Question: Directions Before beginning the discussion, compute for each year Costco's: gross margin percentage (carry to one decimal point), return on assets percentage (carry to one

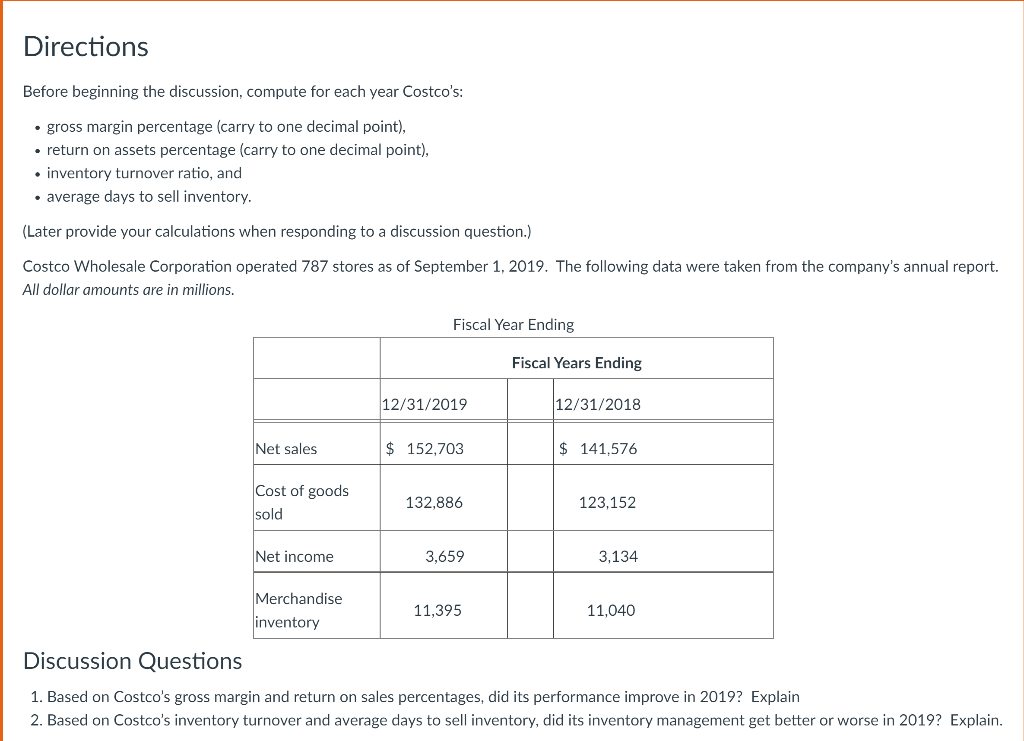

Directions Before beginning the discussion, compute for each year Costco's: gross margin percentage (carry to one decimal point), return on assets percentage (carry to one decimal point), inventory turnover ratio, and average days to sell inventory. (Later provide your calculations when responding to a discussion question.) Costco Wholesale Corporation operated 787 stores as of September 1, 2019. The following data were taken from the company's annual report. All dollar amounts are in millions. Fiscal Year Ending Fiscal Years Ending 12/31/2019 12/31/2018 Net sales $ 152,703 $ 141,576 Cost of goods sold 132,886 123,152 Net income 3,659 3,134 Merchandise inventory 11,395 11,040 Discussion Questions 1. Based on Costco's gross margin and return on sales percentages, did its performance improve in 2019? Explain 2. Based on Costco's inventory turnover and average days to sell inventory, did its inventory management get better or worse in 2019? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts