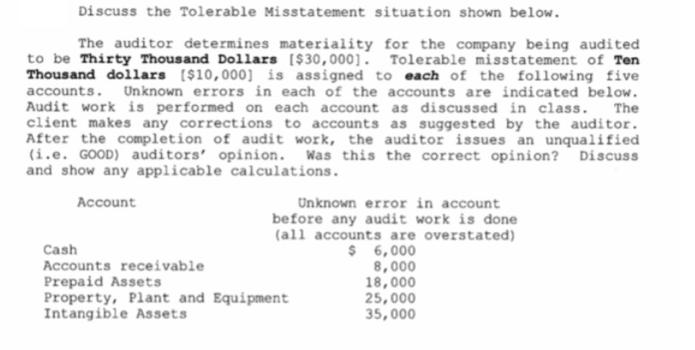

Question: Discuss the Tolerable Misstatement situation shown below. The auditor determines materiality for the company being audited to be Thirty Thousand Dollars [$30,000]. Tolerable misstatement

Discuss the Tolerable Misstatement situation shown below. The auditor determines materiality for the company being audited to be Thirty Thousand Dollars [$30,000]. Tolerable misstatement of Ten Thousand dollars ($10,000] is assigned to each of the following five accounts. Unknown errors in each of the accounts are indicated below. Audit work is performed on each account as discussed in class. The client makes any corrections to accounts as suggested by the auditor. After the completion of audit work, the auditor issues an unqualified (i.e. GOOD) auditors' opinion. Was this the correct opinion? Discuss and show any applicable calculations. Account Cash Accounts receivable Prepaid Assets Unknown error in account before any audit work is done (all accounts are overstated) $ 6,000 8,000 Property, Plant and Equipment Intangible Assets 18,000 25,000 35,000

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Generally 5070 of the determined materiality is used to derive tolerable misstatement In this case m... View full answer

Get step-by-step solutions from verified subject matter experts