Question: Direct Write-Off Method Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables Mar. 17. Received $2,710 from Matthew Chapman and

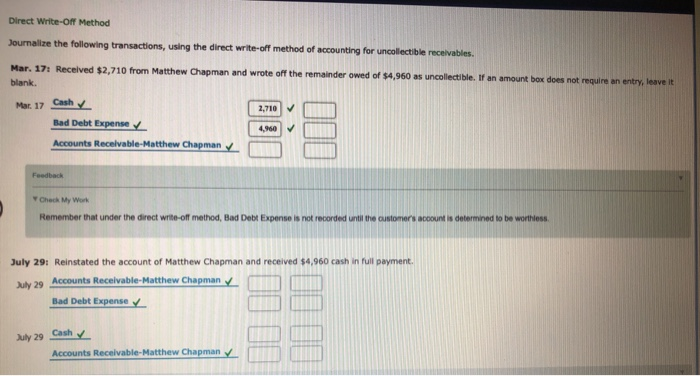

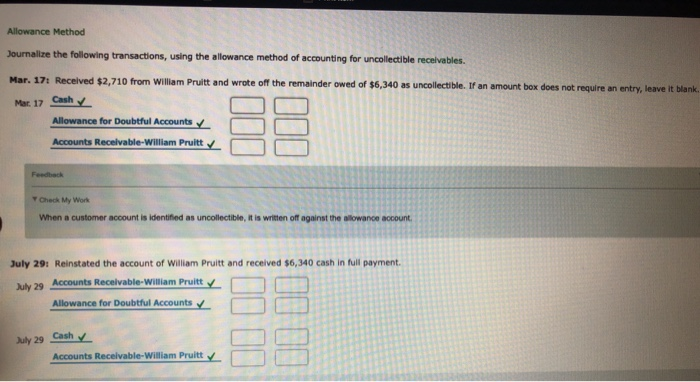

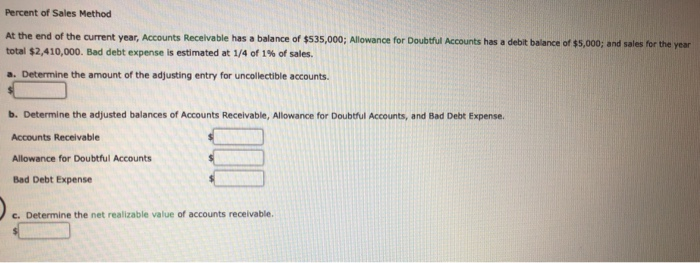

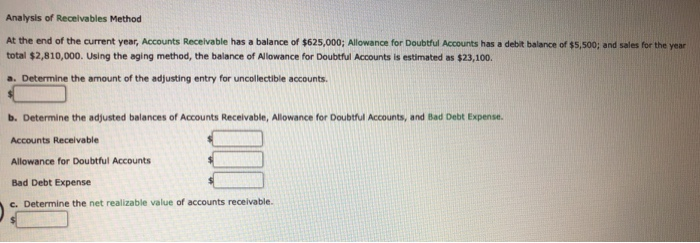

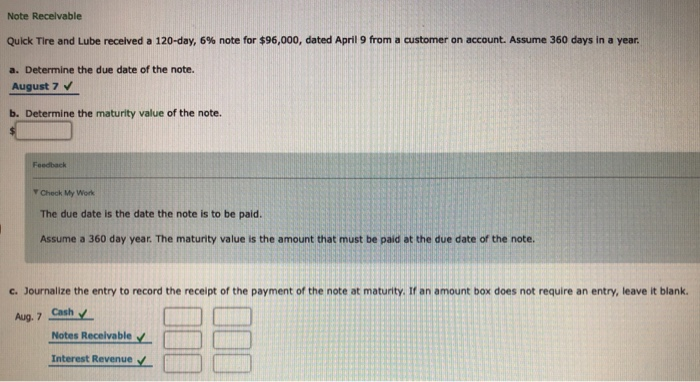

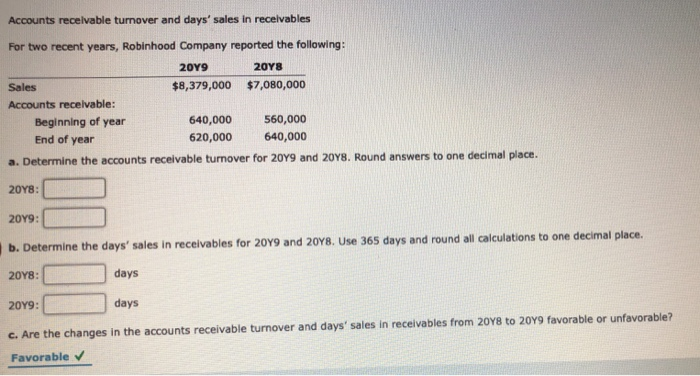

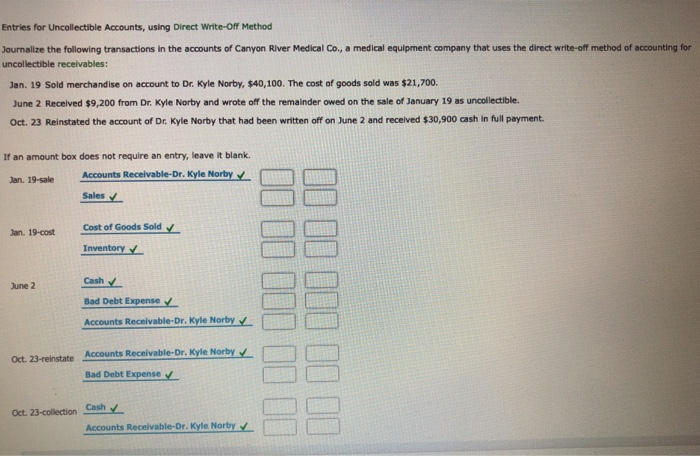

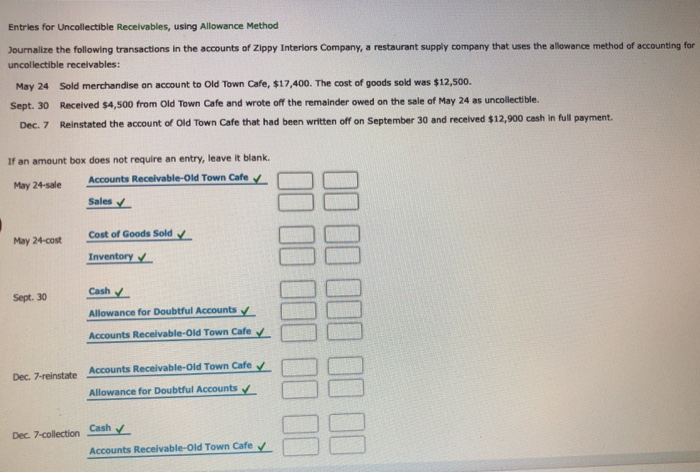

Direct Write-Off Method Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables Mar. 17. Received $2,710 from Matthew Chapman and wrote off the remainder owed of $4,960 as uncollectible. If an amount box does not require an entry leave it blank. Mar. 17 Cash Bad Debt Expense Accounts Receivable-Matthew Chapman Check My Work Remember that under the direct write-off method, Bad Debt Expense is not recorded until the customer's account is determined to be worthless July 29: Reinstated the account of Matthew Chapman and received $4,960 cash in full payment. July 29 Accounts Receivable-Matthew Chapman Bad Debt Expense July 29 Cash Accounts Receivable-Matthew Chapman Allowance Method Journalize the following transactions, using the allowance method of accounting for uncollectible receivables. Mar. 171 Received $2,710 from William Pruitt and wrote off the remainder owed of $6,340 as uncollectible. If an amount box does not require an entry, leave it blank. Mar. 17 Cash Allowance for Doubtful Accounts Accounts Receivable-William Pruitt Feedback Chock My Work When a customer account is identified as uncollectible, it is written off against the allowance account July 291 Reinstated the account of William Pruitt and received $6,340 cash in full payment ly 29 Accounts Receivable-William Pruitt Allowance for Doubtful Accounts July 29 Cash Accounts Receivable-William Pruitt Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $535,000; Allowance for Doubtful Accounts has a debit balance of $5,000; and sales for the year total $2,410,000. Bad debt expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $625,000; Allowance for Doubtful Accounts has a debit balance of $5.500, and sales for the year total $2,810,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $23,100. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and ad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. Note Receivable Quick Tire and Lube received a 120-day, 6% note for $96,000, dated April 9 from a customer on account. Assume 360 days in a year. a. Determine the due date of the note. August 7 b. Determine the maturity value of the note. Feedback Check My Work The due date is the date the note is to be paid. Assume a 360 day year. The maturity value is the amount that must be paid at the due date of the note. C. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Aug. 7 Cash Notes Receivable Interest Revenue Accounts receivable turnover and days' sales in receivables 2018 For two recent years, Robinhood Company reported the following: 2049 Sales $8,379,000 $7,080,000 Accounts receivable: Beginning of year 640,000 560,000 End of year 620,000 640,000 a. Determine the accounts receivable turnover for 20y9 and 2018. Round answers to one decimal place. 2048: 2019: b. Determine the days' sales in receivables for 2049 and 2018. Use 365 days and round all calculations to one decimal place. 2048: days 2049: days C. Are the changes in the accounts receivable turnover and days' sales in receivables from 2048 to 2049 favorable or unfavorable? Favorable Entries for Uncollectible Accounts, using Direct Write-off Method Journalire the following transactions in the accounts of Carvyon River Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19 Sold merchandise on account to Dr. Kyle Norby, $40,100. The cost of goods sold was $21,700. June 2 Received $9,200 from Dr. Kyle Norby and wrote off the remainder owed on the sale of January 19 as uncollectible. Oct. 23 Reinstated the account of Dr Kyle Norby that had been written off on June 2 and received $30,900 cash in full payment. If an amount box does not require an entry, leave it blank. Jan. 19-sale Accounts Receivable-Dr. Kyle Norby Sales Jan. 19-cost Cost of Goods Sold Inventory June 2 Cash Bad Debt Expense Accounts Receivable-Dr. Kyle Norby 10 10 101 00 00 Oct. 23-reinstate Accounts Receivable-Dr. Kyle Norby Bad Debt Expense Oct. 23-collection Cash Accounts Receivable-Dr. Kyle Norby Entries for Uncollectible Receivables, using Allowance Method Journalire the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: May 24 Sold merchandise on account to Old Town Cafe, $17,400. The cost of goods sold was $12,500. Sept. 30 Received $4,500 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $12,900 cash in full payment. If an amount box does not require an entry, leave it blank. Accounts Receivable-Old Town Cafe May 24-sale Sales Cost of Goods Sold May 24-cost Inventory Sept. 30 Cash Allowance for Doubtful Accounts II II 101 10 10 II III II II Accounts Receivable-Old Town Cafe Accounts Receivable-Old Town Cafe Dec. 7-reinstate Allowance for Doubtful Accounts Dec. 7-collection Cash Accounts Receivable-Old Town Cafe Direct Write-Off Method Journalize the following transactions, using the direct write-off method of accounting for uncollectible receivables Mar. 17. Received $2,710 from Matthew Chapman and wrote off the remainder owed of $4,960 as uncollectible. If an amount box does not require an entry leave it blank. Mar. 17 Cash Bad Debt Expense Accounts Receivable-Matthew Chapman Check My Work Remember that under the direct write-off method, Bad Debt Expense is not recorded until the customer's account is determined to be worthless July 29: Reinstated the account of Matthew Chapman and received $4,960 cash in full payment. July 29 Accounts Receivable-Matthew Chapman Bad Debt Expense July 29 Cash Accounts Receivable-Matthew Chapman Allowance Method Journalize the following transactions, using the allowance method of accounting for uncollectible receivables. Mar. 171 Received $2,710 from William Pruitt and wrote off the remainder owed of $6,340 as uncollectible. If an amount box does not require an entry, leave it blank. Mar. 17 Cash Allowance for Doubtful Accounts Accounts Receivable-William Pruitt Feedback Chock My Work When a customer account is identified as uncollectible, it is written off against the allowance account July 291 Reinstated the account of William Pruitt and received $6,340 cash in full payment ly 29 Accounts Receivable-William Pruitt Allowance for Doubtful Accounts July 29 Cash Accounts Receivable-William Pruitt Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $535,000; Allowance for Doubtful Accounts has a debit balance of $5,000; and sales for the year total $2,410,000. Bad debt expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $625,000; Allowance for Doubtful Accounts has a debit balance of $5.500, and sales for the year total $2,810,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $23,100. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and ad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. Note Receivable Quick Tire and Lube received a 120-day, 6% note for $96,000, dated April 9 from a customer on account. Assume 360 days in a year. a. Determine the due date of the note. August 7 b. Determine the maturity value of the note. Feedback Check My Work The due date is the date the note is to be paid. Assume a 360 day year. The maturity value is the amount that must be paid at the due date of the note. C. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Aug. 7 Cash Notes Receivable Interest Revenue Accounts receivable turnover and days' sales in receivables 2018 For two recent years, Robinhood Company reported the following: 2049 Sales $8,379,000 $7,080,000 Accounts receivable: Beginning of year 640,000 560,000 End of year 620,000 640,000 a. Determine the accounts receivable turnover for 20y9 and 2018. Round answers to one decimal place. 2048: 2019: b. Determine the days' sales in receivables for 2049 and 2018. Use 365 days and round all calculations to one decimal place. 2048: days 2049: days C. Are the changes in the accounts receivable turnover and days' sales in receivables from 2048 to 2049 favorable or unfavorable? Favorable Entries for Uncollectible Accounts, using Direct Write-off Method Journalire the following transactions in the accounts of Carvyon River Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19 Sold merchandise on account to Dr. Kyle Norby, $40,100. The cost of goods sold was $21,700. June 2 Received $9,200 from Dr. Kyle Norby and wrote off the remainder owed on the sale of January 19 as uncollectible. Oct. 23 Reinstated the account of Dr Kyle Norby that had been written off on June 2 and received $30,900 cash in full payment. If an amount box does not require an entry, leave it blank. Jan. 19-sale Accounts Receivable-Dr. Kyle Norby Sales Jan. 19-cost Cost of Goods Sold Inventory June 2 Cash Bad Debt Expense Accounts Receivable-Dr. Kyle Norby 10 10 101 00 00 Oct. 23-reinstate Accounts Receivable-Dr. Kyle Norby Bad Debt Expense Oct. 23-collection Cash Accounts Receivable-Dr. Kyle Norby Entries for Uncollectible Receivables, using Allowance Method Journalire the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: May 24 Sold merchandise on account to Old Town Cafe, $17,400. The cost of goods sold was $12,500. Sept. 30 Received $4,500 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $12,900 cash in full payment. If an amount box does not require an entry, leave it blank. Accounts Receivable-Old Town Cafe May 24-sale Sales Cost of Goods Sold May 24-cost Inventory Sept. 30 Cash Allowance for Doubtful Accounts II II 101 10 10 II III II II Accounts Receivable-Old Town Cafe Accounts Receivable-Old Town Cafe Dec. 7-reinstate Allowance for Doubtful Accounts Dec. 7-collection Cash Accounts Receivable-Old Town Cafe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts