Question: Discussion:: Future Value, Present Value, and Interest Rates You decide you would like to retire at age 65, and expect to live until you are

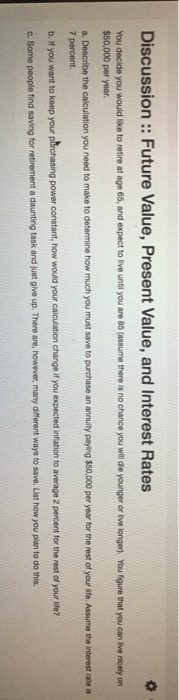

Discussion:: Future Value, Present Value, and Interest Rates You decide you would like to retire at age 65, and expect to live until you are 85 assume there is no chance you will de younger or lelonger. You fgure that you can ive nicely on $50,000 per year a. Describe the calculation you need to make to determine how much you must save to purchase an annuity paying $50,000 per year for the rest of your life. Assume the interest rate is 7 percent. b. If you want to keep your pdrchasing c. Some people f power constant, how would your calculation change if you expected infiation to average 2 percent for the rest of your life? ind saving for retirement a daunting task and just give up. There are, however, many different ways to save. List how you pian to do this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts