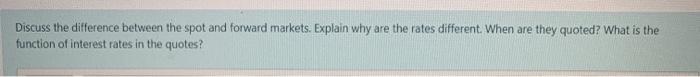

Question: Discuss the difference between the spot and forward markets. Explain why are the rates different. When are they quoted? What is the function of interest

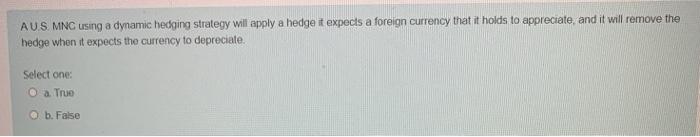

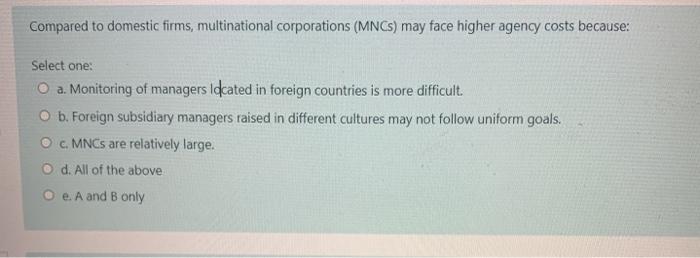

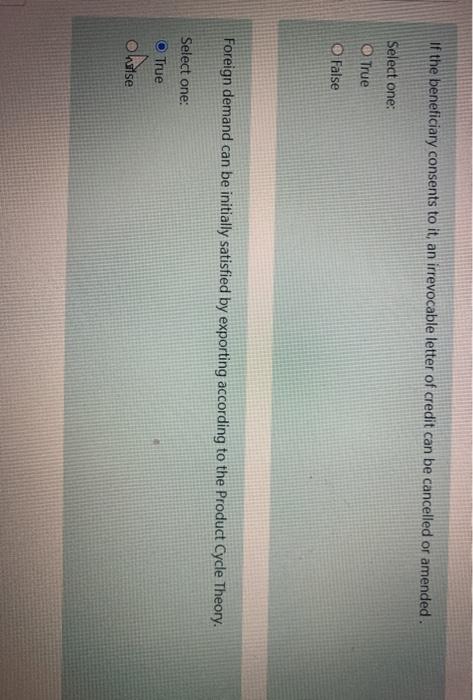

Discuss the difference between the spot and forward markets. Explain why are the rates different. When are they quoted? What is the function of interest rates in the quotes? AUS. MNC using a dynamic hedging strategy will apply a hedge it expects a foreign currency that it holds to appreciate and it will remove the hedge when it expects the currency to dopreciate. Select one: O a True @b. False Compared to domestic firms, multinational corporations (MNCs) may face higher agency costs because: Select one: O a. Monitoring of managers located in foreign countries is more difficult. O b. Foreign subsidiary managers raised in different cultures may not follow uniform goals. O c. MNCs are relatively large. O d. All of the above O e A and B only If the beneficiary consents to it, an irrevocable letter of credit can be cancelled or amended. Select one: True False Foreign demand can be initially satisfied by exporting according to the Product Cycle Theory. Select one: True chatse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts