Question: Directions: Choose the best answer. (Keep 4 decimals unless told otherwise.) If Hannah invests $1,800 in a mutual fund today and it carns 6 percent

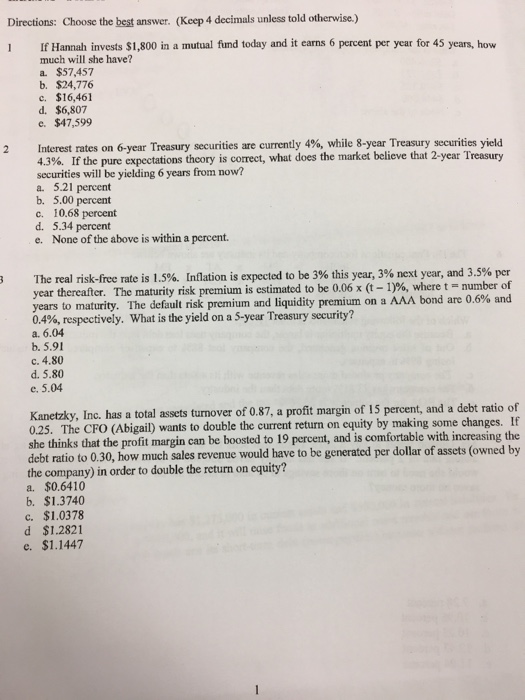

Directions: Choose the best answer. (Keep 4 decimals unless told otherwise.) If Hannah invests $1,800 in a mutual fund today and it carns 6 percent per year for 45 years, how much will she have? a. $57,457 b. $24,776 c. $16,461 d. $6,807 e. $47,599 Interest rates on 6-year Treasury securities are currently 4%, while 8-year Treasury securities yield 4.3%. If the pure expectations theory is correct, what does the market believe that 2-year Treasury securities will be yielding 6 years from now? a 5.21 percent b. 5.00 percent c. 10.68 percent d. 5.34 percent e. None of the above is within a percent. The real risk-free rate is 1.5%. Inflation is expected to be 3% this year. 3% next year, and 3.5% per year thereafter. The maturity risk premium is estimated to be 0.06 x (t-1)%, where t - number of years to maturity. The default risk premium and liquidity premium on a AAA bond are 0.6% and 0.4%, respectively. What is the yield on a 5-year Treasury security? a. 6.04 b. 5.91 c. 4.80 d. 5.80 e. 5.04 Kanetzky, Inc. has a total assets turnover of 0.87, a profit margin of 15 percent, and a debt ratio of 0.25. The CFO (Abigail) wants to double the current return on equity by making some changes. If she thinks that the profit margin can be boosted to 19 percent, and is comfortable with increasing the debt ratio to 0.30, how much sales revenue would have to be generated per dollar of assets (owned by the company) in order to double the return on equity? a. $0.6410 b. $1.3740 c. $1.0378 d $1.2821 e. $1.1447

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts