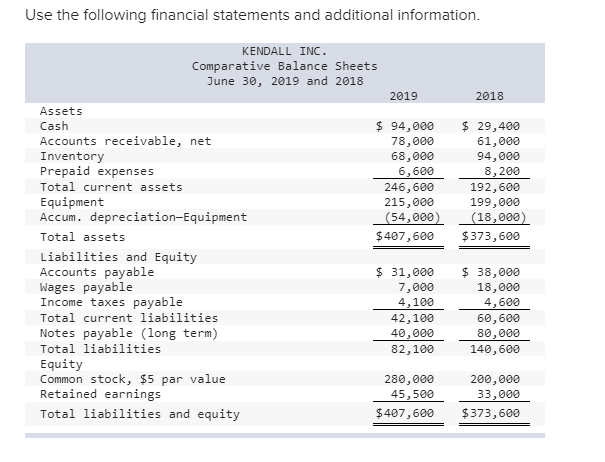

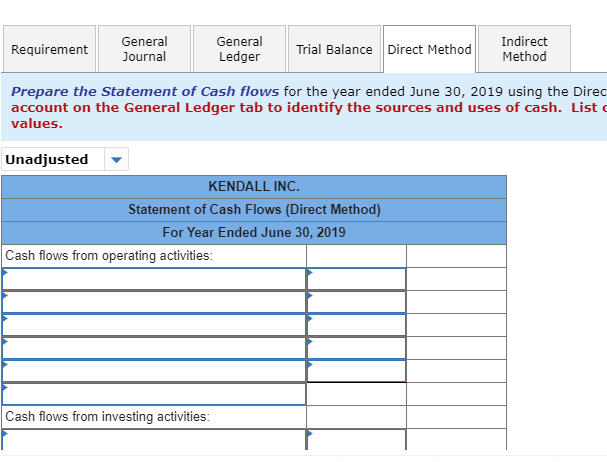

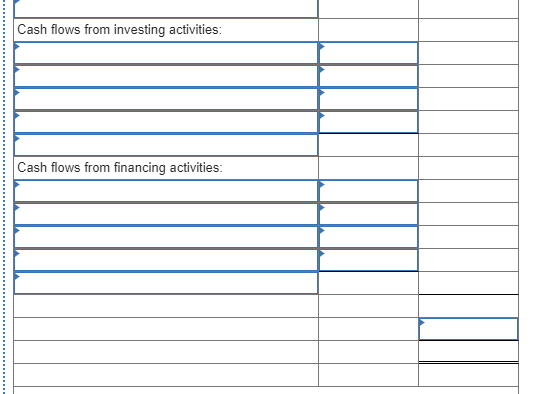

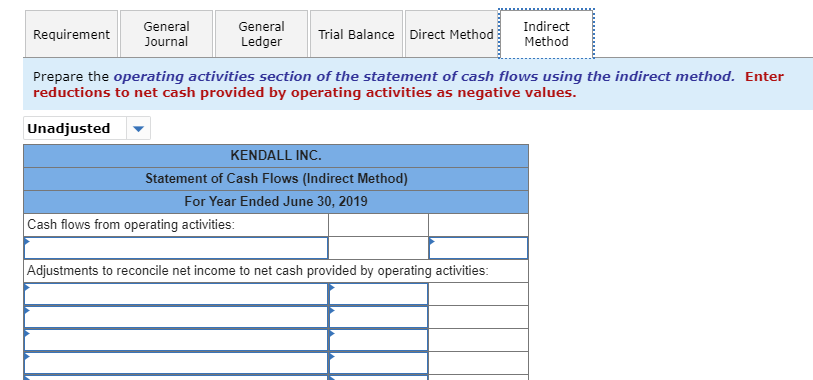

Question: DIRECT METHOD INDIRECT METHOD Use the following financial statements and additional information. KENDALL INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $

DIRECT METHOD

INDIRECT METHOD

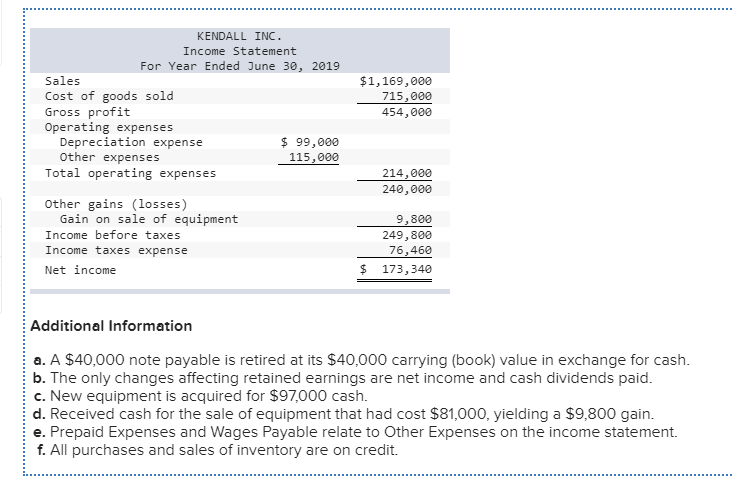

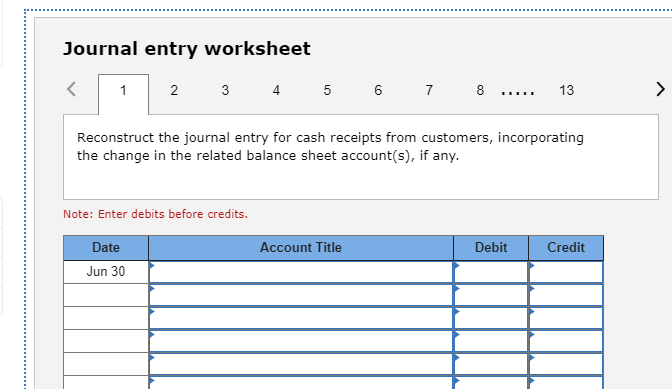

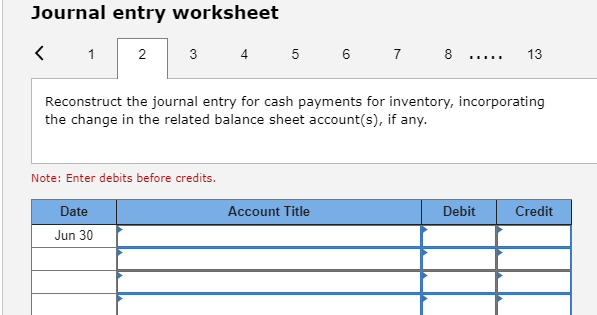

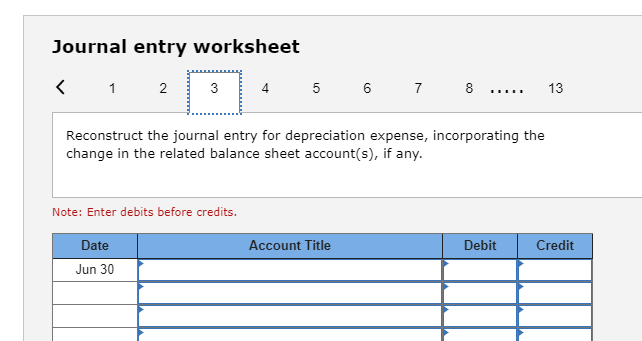

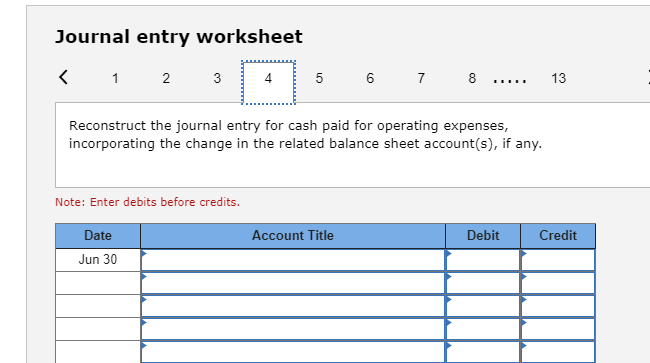

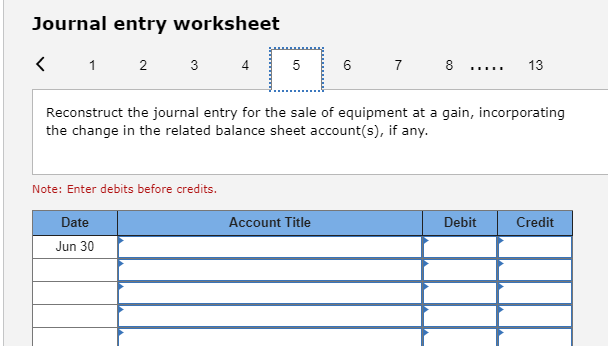

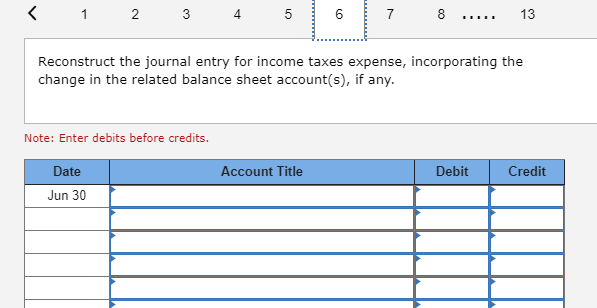

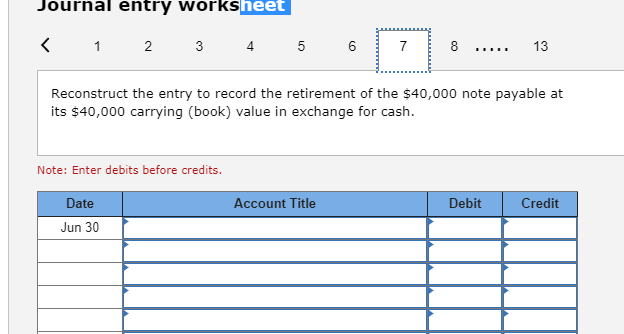

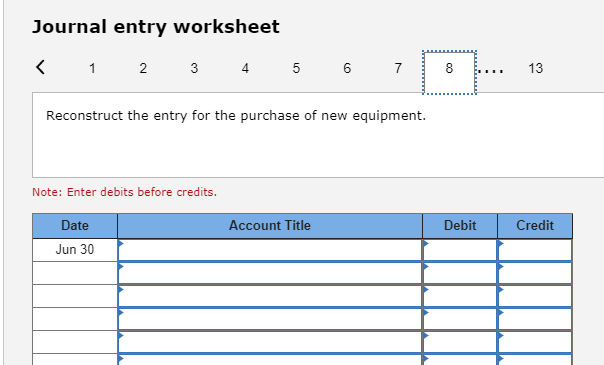

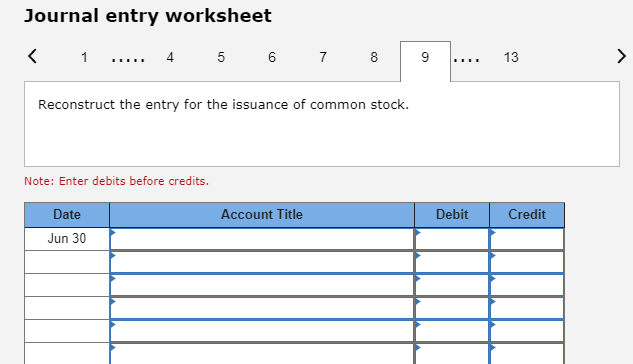

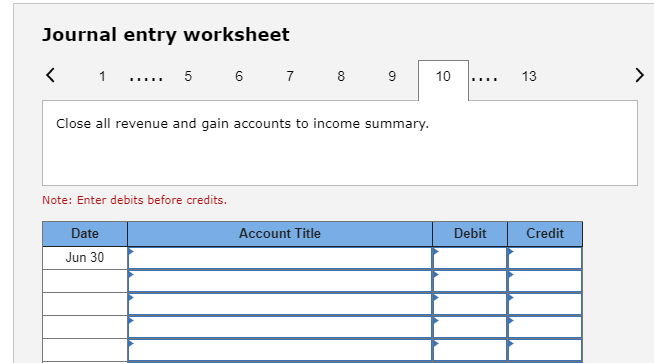

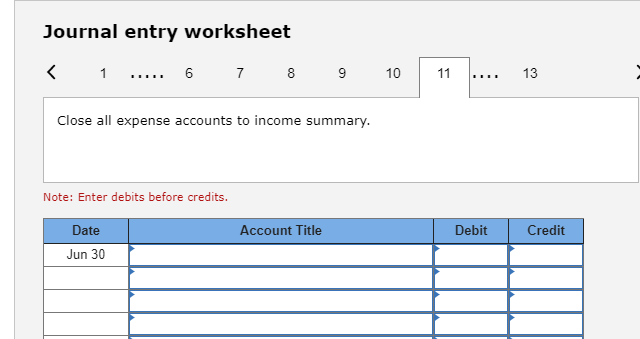

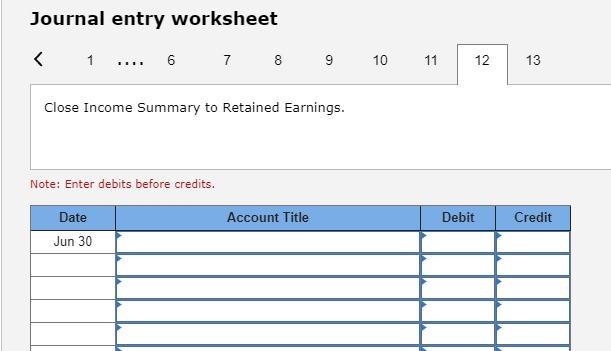

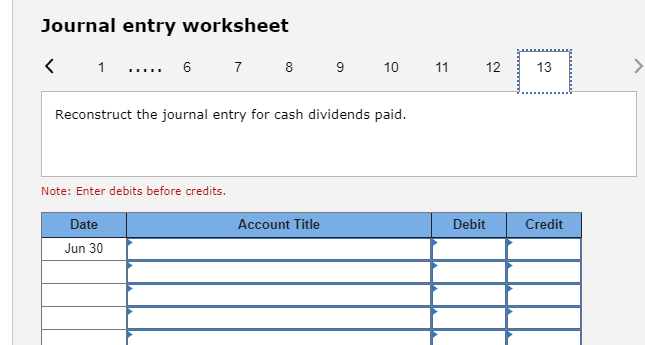

Use the following financial statements and additional information. KENDALL INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $ 94,000 78,000 68,000 6,600 246,600 215,000 (54,000) $407,600 $ 29,400 61,000 94,000 8,200 192,600 199,000 (18,000) $373,600 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Equipment Accum. depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity $ 31,000 7,000 4,100 42,100 40,000 82,100 $ 38,000 18,000 4,600 60,600 80,000 140,600 280,000 45,500 $407,600 200,000 33,000 $373,600 KENDALL INC. Income Statement For Year Ended June 30, 2019 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense $ 99,000 Other expenses 115,000 Total operating expenses $1,169,000 715,000 454,000 214,000 240,000 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense Net income 9,800 249,800 76,460 173,340 $ Additional Information a. A $40.000 note payable is retired at its $40,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $97,000 cash. d. Received cash for the sale of equipment that had cost $81,000, yielding a $9,800 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. Journal entry worksheet 2 3 4 5 6 7 8 ..... 13 Reconstruct the journal entry for cash receipts from customers, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Date Account Title Debit Credit Jun 30 Journal entry worksheet Reconstruct the entry for the issuance of common stock. Note: Enter debits before credits. Account Title Debit Credit Date Jun 30 Journal entry worksheet Close all revenue and gain accounts to income summary. Note: Enter debits before credits. Account Title Debit Credit Date Jun 30 Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts