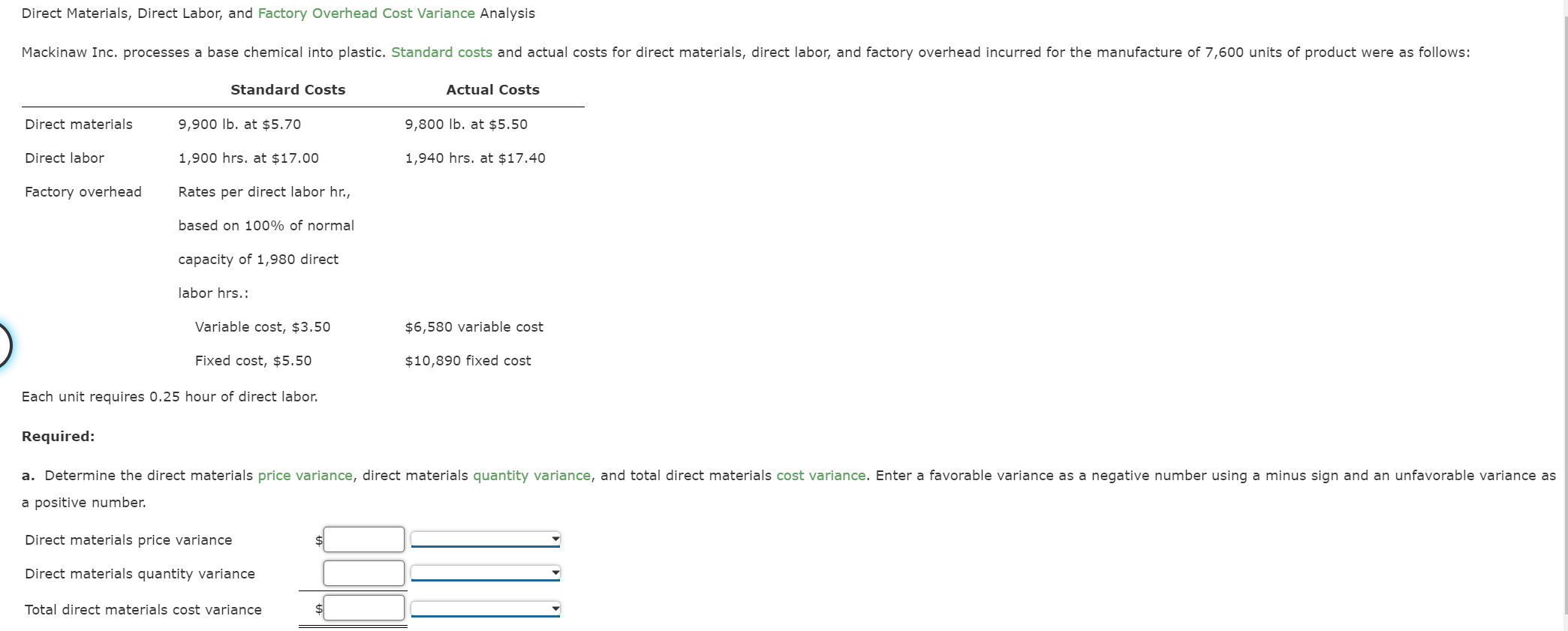

Question: Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis begin{tabular}{lll} & Standard Costs & Actual Costs hline Direct materials & 9,900lb. at $5.70

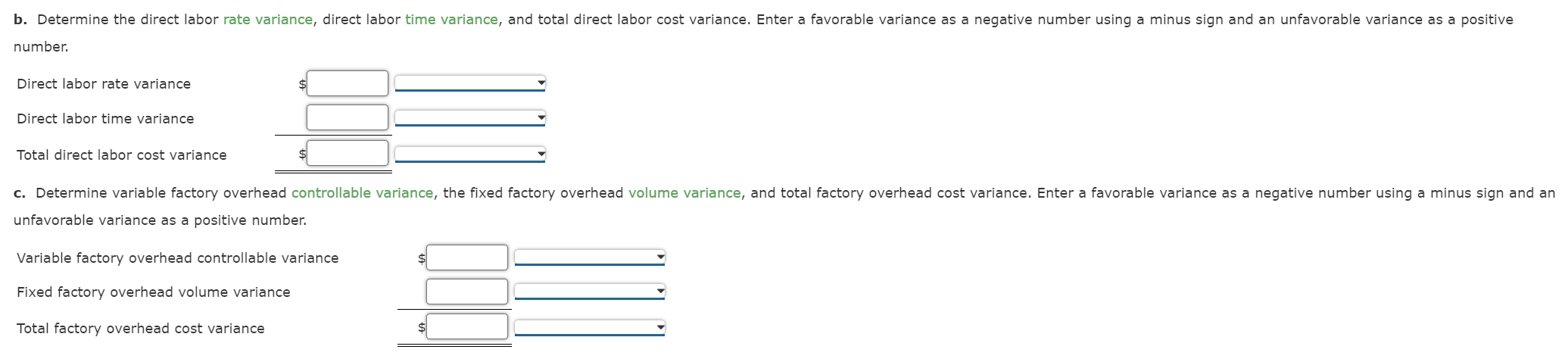

Direct Materials, Direct Labor, and Factory Overhead Cost Variance Analysis \begin{tabular}{lll} & Standard Costs & Actual Costs \\ \hline Direct materials & 9,900lb. at $5.70 & 9,800lb. at $5.50 \\ Direct labor & 1,900 hrs. at $17.00 & 1,940 hrs. at $17.40 \\ Factory overhead & Rates per direct labor hr., \\ & based on 100% of normal \\ & capacity of 1,980 direct & \\ & labor hrs.: \\ Variable cost, $3.50 & $6,580 variable cost \\ Fixed cost, $5.50 & $10,890 fixed cost \end{tabular} Each unit requires 0.25 hour of direct labor. Required: a positive number. Direct materials price variance Direct materials quantity variance Total direct materials cost variance number. Direct labor rate variance Direct labor time variance Total direct labor cost variance unfavorable variance as a positive number. Variable factory overhead controllable variance Fixed factory overhead volume variance Total factory overhead cost variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts