Question: Discussion 7 - Bond Valuations For this week's discussion task we will take the annuity framework in the spreadsheet and apply it to bond pricing.

Discussion 7 - Bond Valuations

For this week's discussion task we will take the annuity framework in the spreadsheet and apply it to bond pricing. Below is a table with individual bond characteristics for each student. You are going to use those characteristics, along with the Excel spreadsheet below to find the Price(PV). YTM (RATE), Maturity (NPER), and Coupon (PMT). Obviously you ignore one of the given characteristics for each calculation - because you are calculating that characteristic. For example, Ayala's given characteristics are:

WE WILL USE THIS EXAMPLE:

| Student | YTM | Maturity (Years) | Coupon | Price | Par |

| Ayala | 4.19% | 16 | $ 40.00 | $ 982.00 | $1,000 |

So in the Price, he would enter the TYM, Maturity, Coupon, and Par to get a price - in this case, $868.09. Please note that your calculated price, maturity, coupon, or YTM will not match what is given in the table below. You can respond to the discussion with just your answers for Price, Maturity, Coupon, and YTM or you can attach your spreadsheet - please include your name in the filename if you do.

| Alex | 4.90% | 10 | $ 32.00 | $ 917.00 |

| Alvarado | 4.42% | 14 | $ 31.00 | $ 1,000.00 |

| Ayala | 4.19% | 16 | $ 40.00 | $ 982.00 |

| Brutus | 4.83% | 16 | $ 35.00 | $ 984.00 |

| Dadouch | 4.45% | 10 | $ 32.00 | $ 932.00 |

| Dantes | 4.22% | 12 | $ 34.00 | $ 979.00 |

| Henriquez | 4.38% | 16 | $ 31.00 | $ 961.00 |

| James | 4.83% | 8 | $ 34.00 | $ 937.00 |

| Kemp | 4.00% | 11 | $ 34.00 | $ 990.00 |

| Mercier | 4.73% | 11 | $ 37.00 | $ 957.00 |

| Paulino | 4.36% | 9 | $ 36.00 | $ 913.00 |

| Ren | 4.98% | 12 | $ 31.00 | $ 997.00 |

| Sam | 4.27% | 11 | $ 34.00 | $ 997.00 |

| Scott | 4.24% | 14 | $ 37.00 | $ 987.00 |

| Sugiyama | 4.99% | 10 | $ 39.00 | $ 999.00 |

| Tang | 4.55% | 10 | $ 31.00 | $ 924.00 |

| Townsend | 4.26% | 9 | $ 40.00 | $ 957.00 |

| Valenzuela | 4.64% | 14 | $ 37.00 | $ 928.00 |

| Yao | 4.55% | 11 | $ 32.00 | $ 920.00 |

This is confusing.

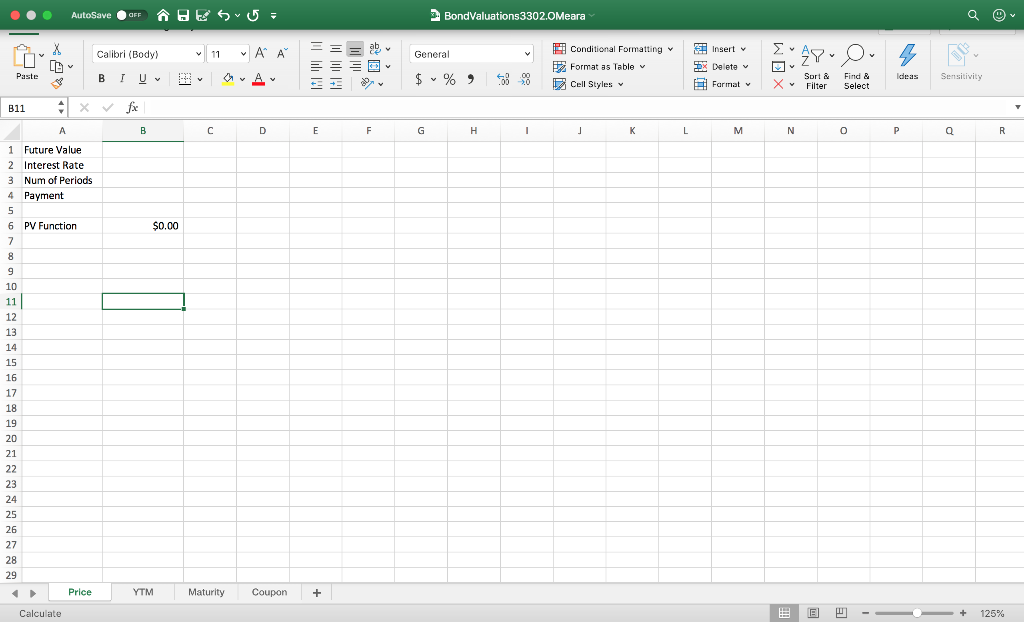

... Autosaven Besvus BondValuations3302.0Meara 11 A A = = = General "AD O 22 LA Calibri (Body) BI U B Conditional Formatting Format as Table Cell Styles Insert * Delete Format Paste O A Ideas Sensitivity $ % 68 Sort & Filter %0 X Find & Select 811 x fie B C D E F G H I J K L M N O P Q R 1 Future Value 2 Interest Rate 3 Num of Periods 4 Payment PV Function $0.00 Price YTM Maturity Coupon + Calculate E E - O 125%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts