Question: Direction: Solve the problems below by choosing the best letter choice for cach. You do not need to show any work. The only way to

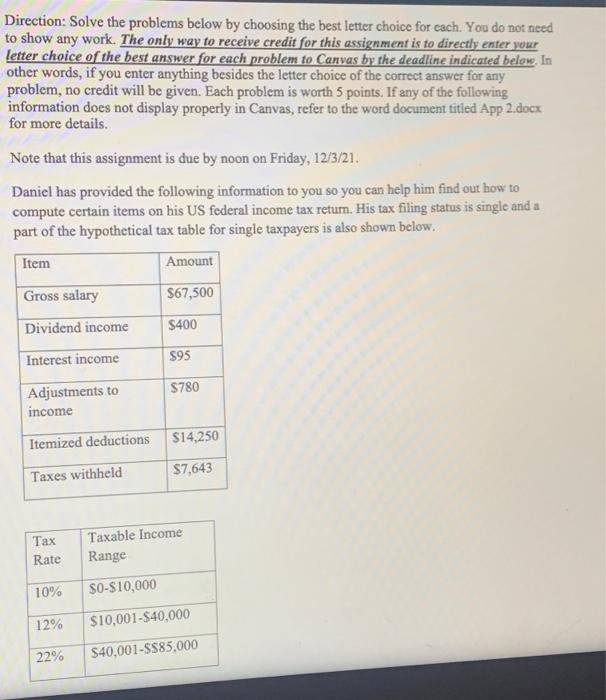

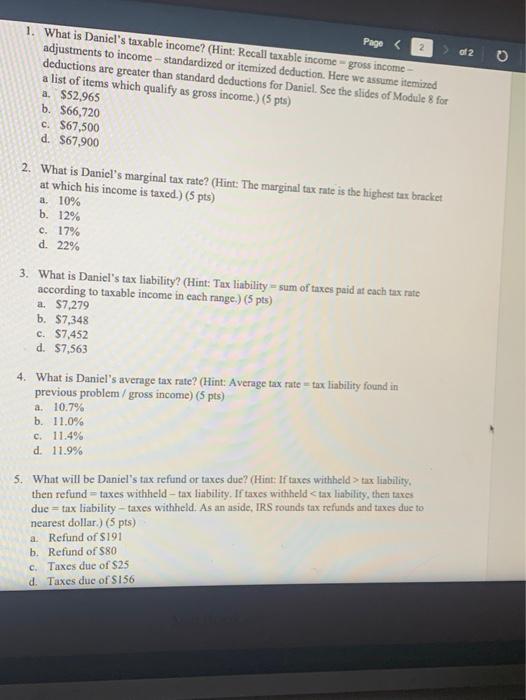

Direction: Solve the problems below by choosing the best letter choice for cach. You do not need to show any work. The only way to receive credit for this assignment is to directly enter your letter choice of the best answer for each problem to Canvas by the deadline indicated below. In other words, if you enter anything besides the letter choice of the correct answer for any problem, no credit will be given. Each problem is worth 5 points. If any of the following information does not display properly in Canvas, refer to the word document titled App 2.docx for more details Note that this assignment is due by noon on Friday, 12/3/21. Daniel has provided the following information to you so you can help him find out how to compute certain items on his US federal income tax retum. His tax filing status is single and a part of the hypothetical tax table for single taxpayers is also shown below. Item Amount Gross salary $67,500 Dividend income $400 Interest income $95 $780 Adjustments to income Itemized deductions $14,250 Taxes withheld $7,643 Tax Rate Taxable Income Range 10% $0-$10,000 12% $10,001-$40,000 22% $40,001-$$85,000 ol2 Page 1. What is Daniel's taxable income? (Hint: Recall taxable income - gross income adjustments to income-standardized or itemized deduction. Here we assume itemized deductions are greater than standard deductions for Daniel. See the slides of Module 8 for a list of items which qualify as gross income.) (5 pts) a. $52,965 b. $66,720 c. $67,500 d. $67,900 2. What is Daniel's marginal tax rate? (Hint: The marginal tax rate is the highest tax bracket at which his income is taxed.) (5 pts) a 10% b. 12% c. 17% d. 22% 3. What is Daniel's tax liability? (Hint: Tax liability - sum of taxes paid at each tax rate according to taxable income in each range.) (5 pts) a. $7,279 b. $7,348 C. $7,452 d. $7,563 4. What is Daniel's average tax rate? (Hint: Average tax rate=tax liability found in previous problem / gross income) (5 pts) a. 10.7% b. 11.0% c. 11.49 d. 11.9% 5. What will be Daniel's tax refund or taxes due? (Hint: If taxes withheld > tax liability, then refund = taxes withfield - tax liability. If taxes withheld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts