Question: Discuss how CIL's value is maximized using different capital structures. Also make all necessary comments relevant to optimal capital structure and firm value maximisation. Question

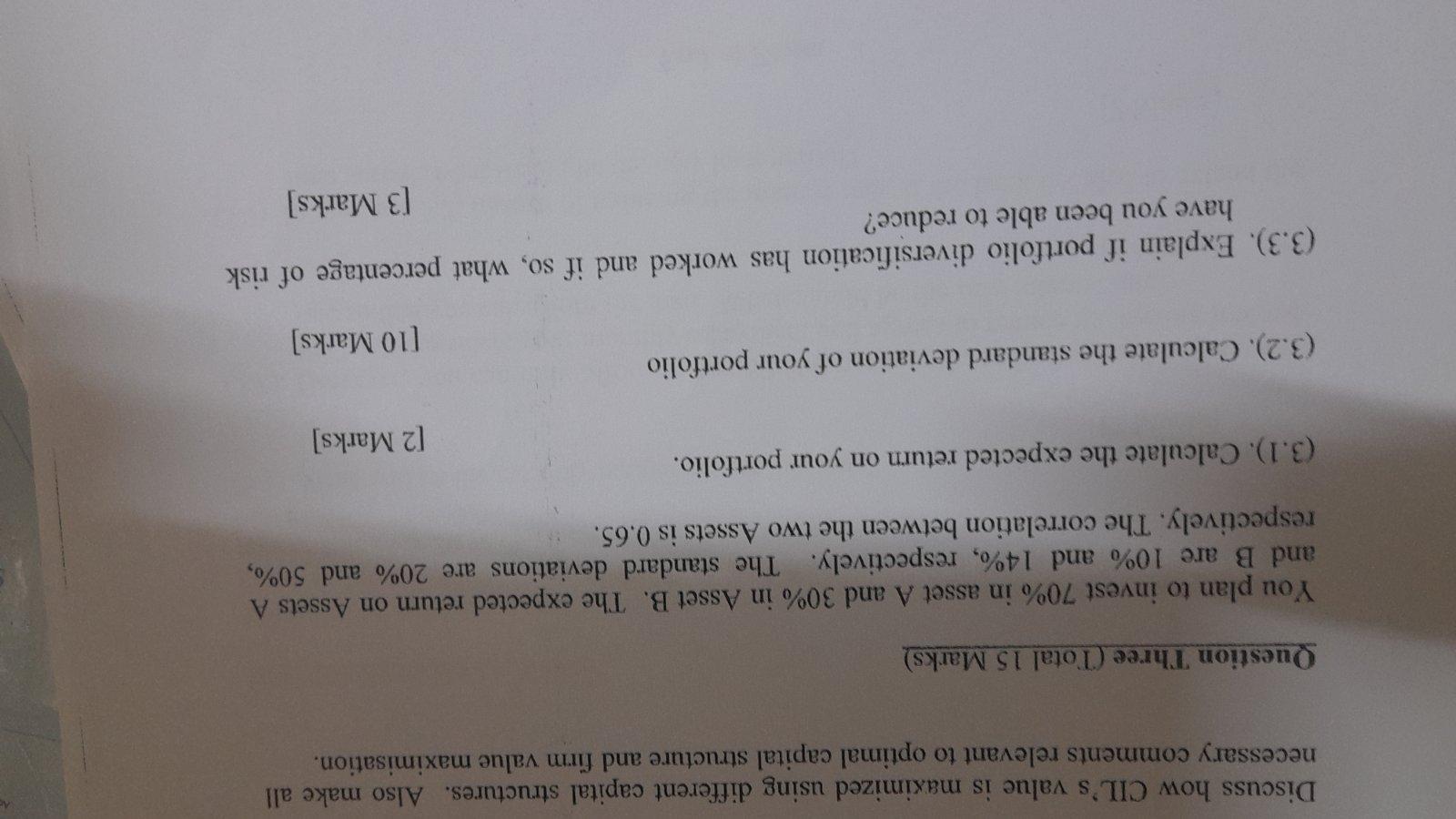

Discuss how CIL's value is maximized using different capital structures. Also make all necessary comments relevant to optimal capital structure and firm value maximisation. Question Three (Total 15 Marks) You plan to invest 70% in asset A and 30% in Asset B. The expected return on Assets A and B are 10% and 14%, respectively. The standard deviations are 20% and 50%, respectively. The correlation between the two Assets is 0.65. (3.1). Calculate the expected return on your portfolio. [2 marks] (3.2). Calculate the standard deviation of your portfolio [10 Marks] (3.3). Explain if portfolio diversification has worked and if so, what percentage of risk have you been able to reduce? [3 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts