Question: Discuss how much they should contribute to superannuation (develop a contribution schedule), providing information about the contribution rules, including contribution caps and eligibility to make

- Discuss how much they should contribute to superannuation (develop a contribution schedule), providing information about the contribution rules, including contribution caps and eligibility to make concessional and non-concessional contributions, where appropriate.

- Highlight the recent legislative changes to the contribution cap and how Paul can benefit from the recent changes.

- Discuss the availability of other contribution avenues, such as Co Contribution and Spouse Contribution to maximise the retirement benefits.

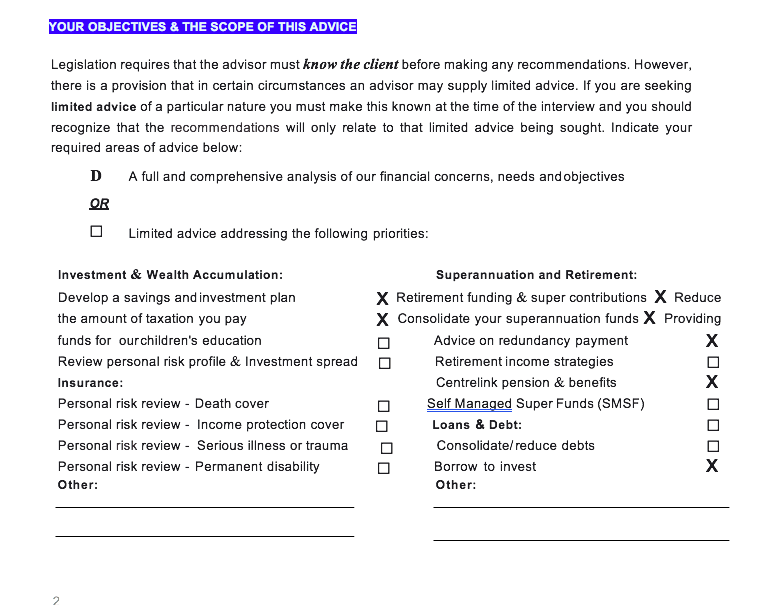

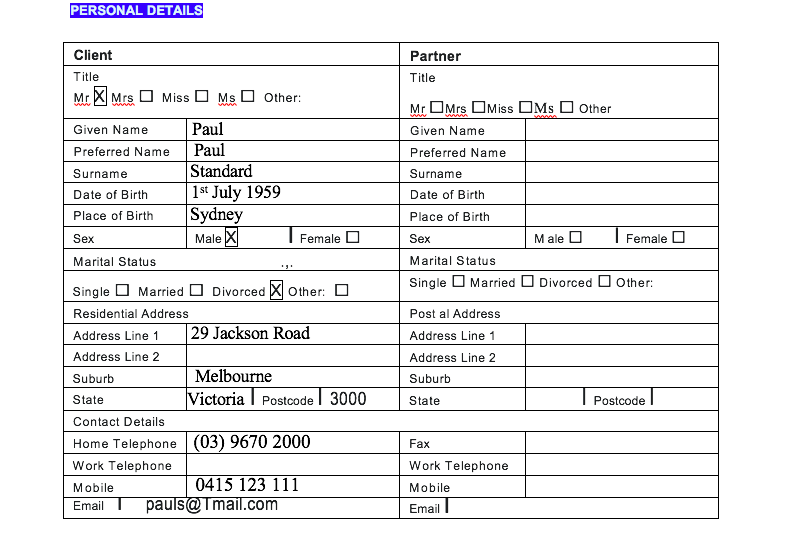

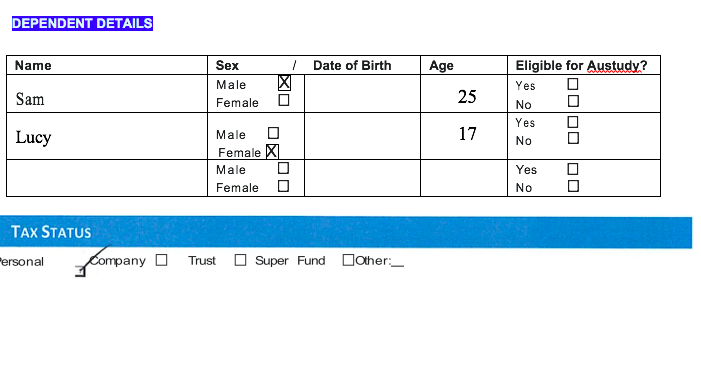

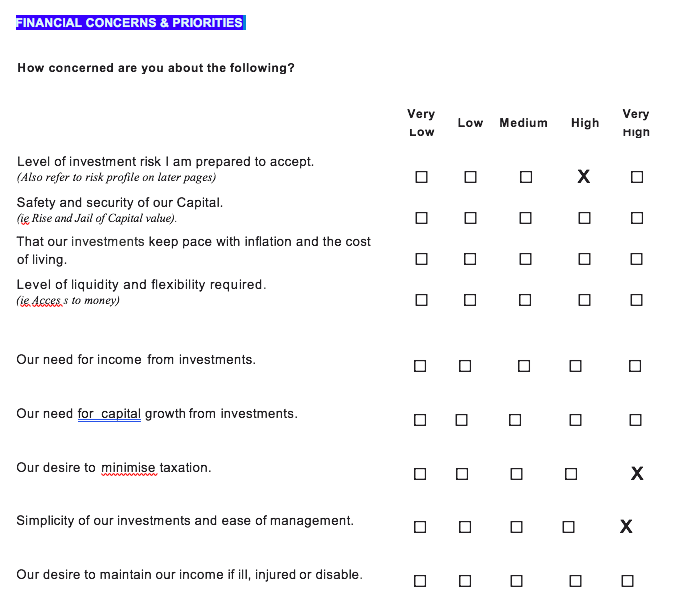

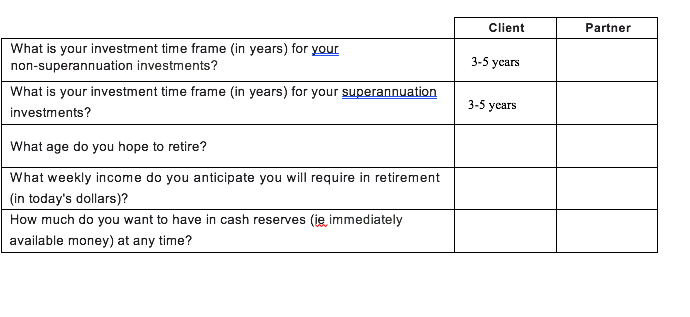

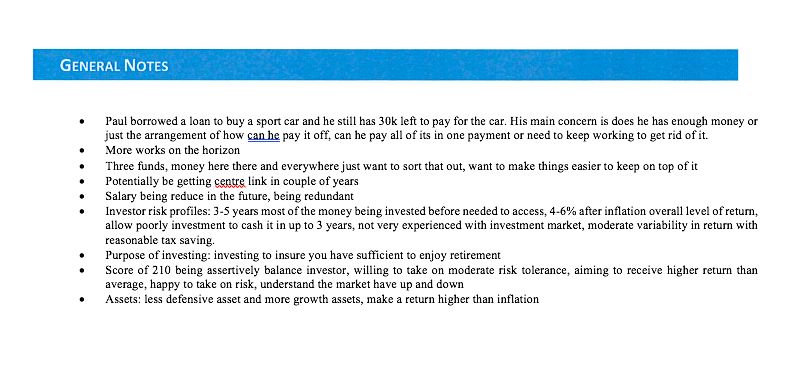

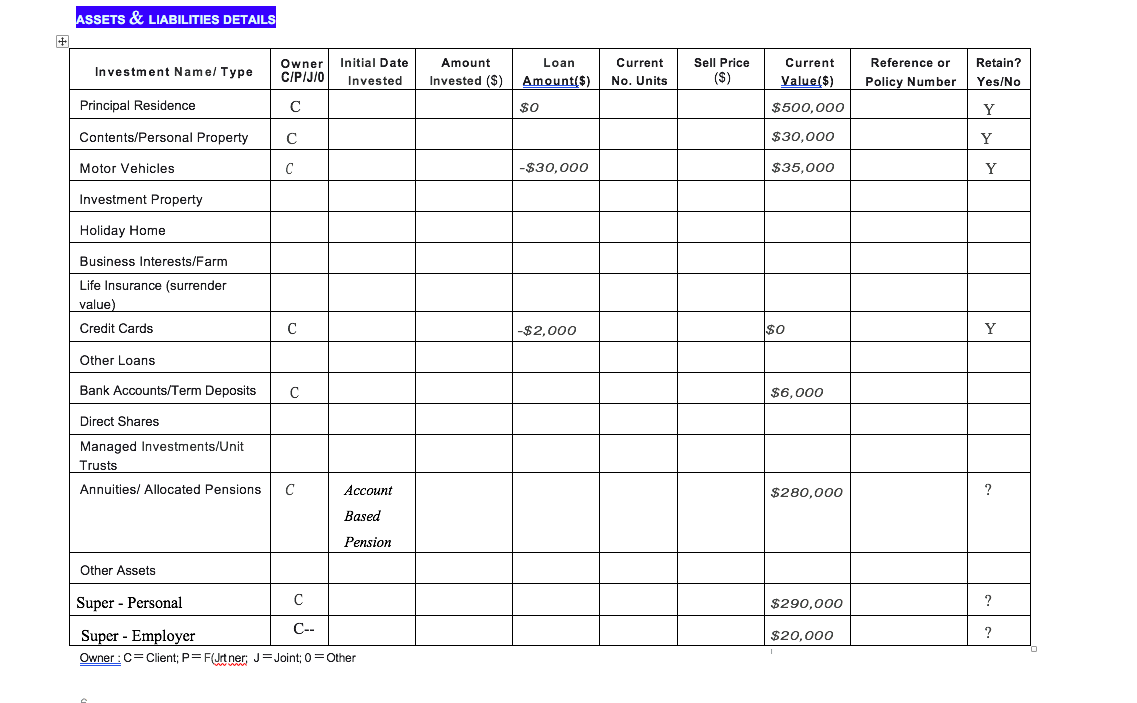

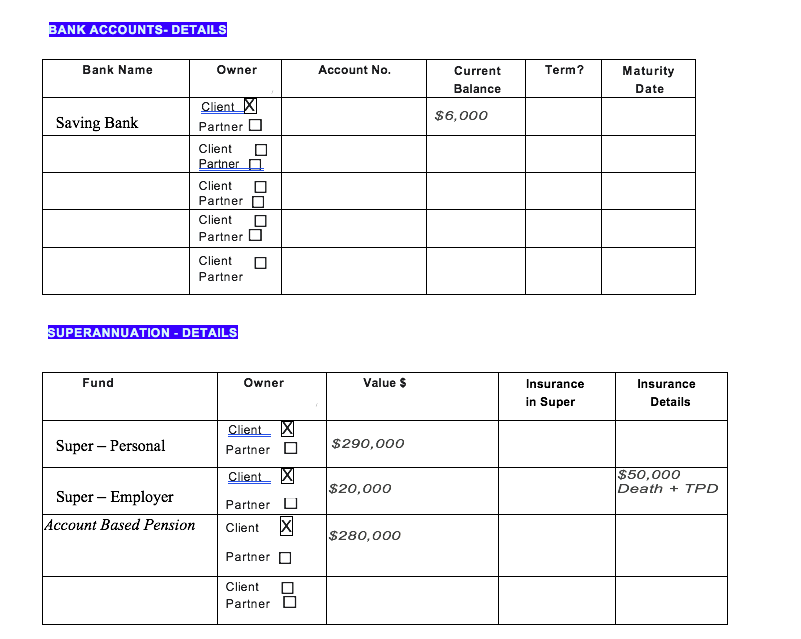

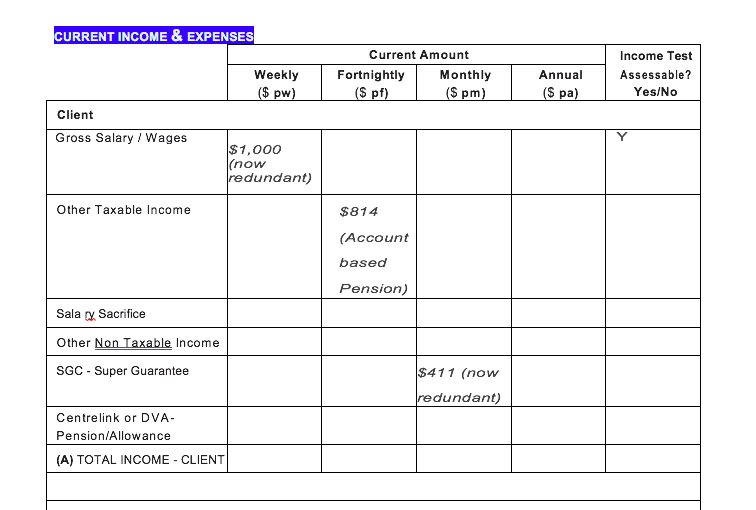

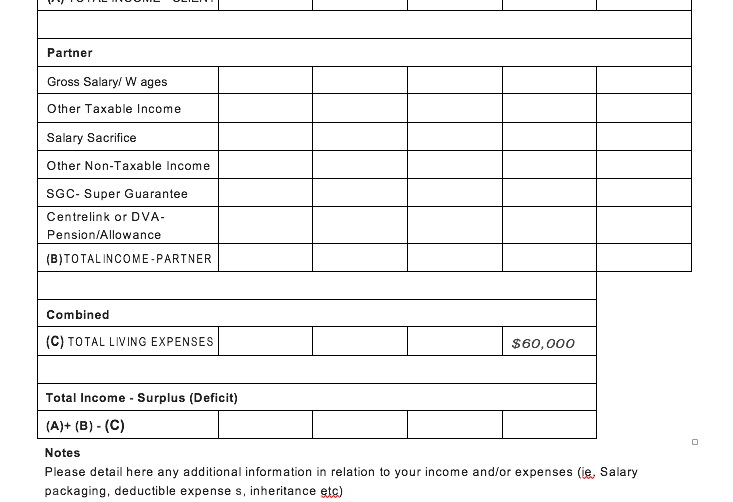

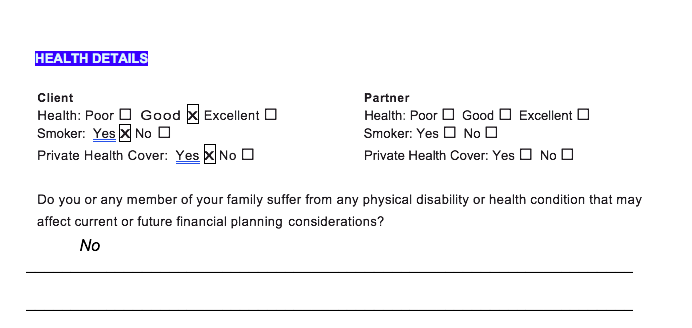

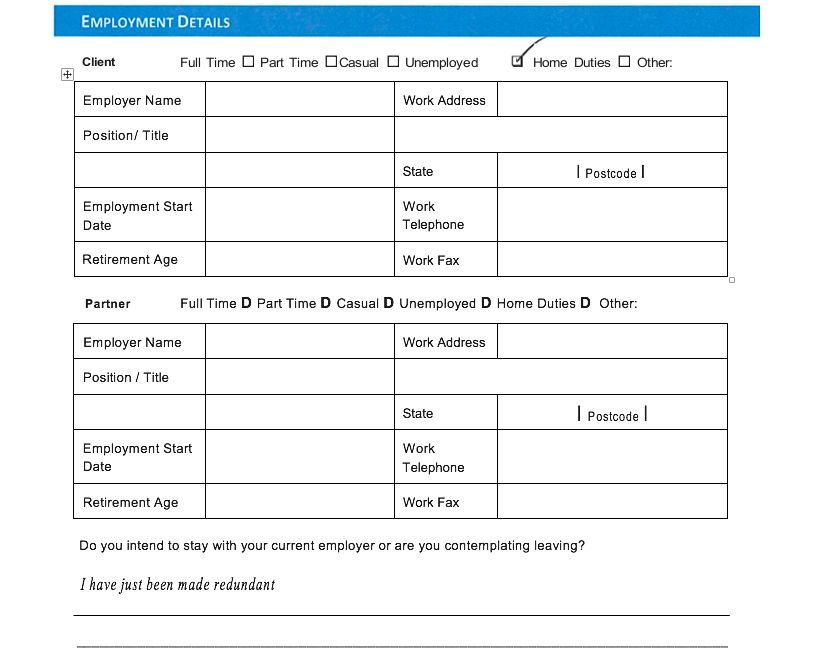

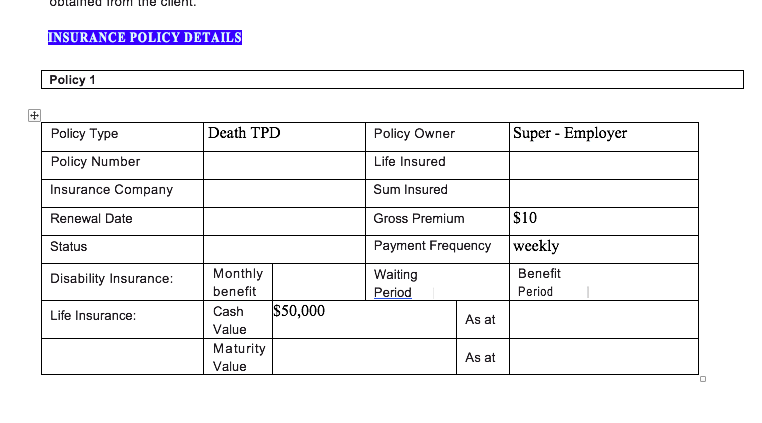

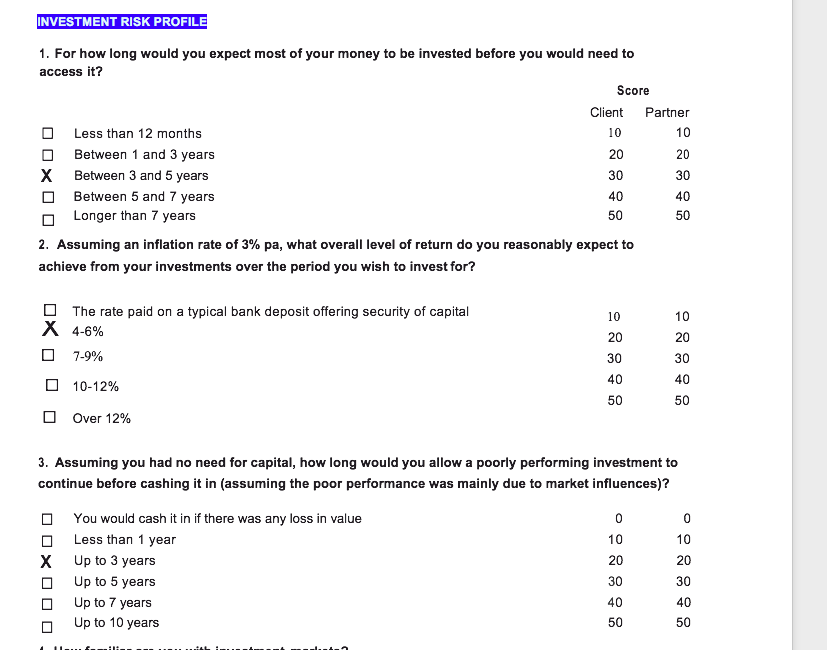

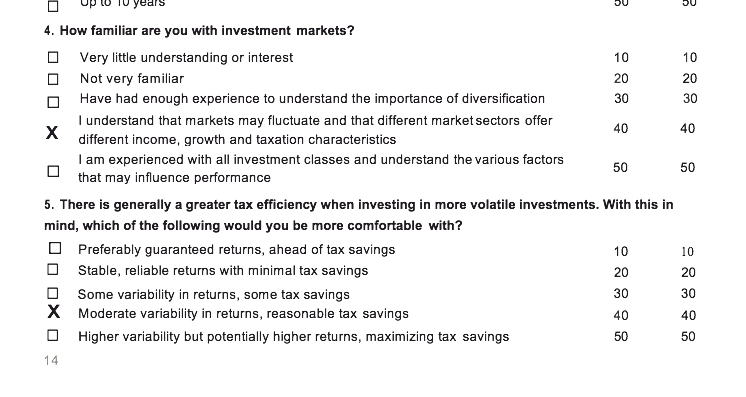

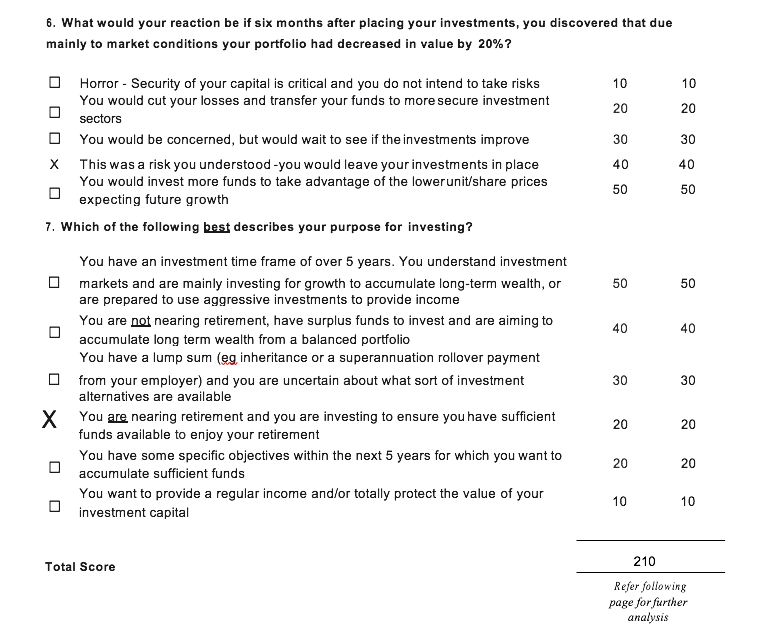

YOUR OBJECTIVES & THE SCOPE OF THIS ADVICE Legislation requires that the advisor must know the client before making any recommendations. However, there is a provision that in certain circumstances an advisor may supply limited advice. If you are seeking limited advice of a particular nature you must make this known at the time of the interview and you should recognize that the recommendations will only relate to that limited advice being sought. Indicate your required areas of advice below: D A full and comprehensive analysis of our financial concerns, needs andobjectives OR Limited advice addressing the following priorities: Investment & Wealth Accumulation: Develop a savings and investment plan the amount of taxation you pay funds for our children's education Review personal risk profile & Investment spread Insurance: Personal risk review - Death cover Personal risk review - Income protection cover Personal risk review - Serious illness or trauma Personal risk review - Permanent disability Other: Superannuation and Retirement: X Retirement funding & super contributions X Reduce X Consolidate your superannuation funds X Providing Advice on redundancy payment Retirement income strategies Centrelink pension & benefits Self Managed Super Funds (SMSF) Loans & Debt: Consolidate/reduce debts Borrow to invest Other: PERSONAL DETAILS Partner Title Client Title Mr Mrs Miss Ms Other: Given Name Paul Preferred Name Paul Surname Standard Date of Birth 1st July 1959 Place of Birth Sydney Sex Male Female D Marital Status Single a Married a Divorced Other: 0 Residential Address Address Line 1 29 Jackson Road Address Line 2 Suburb Melbourne State Victoria Postcode 3000 Contact Details Home Telephone (03) 9670 2000 Work Telephone Mobile 0415 123 111 Email pauls@Tmail.com Mr Mrs Miss Ms Other Given Name Preferred Name Surname Date of Birth Place of Birth Sex Male o Female Marital Status Single Married Divorced Other: 9 Post al Address Address Line 1 Address Line 2 Suburb State Postcode T Fax Work Telephone Mobile Email DEPENDENT DETAILS Name / Date of Birth Age Sex Male Female Sam 25 Eligible for Austudy? Yes No Yes Lucy 17 No Male Female XI Male Female Yes No OO TAX STATUS Personal Company o Trust Super Fund other__ FINANCIAL CONCERNS & PRIORITIES How concerned are you about the following? Very LOW Low Medium High Very Hign ) Level of investment risk I am prepared to accept. (Also refer to risk profile on later pages) Safety and security of our Capital. (ie Rise and Jail of Capital value). That our investments keep pace with inflation and the cost of living Level of liquidity and flexibility required. (ie. Access to money) ] O U U U U Our need for income from investments. n O Our need for capital growth from investments. U U Our desire to minimise taxation. O n U Simplicity of our investments and ease of management. U O ) ) Our desire to maintain our income if ill, injured or disable. Client Partner 3-5 years What is your investment time frame (in years) for your non-superannuation investments? What is your investment time frame (in years) for your superannuation investments ? 3-5 years What age do you hope to retire? What weekly income do you anticipate you will require in retirement (in today's dollars)? How much do you want to have in cash reserves (ie immediately available money) at any time? GENERAL NOTES Paul borrowed a loan to buy a sport car and he still has 30k left to pay for the car. His main concern is does he has enough money or just the arrangement of how can he pay it off, can he pay all of its in one payment or need to keep working to get rid of it. More works on the horizon Three funds, money here there and everywhere just want to sort that out, want to make things easier to keep on top of it Potentially be getting centre link in couple of years Salary being reduce in the future, being redundant Investor risk profiles: 3-5 years most of the money being invested before needed to access, 4-6% after inflation overall level of return, allow poorly investment to cash it in up to 3 years, not very experienced with investment market, moderate variability in return with reasonable tax saving. Purpose of investing investing to insure you have sufficient to enjoy retirement Score of 210 being assertively balance investor, willing to take on moderate risk tolerance, aiming to receive higher return than average, happy to take on risk, understand the market have up and down Assets: less defensive asset and more growth assets, make a return higher than inflation ASSETS & LIABILITIES DETAILS Investment Namel Type Owner C/P/J/O Initial Date Invested Amount Loan Invested ($) Amount($) Current No. Units Sell Price ($) Current Value($) Reference or Policy Number Retain? Yes/No Principal Residence C $0 $500,000 Y Contents/Personal Property $30,000 Y Motor Vehicles -$30,000 $35,000 Y Investment Property Holiday Home Business Interests/Farm Life Insurance (surrender value) Credit Cards -$2,000 $0 Y Other Loans Bank Accounts/Term Deposits $6,000 Direct Shares Managed Investments/Unit Trusts Annuities/ Allocated Pensions C Account $280,000 ? Based Pension Other Assets $290,000 ? Super - Personal Super - Employer C- Owner : C=Client; P=F(Jrtner; v=Joint: 0 = Other $20,000 ? o BANK ACCOUNTS-DETAILS Bank Name Owner Account No. Term? Current Balance Maturity Date Client Partner O $6,000 Saving Bank Client Partner Client Partner Client Partner Client Partner SUPERANNUATION - DETAILS Fund Owner Value $ Insurance in Super Insurance Details Super - Personal Client X Partner $290,000 Client $50,000 Death + TPD $20,000 Super - Employer Account Based Pension Partner D Client $280,000 Partner o Client Partner OD CURRENT INCOME & EXPENSES Weekly ($ pw) Current Amount Fortnightly Monthly ($ pf) (5 pm) Annual Income Test Assessable? Yes/No (Spa) Client Gross Salary / Wages Y $1,000 (now redundant) Other Taxable income $814 (Account based Pension) Sala x Sacrifice Other Non Taxable income SGC - Super Guarantee $411 (now redundant) Centrelink or DVA- Pension/Allowance (A) TOTAL INCOME - CLIENT Partner Gross Salary/W ages Other Taxable income Salary Sacrifice Other Non-Taxable income SGC- Super Guarantee Centrelink or DVA- Pension/Allowance (B)TOTAL INCOME-PARTNER Combined (C) TOTAL LIVING EXPENSES $60,000 Total Income - Surplus (Deficit) (A)+ (B)-(C) Notes Please detail here any additional information in relation to your income and/or expenses (ie, Salary packaging, deductible expense s, inheritance etc) HEALTH DETAILS Client Health: Poor O Good Excellent O Smoker: Yes No O Private Health Cover: Yes x No O Partner Health: Poor Good Excellent Smoker: Yes No O Private Health Cover: Yes No O Do you or any member of your family suffer from any physical disability or health condition that may affect current or future financial planning considerations? No EMPLOYMENT DETAILS Client Full Time Part Time Casual Unemployed Home Duties Other: Employer Name Work Address Position/ Title State Postcode Employment Start Date Work Telephone Retirement Age Work Fax Partner Full Time D Part Time D Casual D Unemployed D Home Duties D Other: Employer Name Work Address Position / Title State Postcode Employment Start Date Work Telephone Retirement Age Work Fax Do you intend to stay with your current employer or are you contemplating leaving? I have just been made redundant Do you foresee any substantial change to your income in the next two to five years? After retirement, do you intend to work again either on a full time or part time basis? If I find casual work, I would consider it. obtained irorri te INSURANCE POLICY DETAILS Policy 1 Death TPD Policy Owner Super - Employer Policy Type Policy Number Life Insured Insurance Company Sum Insured Renewal Date $10 Gross Premium Payment Frequency Status weekly Disability Insurance: Waiting Period Benefit Period Life Insurance: Monthly benefit Cash $50,000 Value Maturity Value As at As at INVESTMENT RISK PROFILE 1. For how long would you expect most of your money to be invested before you would need to access it? Score Client Partner Less than 12 months 10 10 Between 1 and 3 years 20 20 Between 3 and 5 years 30 30 Between 5 and 7 years 40 40 Longer than 7 years 50 50 2. Assuming an inflation rate of 3% pa, what overall level of return do you reasonably expect to achieve from your investments over the period you wish to invest for? 10 The rate paid on a typical bank deposit offering security of capital X 4-6% D 7-9% 10 20 30 20 30 40 50 40 0 10-12% 50 Over 12% 3. Assuming you had no need for capital, how long would you allow a poorly performing investment to continue before cashing it in (assuming the poor performance was mainly due to market influences)? You would cash it in if there was any loss in value Less than 1 year X Up to 3 years Up to 5 years Up to 7 years Up to 10 years 0 10 20 30 40 50 0 10 20 30 40 50 years OU OU 10 40 4. How familiar are you with investment markets? Very little understanding or interest 10 Not very familiar 20 20 Have had enough experience to understand the importance of diversification 30 30 I understand that markets may fluctuate and that different market sectors offer 40 different income, growth and taxation characteristics I am experienced with all investment classes and understand the various factors 50 50 that may influence performance 5. There is generally a greater tax efficiency when investing in more volatile investments. With this in mind, which of the following would you be more comfortable with? O Preferably guaranteed returns, ahead of tax savings 10 Stable, reliable returns with minimal tax savings 20 20 Some variability in returns, some tax savings 30 30 X Moderate variability in returns, reasonable tax savings 40 Higher variability but potentially higher returns, maximizing tax savings 50 50 10 OOX 40 14 6. What would your reaction be if six months after placing your investments, you discovered that due mainly to market conditions your portfolio had decreased in value by 20%? 10 10 20 20 30 30 40 40 50 50 50 50 O Horror - Security of your capital is critical and you do not intend to take risks You would cut your losses and transfer your funds to more secure investment sectors 0 You would be concerned, but would wait to see if the investments improve X This was a risk you understood -you would leave your investments in place You would invest more funds to take advantage of the lower unit/share prices expecting future growth 7. Which of the following best describes your purpose for investing? You have an investment time frame of over 5 years. You understand investment markets and are mainly investing for growth to accumulate long-term wealth, or are prepared to use aggressive investments to provide income You are not nearing retirement, have surplus funds to invest and are aiming to accumulate long term wealth from a balanced portfolio You have a lump sum (eg inheritance or a superannuation rollover payment from your employer) and you are uncertain about what sort of investment alternatives are available X You are nearing retirement and you are investing to ensure you have sufficient funds available to enjoy your retirement You have some specific objectives within the next 5 years for which you want to accumulate sufficient funds You want to provide a regular income and/or totally protect the value of your investment capital 40 40 30 30 20 20 20 20 10 10 Total Score 210 Refer following page for further analysis YOUR OBJECTIVES & THE SCOPE OF THIS ADVICE Legislation requires that the advisor must know the client before making any recommendations. However, there is a provision that in certain circumstances an advisor may supply limited advice. If you are seeking limited advice of a particular nature you must make this known at the time of the interview and you should recognize that the recommendations will only relate to that limited advice being sought. Indicate your required areas of advice below: D A full and comprehensive analysis of our financial concerns, needs andobjectives OR Limited advice addressing the following priorities: Investment & Wealth Accumulation: Develop a savings and investment plan the amount of taxation you pay funds for our children's education Review personal risk profile & Investment spread Insurance: Personal risk review - Death cover Personal risk review - Income protection cover Personal risk review - Serious illness or trauma Personal risk review - Permanent disability Other: Superannuation and Retirement: X Retirement funding & super contributions X Reduce X Consolidate your superannuation funds X Providing Advice on redundancy payment Retirement income strategies Centrelink pension & benefits Self Managed Super Funds (SMSF) Loans & Debt: Consolidate/reduce debts Borrow to invest Other: PERSONAL DETAILS Partner Title Client Title Mr Mrs Miss Ms Other: Given Name Paul Preferred Name Paul Surname Standard Date of Birth 1st July 1959 Place of Birth Sydney Sex Male Female D Marital Status Single a Married a Divorced Other: 0 Residential Address Address Line 1 29 Jackson Road Address Line 2 Suburb Melbourne State Victoria Postcode 3000 Contact Details Home Telephone (03) 9670 2000 Work Telephone Mobile 0415 123 111 Email pauls@Tmail.com Mr Mrs Miss Ms Other Given Name Preferred Name Surname Date of Birth Place of Birth Sex Male o Female Marital Status Single Married Divorced Other: 9 Post al Address Address Line 1 Address Line 2 Suburb State Postcode T Fax Work Telephone Mobile Email DEPENDENT DETAILS Name / Date of Birth Age Sex Male Female Sam 25 Eligible for Austudy? Yes No Yes Lucy 17 No Male Female XI Male Female Yes No OO TAX STATUS Personal Company o Trust Super Fund other__ FINANCIAL CONCERNS & PRIORITIES How concerned are you about the following? Very LOW Low Medium High Very Hign ) Level of investment risk I am prepared to accept. (Also refer to risk profile on later pages) Safety and security of our Capital. (ie Rise and Jail of Capital value). That our investments keep pace with inflation and the cost of living Level of liquidity and flexibility required. (ie. Access to money) ] O U U U U Our need for income from investments. n O Our need for capital growth from investments. U U Our desire to minimise taxation. O n U Simplicity of our investments and ease of management. U O ) ) Our desire to maintain our income if ill, injured or disable. Client Partner 3-5 years What is your investment time frame (in years) for your non-superannuation investments? What is your investment time frame (in years) for your superannuation investments ? 3-5 years What age do you hope to retire? What weekly income do you anticipate you will require in retirement (in today's dollars)? How much do you want to have in cash reserves (ie immediately available money) at any time? GENERAL NOTES Paul borrowed a loan to buy a sport car and he still has 30k left to pay for the car. His main concern is does he has enough money or just the arrangement of how can he pay it off, can he pay all of its in one payment or need to keep working to get rid of it. More works on the horizon Three funds, money here there and everywhere just want to sort that out, want to make things easier to keep on top of it Potentially be getting centre link in couple of years Salary being reduce in the future, being redundant Investor risk profiles: 3-5 years most of the money being invested before needed to access, 4-6% after inflation overall level of return, allow poorly investment to cash it in up to 3 years, not very experienced with investment market, moderate variability in return with reasonable tax saving. Purpose of investing investing to insure you have sufficient to enjoy retirement Score of 210 being assertively balance investor, willing to take on moderate risk tolerance, aiming to receive higher return than average, happy to take on risk, understand the market have up and down Assets: less defensive asset and more growth assets, make a return higher than inflation ASSETS & LIABILITIES DETAILS Investment Namel Type Owner C/P/J/O Initial Date Invested Amount Loan Invested ($) Amount($) Current No. Units Sell Price ($) Current Value($) Reference or Policy Number Retain? Yes/No Principal Residence C $0 $500,000 Y Contents/Personal Property $30,000 Y Motor Vehicles -$30,000 $35,000 Y Investment Property Holiday Home Business Interests/Farm Life Insurance (surrender value) Credit Cards -$2,000 $0 Y Other Loans Bank Accounts/Term Deposits $6,000 Direct Shares Managed Investments/Unit Trusts Annuities/ Allocated Pensions C Account $280,000 ? Based Pension Other Assets $290,000 ? Super - Personal Super - Employer C- Owner : C=Client; P=F(Jrtner; v=Joint: 0 = Other $20,000 ? o BANK ACCOUNTS-DETAILS Bank Name Owner Account No. Term? Current Balance Maturity Date Client Partner O $6,000 Saving Bank Client Partner Client Partner Client Partner Client Partner SUPERANNUATION - DETAILS Fund Owner Value $ Insurance in Super Insurance Details Super - Personal Client X Partner $290,000 Client $50,000 Death + TPD $20,000 Super - Employer Account Based Pension Partner D Client $280,000 Partner o Client Partner OD CURRENT INCOME & EXPENSES Weekly ($ pw) Current Amount Fortnightly Monthly ($ pf) (5 pm) Annual Income Test Assessable? Yes/No (Spa) Client Gross Salary / Wages Y $1,000 (now redundant) Other Taxable income $814 (Account based Pension) Sala x Sacrifice Other Non Taxable income SGC - Super Guarantee $411 (now redundant) Centrelink or DVA- Pension/Allowance (A) TOTAL INCOME - CLIENT Partner Gross Salary/W ages Other Taxable income Salary Sacrifice Other Non-Taxable income SGC- Super Guarantee Centrelink or DVA- Pension/Allowance (B)TOTAL INCOME-PARTNER Combined (C) TOTAL LIVING EXPENSES $60,000 Total Income - Surplus (Deficit) (A)+ (B)-(C) Notes Please detail here any additional information in relation to your income and/or expenses (ie, Salary packaging, deductible expense s, inheritance etc) HEALTH DETAILS Client Health: Poor O Good Excellent O Smoker: Yes No O Private Health Cover: Yes x No O Partner Health: Poor Good Excellent Smoker: Yes No O Private Health Cover: Yes No O Do you or any member of your family suffer from any physical disability or health condition that may affect current or future financial planning considerations? No EMPLOYMENT DETAILS Client Full Time Part Time Casual Unemployed Home Duties Other: Employer Name Work Address Position/ Title State Postcode Employment Start Date Work Telephone Retirement Age Work Fax Partner Full Time D Part Time D Casual D Unemployed D Home Duties D Other: Employer Name Work Address Position / Title State Postcode Employment Start Date Work Telephone Retirement Age Work Fax Do you intend to stay with your current employer or are you contemplating leaving? I have just been made redundant Do you foresee any substantial change to your income in the next two to five years? After retirement, do you intend to work again either on a full time or part time basis? If I find casual work, I would consider it. obtained irorri te INSURANCE POLICY DETAILS Policy 1 Death TPD Policy Owner Super - Employer Policy Type Policy Number Life Insured Insurance Company Sum Insured Renewal Date $10 Gross Premium Payment Frequency Status weekly Disability Insurance: Waiting Period Benefit Period Life Insurance: Monthly benefit Cash $50,000 Value Maturity Value As at As at INVESTMENT RISK PROFILE 1. For how long would you expect most of your money to be invested before you would need to access it? Score Client Partner Less than 12 months 10 10 Between 1 and 3 years 20 20 Between 3 and 5 years 30 30 Between 5 and 7 years 40 40 Longer than 7 years 50 50 2. Assuming an inflation rate of 3% pa, what overall level of return do you reasonably expect to achieve from your investments over the period you wish to invest for? 10 The rate paid on a typical bank deposit offering security of capital X 4-6% D 7-9% 10 20 30 20 30 40 50 40 0 10-12% 50 Over 12% 3. Assuming you had no need for capital, how long would you allow a poorly performing investment to continue before cashing it in (assuming the poor performance was mainly due to market influences)? You would cash it in if there was any loss in value Less than 1 year X Up to 3 years Up to 5 years Up to 7 years Up to 10 years 0 10 20 30 40 50 0 10 20 30 40 50 years OU OU 10 40 4. How familiar are you with investment markets? Very little understanding or interest 10 Not very familiar 20 20 Have had enough experience to understand the importance of diversification 30 30 I understand that markets may fluctuate and that different market sectors offer 40 different income, growth and taxation characteristics I am experienced with all investment classes and understand the various factors 50 50 that may influence performance 5. There is generally a greater tax efficiency when investing in more volatile investments. With this in mind, which of the following would you be more comfortable with? O Preferably guaranteed returns, ahead of tax savings 10 Stable, reliable returns with minimal tax savings 20 20 Some variability in returns, some tax savings 30 30 X Moderate variability in returns, reasonable tax savings 40 Higher variability but potentially higher returns, maximizing tax savings 50 50 10 OOX 40 14 6. What would your reaction be if six months after placing your investments, you discovered that due mainly to market conditions your portfolio had decreased in value by 20%? 10 10 20 20 30 30 40 40 50 50 50 50 O Horror - Security of your capital is critical and you do not intend to take risks You would cut your losses and transfer your funds to more secure investment sectors 0 You would be concerned, but would wait to see if the investments improve X This was a risk you understood -you would leave your investments in place You would invest more funds to take advantage of the lower unit/share prices expecting future growth 7. Which of the following best describes your purpose for investing? You have an investment time frame of over 5 years. You understand investment markets and are mainly investing for growth to accumulate long-term wealth, or are prepared to use aggressive investments to provide income You are not nearing retirement, have surplus funds to invest and are aiming to accumulate long term wealth from a balanced portfolio You have a lump sum (eg inheritance or a superannuation rollover payment from your employer) and you are uncertain about what sort of investment alternatives are available X You are nearing retirement and you are investing to ensure you have sufficient funds available to enjoy your retirement You have some specific objectives within the next 5 years for which you want to accumulate sufficient funds You want to provide a regular income and/or totally protect the value of your investment capital 40 40 30 30 20 20 20 20 10 10 Total Score 210 Refer following page for further analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts