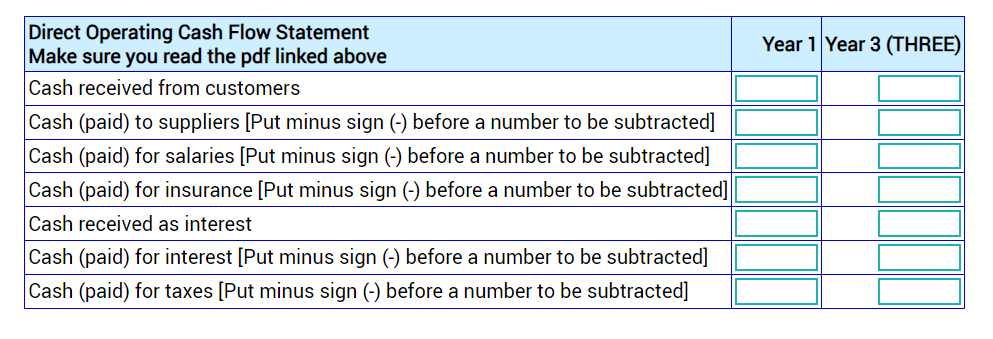

Question: Direct Operating Cash Flow Statement Make sure you read the pdf linked above Cash received from customers Cash (paid) to suppliers [Put minus sign (-)

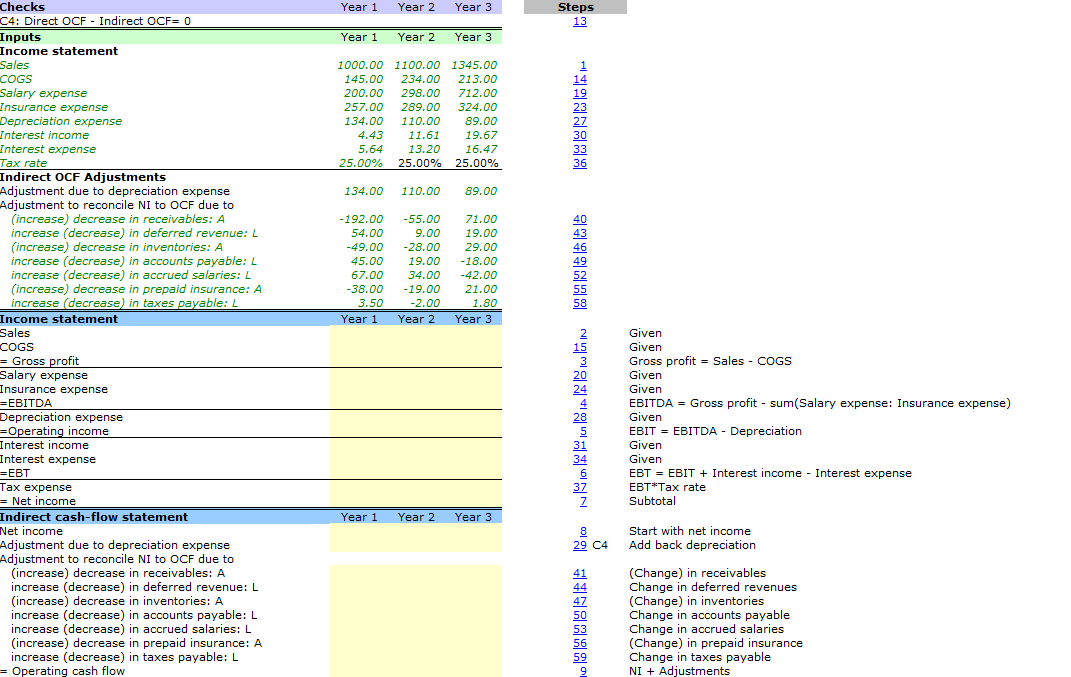

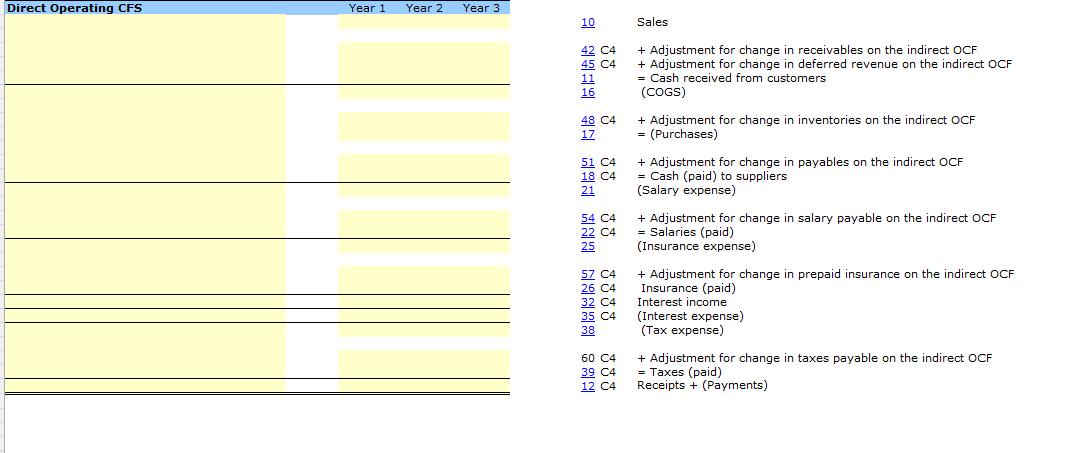

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts