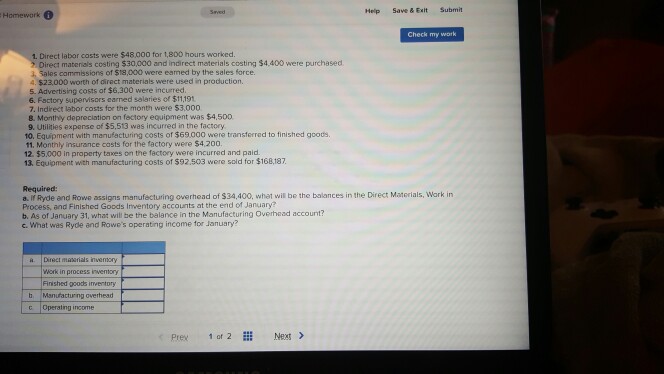

Question: direct materials inventory. $8700 work in progress inventory $76500 finished goods inventory. $53000 manufacturing overhead. $0 Homework Help Save & Exit Submit 1. Direct labor

direct materials inventory. $8700 work in progress inventory $76500 finished goods inventory. $53000 manufacturing overhead. $0

Homework Help Save & Exit Submit 1. Direct labor casts were $48.000 for 1,800 hours worked. ? Direct materials costing $30,000 and indirect materials costing $4,400 were purchased a, Sales commissions of $18,000 were eamed by the sales force 4$23,000 worth of direct materials were used in production. 5. Advertising costs of $6.300 were incurred. 6. Factory supervisors earned salaries of $11,191 7. Indirect labor costs for the month were $3,000 B. Monthy depreclation on factory equipment was $4,500 9. Utilities expense of $5,513 was incurred in the factory 10. Equipment with manufacturing costs of $69.000 were transferred to finished goods. 11. Monthly insurance casts for the factory were $4,200 12. $5.000 in property taxes on the factory were incurred and paid 13. Equipment with manufacturing costs of $92.503 were sold for $16B,187 Required: a. If Ryde and Rowe assigns manufacturing overhead of $34,400, whet wil be the balances in the Direct Matorials, Wark in Process, and Finished Goods Inventory accounts at the end of January? b. As of January 31, what wil be the balance in the Manufacturing Overhead account? c. What was Ryde and Rowe's operating income for January? a Direct macarials invemory Work in process inventory Finished goods inventory b Manifacturing overthead c Operating income Prex 1 of 2 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts