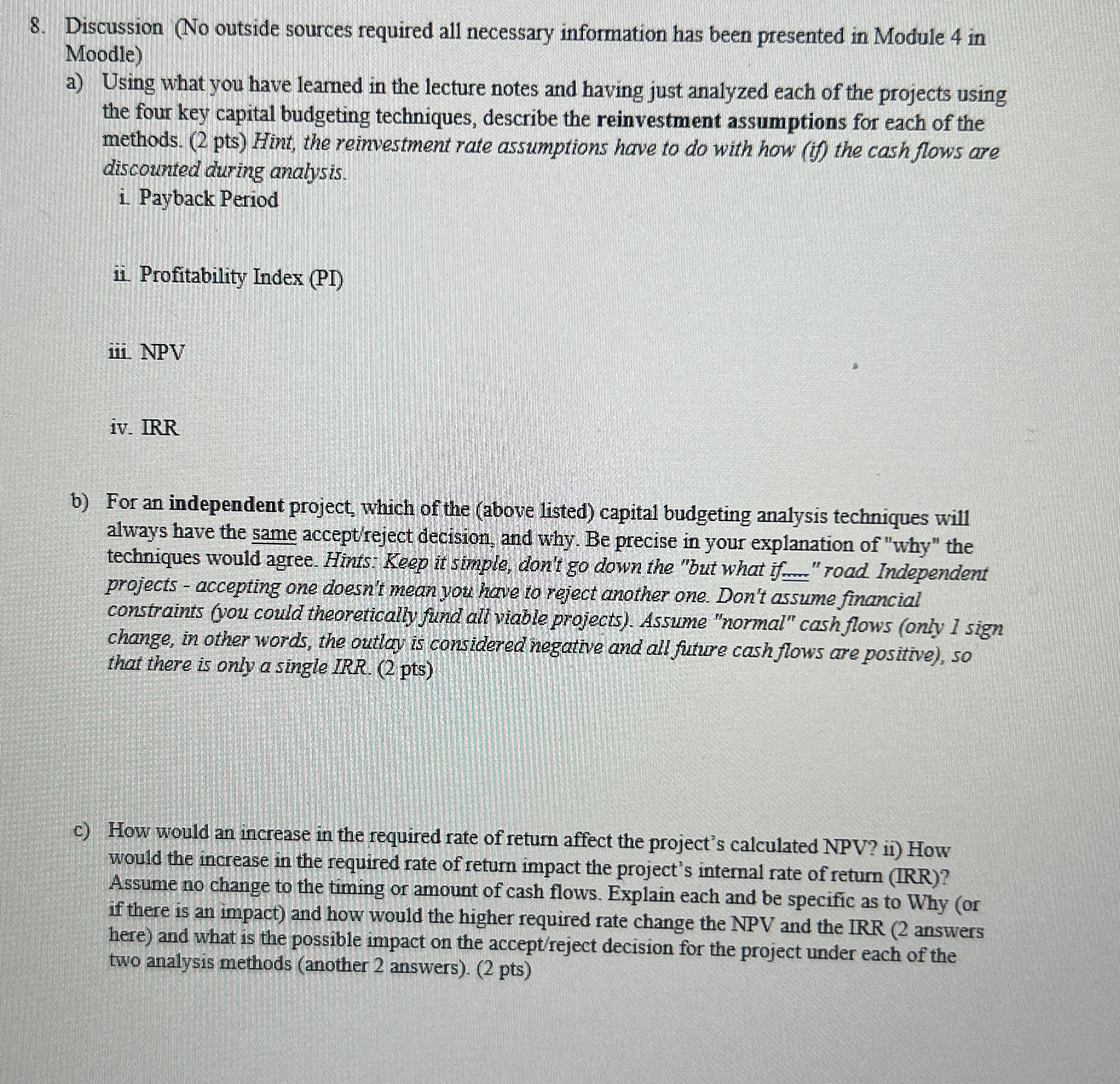

Question: Discussion ( No outside sources required all necessary information has been presented in Module 4 in Moodle ) a ) Using what you have leamed

Discussion No outside sources required all necessary information has been presented in Module in Moodle

a Using what you have leamed in the lecture notes and having just analyzed each of the projects using the four key capital budgeting techniques, describe the reinvestment assumptions for each of the methods. pts Hint, the reinvestment rate assumptions have to do with how ij the cash flows are discounted during analysis.

i Payback Period

ii Profitability Index PI

iii. NPV

iv IRR

b For an independent project, which of the above listed capital budgeting analysis techniques will always have the same acceptreject decision, and why. Be precise in your explanation of "why" the techniques would agree. Hints: Keep it simple, don't go down the "but what if road Independent projects accepting one doesn't mean you have to reject another one. Don't assume financial constraints you could theoretically flund alt vable projects Assume "normal" cash flows only sign change, in other words, the outtoy is considered negative and all future cash flows are positive so that there is only a single IRR. pts

c How would an increase in the required rate of return affect the project's calculated NPV ii How would the increase in the required rate of return impact the project's internal rate of return IRR Assume no change to the timing or amount of cash flows. Explain each and be specific as to Why or if there is an impact and how would the higher required rate change the NPV and the IRR answers here and what is the possible impact on the acceptreject decision for the project under each of the two analysis methods another answers pts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock