Question: Discuss if the currency went up/down or stayed flat and how that affected the different strategies. Which strategy was most profitable? Which strategy performed the

Discuss if the currency went up/down or stayed flat and how that affected the different strategies. Which strategy was most profitable? Which strategy performed the worst? Was it good to follow the "experts"? Which option is better ATM, ITM or OTM? Why are rollover estimates different among brokers? What conclusions can you get from this exercise?

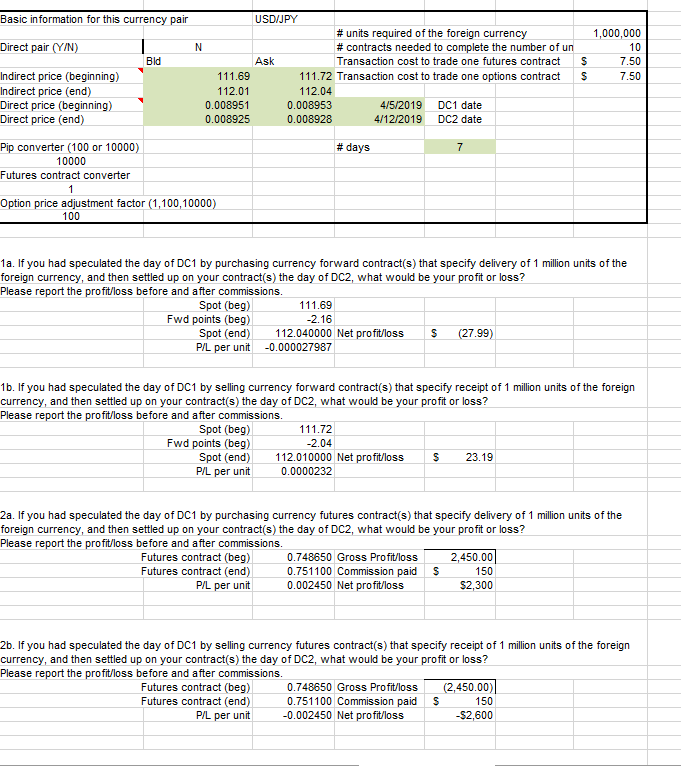

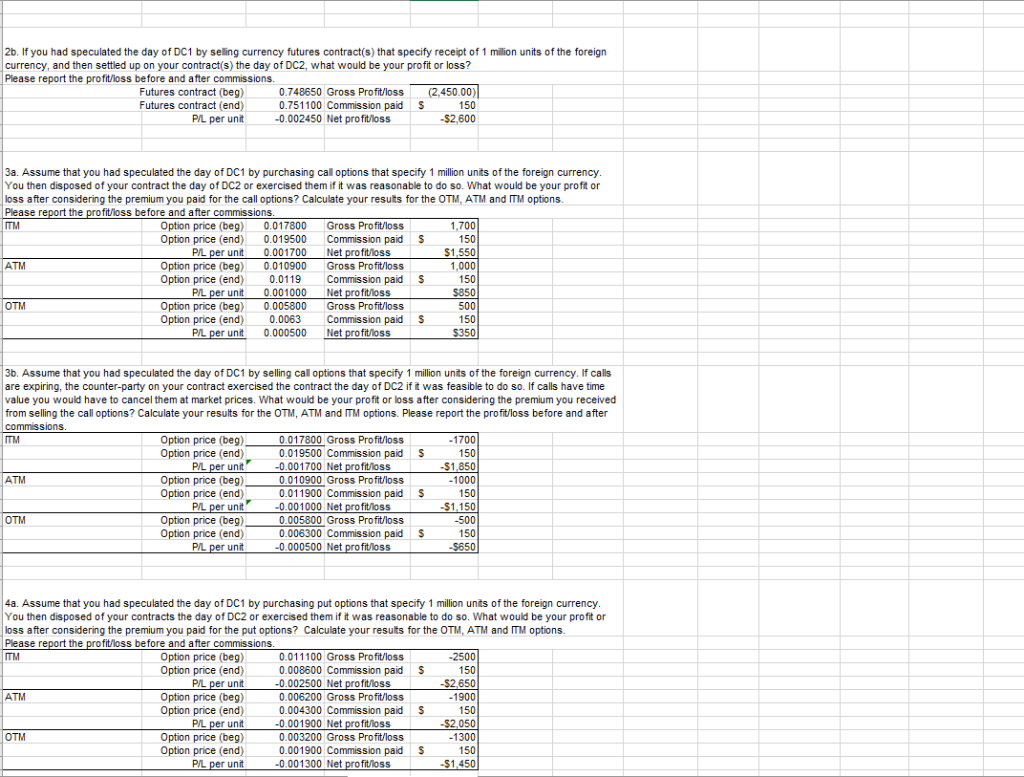

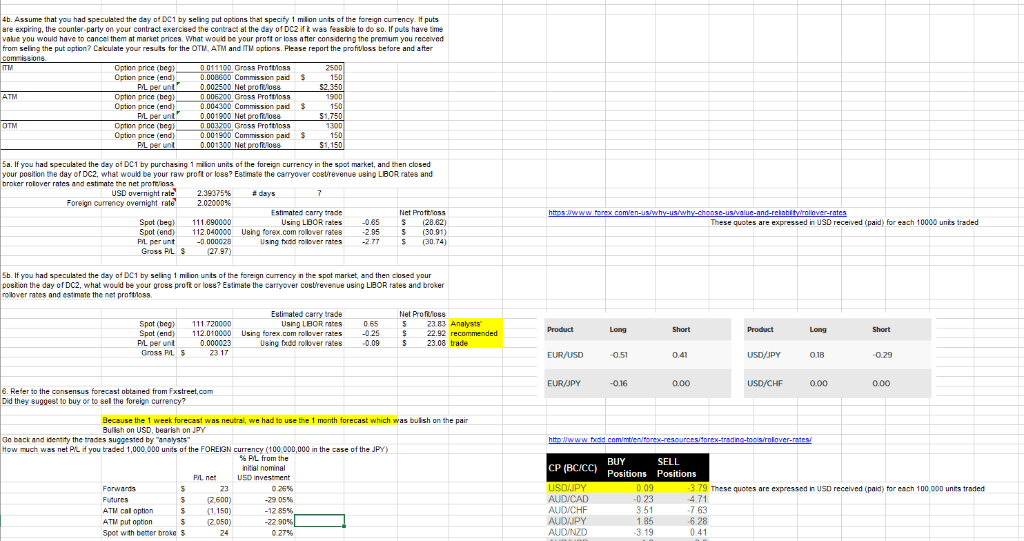

Basic information for this currency pair USD/JPY # units required of the foreign currency # contracts needed to complete the number of u Transaction cost to trade one futures contract 1,000,000 10 7.50 7.50 Direct pair (YIN) Bld Ask S 111.72 Transaction cost to trade one options contractS Indirect price (beginning) Indirect price (end) Direct price (beginning) Direct price (end) 111.69 112.01 0.008951 0.008925 112.04 0.008953 0.008928 2019DC1 date 4/12/2019 DC2 date Pip converter (100 or 10000) # days 10000 Futures contract converter Option price adjustment factor (1,100,10000) 100 1a. If you had speculated the day of DC1 by purchasing currency forward contract(s) that specify delivery of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Spot (beg) 111.69 2.16 Fwd points (beg) Spot (end)112.040000 Net profit/loss P/L per unit-0.000027987 S 1b. If you had speculated the day of DC1 by selling currency forward contract(s) that specify receipt of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Spot (beg) 111.72 2.04 Fwd points (beg) Spot (end)112.010000 Net profit/loss P/L per unit S 23.19 0.0000232 2a. If you had speculated the day of DC1 by purchasing currency futures contract(s) that specify delivery of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions 2,450.00 150 300 Futures contract (beg) Futures contract (end) P/L per unit 0.748650 Gross Profi/loss 0.751100 Commission paid S 0.002450 Net profitloss 2b. If you had speculated the day of DC1 by selling currency futures contract(s) that specify receipt of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Futures contract (beg) Futures contract (end) P/L per unit 0.748650 Gross Pro fit/loss (2,450.00) 0.751100 Commission paidS 0.002450 Net profit/loss 150 $2,600 2b. If you had speculated the day of DC1 by selling currency futures contract(s) that specify receipt of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Futures contract (beg) 0.748650 Gross Profitloss (2,450.00) 150 Futures contract (end) P/L per unit 0.751100 Commission paid 0.002450 Net profitloss S $2,600 3a. Assume that you had speculated the day of DC1 by purchasing call options that specify 1 million units of the foreign currency You then disposed of your contract the day of DC2 or exercised them if it was reasonable to do so. What would be your proft or loss after considering the premium you paid for the call options? Calculate your resuts for the OTM,ATM and T options Please the profitloss before and after commissions ITM Option price (beg) 0.017800 Gross Profit/loss Option price (end) 0.019500 Commission paid S 1,700 150 PL per unit 0.001700 Net profitloss ATM Option price (beg) Option price (end) 0.010900 Gross Profit/loss 1,000 150 S850 500 150 0.0119 Commission paid S PL per unit 0.001000 Net profit/loss Option price (beg) Option price (end) 0.005800 Gross Profit/loss 0.0063 Commission paid S PL per unit 0.000500 Net profitloss 3b. Assume that you had speculated the day of DC1 by selling cal options that specify 1 million units of the foreign currency. If calls are expiring, the counter-party on your contract exercised the contract the day of DC2 if t was feasible to do so. If calls have time value you would have to cancel them at market prices. What would be your profit or loss after considering the premium you received from selling the call options? Calculate your results for the OTM, ATM and TM options. Please report the profit/loss before and after commssionS Option price (beg) Option price (end) P/L per unit Option price (beg) Option price (end) PL per uni Option price (beg) Option price (end) P/L per unit 0.017800 Gross Profit/loss 0.019500 Commission paid S 1700 150 t-0.001700 Net profitloss ATM 0.010900 Gross Profi/loss 0.011900 Commission paid S 1000 150 $1,150 -500 150 50 t 0.001000 Net proft/loss OTM 0.005800 Gross Profit/loss 0.006300 Commission paid 0.000500 Net profitloss S 4a. Assume that you had speculated the day of DC1 by purchasing put options that specify 1 million unts of the foreign currency You then disposed of your contracts the day of DC2 or exercised them if t was reasonable to do so. What would be your profit or oss after considering the premium you paid for the put options? Calculate your resuts for the OTM,ATM and TM options Ple ase report the profit/loss before and a fter commissions Option price (beg) Option price (end) PL per unit Option price (beg) Option price (end) PL per unit Option price (beg) Option price (end) P/L per unit 0.011100 Gross Profi/loss 0.008600 Commission paid S 0.002500 Net profitloss 0.006200 Gross Profit/loss 0.004300 Commission paid S 0.001900 Net profitloss 0.003200 Gross Profit/loss 0.001900 Commission paid S 0.001300 Net profitloss 2500 150 1900 150 ATM OTM -1300 150 $1,450 b. Assume that you had speculated the day of DC1 by seling put opbons that specify 1 mlon unts of the foreign currency. If puts are expiring, the counter-party on your contract exercised the contract st the day of DC2 if t was fessible to do so. If puts have time value you would have to cancel them at market prices. What would be your prott or loss atter considering the premium you received from seling the put option? Caculate your resuts for the OTM, ATM and IT options Please report the profitloss before and after Option price (beg) Option price (end) 011100 Gross Prottioss 0.008800 Commission paid S 150 PyL per unt 002500 Net profToss 006200 Gross Proibloss Option price (beg) Option price (end) 0.004300 Commission paid S 150 001900 Net profToss 003200 Gross Proibioss Option price (beg) Option price (end 0.001900 Commission paid S Net prono 150 5a. If you had speculated the day of DC1 by purchasing 1 miion units of the foreign currency in the spot market, and then closed your poeition the day of DC2, what would be your raw proft or los8? Estmate the carryover costrevenue using LBOR rates and broker rolover rates and estimate the net proft/loss USD overnight rate Foreign currency overnight rate, 2.39375% 2.02000% #days Estimated carry trade Using LBOR rates Using forex.com rolover rates usng todd rolover rates Net ProtE 055 S (28.82) (30.81) (30.74) Spot (beg)111.890000 112.040000 -0.000028 -085 2.95 -277 These quotes are expressed in USD received (paid) for each 10000 unts traded Spot (end PL per unt Gross P/L S Sb. If you had speculated the day of DC1 by seling 1 mlion unts of the foreign currency in the spot market, and then closed your postion the day of DC2, what would be your gross prot or loss? Estimate the carryover costrevenue using LIBOR rales and broker olower rates and estimate the net prottloss Esti ated carry trade Net Pronuloss Spot (beg) 111.720000 Spot (end)112.010000 PL per unt 0.000023 Gross P/LS Using LBOR rates Using forex.com rollover rates 025 fxdd rollover rates 065 23.83 22.92 recommended S 0.09 3.08 trade - 23 17 0.51 0.41 USD/JPY 0.18 .0.16 0.00 0.00 6. Refer to the consensus forecast obtained from Fxstreet.com Did they suggeet to buy or to sel the foreign currency? Because the 1 week forecast was neutral, we had to use the 1 month forecast which was bulish on the pair Bulish on USD, bearish on JPY Go back and idenaity the trades suggested by anaysts How much was net PIL if you traded 1,000,000 units of the FOREIGN currency( (100,000,000 in the case of the % PL from the USD investment 29 056 CP (BCICC) nitial nominal Positions Positions P/L net 23 (2,600) 1.150) 2,050) 0 26% 3.79 These quotes are expressed in USD received (paid) for cach 100,000 unrs traded 4.71 0.23 63 6 28 0.41 ATW cal option ATM put opbon Spot with beter broke S 12 8556 1.85 3.19 02756 Basic information for this currency pair USD/JPY # units required of the foreign currency # contracts needed to complete the number of u Transaction cost to trade one futures contract 1,000,000 10 7.50 7.50 Direct pair (YIN) Bld Ask S 111.72 Transaction cost to trade one options contractS Indirect price (beginning) Indirect price (end) Direct price (beginning) Direct price (end) 111.69 112.01 0.008951 0.008925 112.04 0.008953 0.008928 2019DC1 date 4/12/2019 DC2 date Pip converter (100 or 10000) # days 10000 Futures contract converter Option price adjustment factor (1,100,10000) 100 1a. If you had speculated the day of DC1 by purchasing currency forward contract(s) that specify delivery of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Spot (beg) 111.69 2.16 Fwd points (beg) Spot (end)112.040000 Net profit/loss P/L per unit-0.000027987 S 1b. If you had speculated the day of DC1 by selling currency forward contract(s) that specify receipt of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Spot (beg) 111.72 2.04 Fwd points (beg) Spot (end)112.010000 Net profit/loss P/L per unit S 23.19 0.0000232 2a. If you had speculated the day of DC1 by purchasing currency futures contract(s) that specify delivery of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions 2,450.00 150 300 Futures contract (beg) Futures contract (end) P/L per unit 0.748650 Gross Profi/loss 0.751100 Commission paid S 0.002450 Net profitloss 2b. If you had speculated the day of DC1 by selling currency futures contract(s) that specify receipt of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Futures contract (beg) Futures contract (end) P/L per unit 0.748650 Gross Pro fit/loss (2,450.00) 0.751100 Commission paidS 0.002450 Net profit/loss 150 $2,600 2b. If you had speculated the day of DC1 by selling currency futures contract(s) that specify receipt of 1 million units of the foreign currency, and then settled up on your contract(s) the day of DC2, what would be your profit or loss? Please report the profit/loss before and after commissions Futures contract (beg) 0.748650 Gross Profitloss (2,450.00) 150 Futures contract (end) P/L per unit 0.751100 Commission paid 0.002450 Net profitloss S $2,600 3a. Assume that you had speculated the day of DC1 by purchasing call options that specify 1 million units of the foreign currency You then disposed of your contract the day of DC2 or exercised them if it was reasonable to do so. What would be your proft or loss after considering the premium you paid for the call options? Calculate your resuts for the OTM,ATM and T options Please the profitloss before and after commissions ITM Option price (beg) 0.017800 Gross Profit/loss Option price (end) 0.019500 Commission paid S 1,700 150 PL per unit 0.001700 Net profitloss ATM Option price (beg) Option price (end) 0.010900 Gross Profit/loss 1,000 150 S850 500 150 0.0119 Commission paid S PL per unit 0.001000 Net profit/loss Option price (beg) Option price (end) 0.005800 Gross Profit/loss 0.0063 Commission paid S PL per unit 0.000500 Net profitloss 3b. Assume that you had speculated the day of DC1 by selling cal options that specify 1 million units of the foreign currency. If calls are expiring, the counter-party on your contract exercised the contract the day of DC2 if t was feasible to do so. If calls have time value you would have to cancel them at market prices. What would be your profit or loss after considering the premium you received from selling the call options? Calculate your results for the OTM, ATM and TM options. Please report the profit/loss before and after commssionS Option price (beg) Option price (end) P/L per unit Option price (beg) Option price (end) PL per uni Option price (beg) Option price (end) P/L per unit 0.017800 Gross Profit/loss 0.019500 Commission paid S 1700 150 t-0.001700 Net profitloss ATM 0.010900 Gross Profi/loss 0.011900 Commission paid S 1000 150 $1,150 -500 150 50 t 0.001000 Net proft/loss OTM 0.005800 Gross Profit/loss 0.006300 Commission paid 0.000500 Net profitloss S 4a. Assume that you had speculated the day of DC1 by purchasing put options that specify 1 million unts of the foreign currency You then disposed of your contracts the day of DC2 or exercised them if t was reasonable to do so. What would be your profit or oss after considering the premium you paid for the put options? Calculate your resuts for the OTM,ATM and TM options Ple ase report the profit/loss before and a fter commissions Option price (beg) Option price (end) PL per unit Option price (beg) Option price (end) PL per unit Option price (beg) Option price (end) P/L per unit 0.011100 Gross Profi/loss 0.008600 Commission paid S 0.002500 Net profitloss 0.006200 Gross Profit/loss 0.004300 Commission paid S 0.001900 Net profitloss 0.003200 Gross Profit/loss 0.001900 Commission paid S 0.001300 Net profitloss 2500 150 1900 150 ATM OTM -1300 150 $1,450 b. Assume that you had speculated the day of DC1 by seling put opbons that specify 1 mlon unts of the foreign currency. If puts are expiring, the counter-party on your contract exercised the contract st the day of DC2 if t was fessible to do so. If puts have time value you would have to cancel them at market prices. What would be your prott or loss atter considering the premium you received from seling the put option? Caculate your resuts for the OTM, ATM and IT options Please report the profitloss before and after Option price (beg) Option price (end) 011100 Gross Prottioss 0.008800 Commission paid S 150 PyL per unt 002500 Net profToss 006200 Gross Proibloss Option price (beg) Option price (end) 0.004300 Commission paid S 150 001900 Net profToss 003200 Gross Proibioss Option price (beg) Option price (end 0.001900 Commission paid S Net prono 150 5a. If you had speculated the day of DC1 by purchasing 1 miion units of the foreign currency in the spot market, and then closed your poeition the day of DC2, what would be your raw proft or los8? Estmate the carryover costrevenue using LBOR rates and broker rolover rates and estimate the net proft/loss USD overnight rate Foreign currency overnight rate, 2.39375% 2.02000% #days Estimated carry trade Using LBOR rates Using forex.com rolover rates usng todd rolover rates Net ProtE 055 S (28.82) (30.81) (30.74) Spot (beg)111.890000 112.040000 -0.000028 -085 2.95 -277 These quotes are expressed in USD received (paid) for each 10000 unts traded Spot (end PL per unt Gross P/L S Sb. If you had speculated the day of DC1 by seling 1 mlion unts of the foreign currency in the spot market, and then closed your postion the day of DC2, what would be your gross prot or loss? Estimate the carryover costrevenue using LIBOR rales and broker olower rates and estimate the net prottloss Esti ated carry trade Net Pronuloss Spot (beg) 111.720000 Spot (end)112.010000 PL per unt 0.000023 Gross P/LS Using LBOR rates Using forex.com rollover rates 025 fxdd rollover rates 065 23.83 22.92 recommended S 0.09 3.08 trade - 23 17 0.51 0.41 USD/JPY 0.18 .0.16 0.00 0.00 6. Refer to the consensus forecast obtained from Fxstreet.com Did they suggeet to buy or to sel the foreign currency? Because the 1 week forecast was neutral, we had to use the 1 month forecast which was bulish on the pair Bulish on USD, bearish on JPY Go back and idenaity the trades suggested by anaysts How much was net PIL if you traded 1,000,000 units of the FOREIGN currency( (100,000,000 in the case of the % PL from the USD investment 29 056 CP (BCICC) nitial nominal Positions Positions P/L net 23 (2,600) 1.150) 2,050) 0 26% 3.79 These quotes are expressed in USD received (paid) for cach 100,000 unrs traded 4.71 0.23 63 6 28 0.41 ATW cal option ATM put opbon Spot with beter broke S 12 8556 1.85 3.19 02756

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts