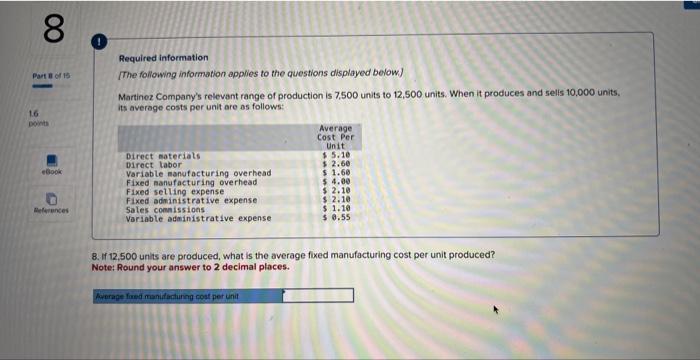

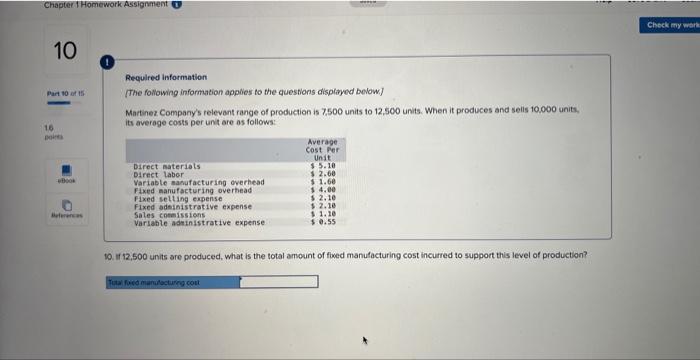

Question: Direct Materials - $5.10 Direct Labor - $2.60 Variable Manufacturing overhead - $1.60 Fixed manufacturing overhead - $4.00 Fixed selling expense - $2.10 Fixed administrative

Required information [he following information applies to the questions displayed beiow] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and selis 10,000 units. its average costs per unit are as follows: 2. For financiat accounting purposes, what is the total amount of period costs incurred to sell 10,000 units? Note: Do not round intermediate calculations. Required information The following information applies fo the questlons displayed below\}? Martinet Company's relevant range of production is 7,500 units to 12,500 units. When it peoduces and selis 10,000 units. its average costs per unit are as foliows: 3. If 8.000 units are produced and sold, what is the variable cost per unit produced and sold? Note: Pound your answer to 2 decimal places. Required information The following information applies fo the questions displayed betow? Martinez Company's felevant range of production is 7.500 units to 12,500 units. When it produces and sells 10.000 units, its average costs per unit are as follows: 4. If 12.500 units are produced and sold, what is the variable cost per unit produced and sold? Note: Round your answer to 2 decimal places. Pequired information (The following information apphies fo the questions dispiayed betow.). Martine z Company's relevant range of production is 7.500 unas to 12.500 units. When it produces and 1 elis 10,000 units. its average costs per unit are as foliows: 5. If 8,000 units are produced and sold, what is the total ameunt of voriable costs related to the units produced and sold? Note: Do not round intermediate calculations. Required information (The foliowing information applies to the questions displayed beiow.) Martinez Company's relevant range of prodiction is 7,500 units to 12,500 units. When it produces and selis to.000 units. its average costs per unt are as follows: 6. If 12.500 units are produced and sold, what is the total amount of variable costs related to the units produced and sold? Note: Do not round intermediate calculations. Required information The following information applies to the questions displayed beiow.] Martinez Company's relevant range of production is 7,500 units to 12.500 units. When it produces and selis 10,000 units, its average costs per unit are as follows: 7. If 8.000 units are produced, what is the average fixed manufacturing cost per unit produced? Required information The following information applies to the questions displayed below] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and selis 10,000 units. its average costs per unit are os follows: 8. If 12,500 units are produced, what is the average fixed manufacturing cost per unit produced? Note: Round your answer to 2 decimal places. Aequired information [he fociowing information apples to the questions displeyed below] Martnez Compaty's relevant range of production is 7,500 units to 2.500 units. When it produces and sels 10.000 units its average costs ner unt are as follows: 9. A 8.000 units are produced, what is the total amount of fixed manufacturing cost incurred to support this lovel of production? Requlred information [he following information applies to the questions displityod below] Martinez. Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10.000 units. its average costs per unt are as follows: 10 it 12,500 units are produced, what is the total amount of fowed manufacturing cost incurred to support this level of production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts