Question: DIRECTIONS: Read each statement carefully. If the statement is true, write T in the space provided; if the statement is false, write F in the

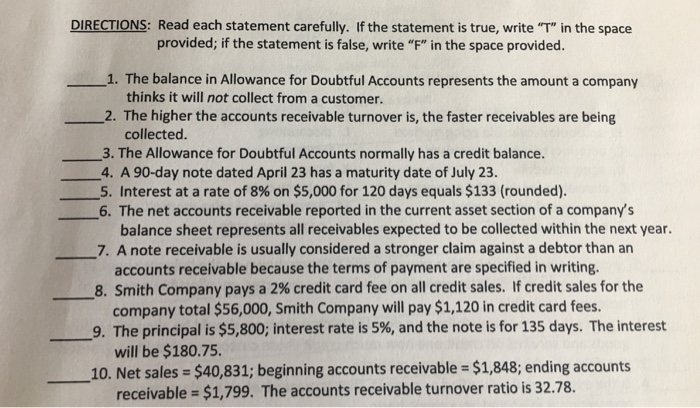

DIRECTIONS: Read each statement carefully. If the statement is true, write "T" in the space provided; if the statement is false, write "F" in the space provided 1. The balance in Allowance for Doubtful Accounts represents the amount a company thinks it will not collect from a customer. 2The higher the accounts receivable turnover is, the faster receivables are being collected. -3. The Allowance for Doubtful Accounts normally has a credit balance. 4. A 90-day note dated April 23 has a maturity date of July 23 5. Interest at a rate of 8% on $5,000 for 120 days equals $133 (rounded) 6. The net accounts receivable reported in the current asset section of a company's 7. A note receivable is usually considered a stronger claim against a debtor than an 8. Smith Company pays a 2% credit card fee on all credit sales. If credit sales for the 9. The principal is $5,800; interest rate is 5%, and the note is for 135 days. The interest 10. Net sales-$40,831, beginning accounts receivables $1,848; ending accounts balance sheet represents all receivables expected to be collected within the next year. accounts receivable because the terms of payment are specified in writing. company total $56,000, Smith Company will pay $1,120 in credit card fees. will be $180.75 receivable $1,799. The accounts receivable turnover ratio is 32.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts