Question: Direct Method and Dual-Rate Allocation. Karon Realty Company has three operating departments (Commercial Real Estate, Residential Real Estate, Apartment Location Service) and two service departments

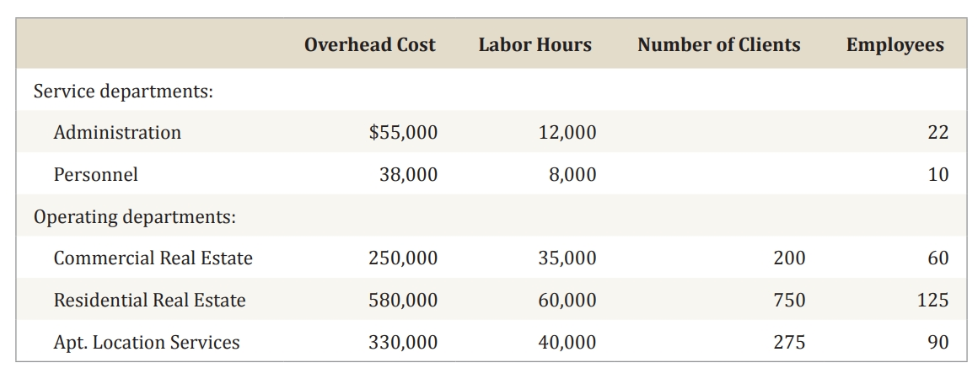

Direct Method and Dual-Rate Allocation. Karon Realty Company has three operating departments (Commercial Real Estate, Residential Real Estate, Apartment Location Service) and two service departments (Administration, Personnel). The budgeted data for the year are as follows:

Administration costs are allocated based on labor hours, and the Personnel allocation is based on number of employees. Sixty percent of the Administration costs are fixed; the long-run needs of each of the operating departments were considered as being equal when these costs were incurred. The overhead rates in each operating department are based on the number of clients.

Administration costs are allocated based on labor hours, and the Personnel allocation is based on number of employees. Sixty percent of the Administration costs are fixed; the long-run needs of each of the operating departments were considered as being equal when these costs were incurred. The overhead rates in each operating department are based on the number of clients.

Question: Using the direct method in conjunction with dual-rate allocation, allocate the service departments costs to the operating departments, and calculate overhead rates for each operating department.

Overhead Cost Labor Hours Number of Clients Employees Service departments: Administration $55,000 12,000 22 Personnel 38,000 8,000 10 Operating departments: Commercial Real Estate 250,000 35,000 200 60 Residential Real Estate 580,000 60,000 750 125 Apt. Location Services 330,000 40,000 275 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts