Question: DISCUSSION - Please answer the following using complete sentences. (2 points each) 1. How does the method of depreciation affect financial analynia? 2. How does

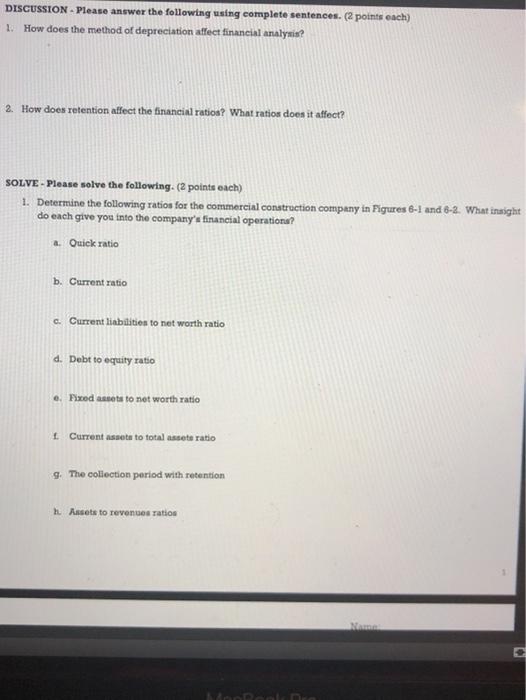

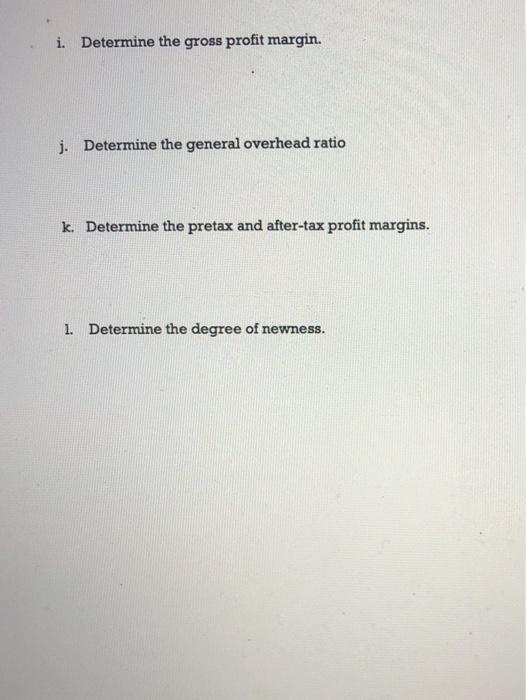

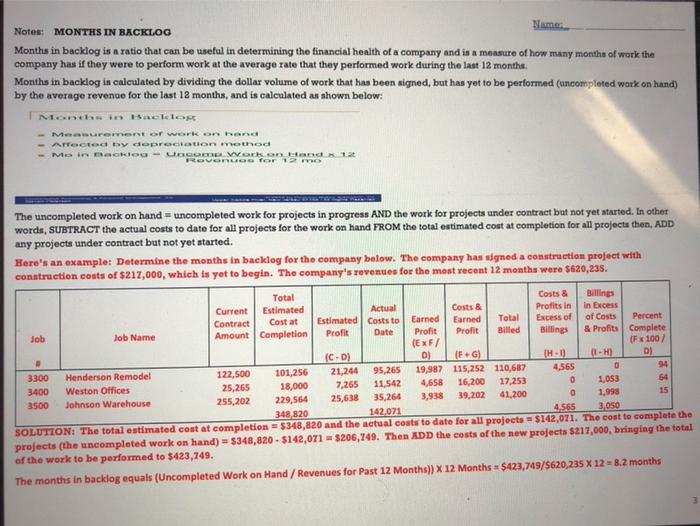

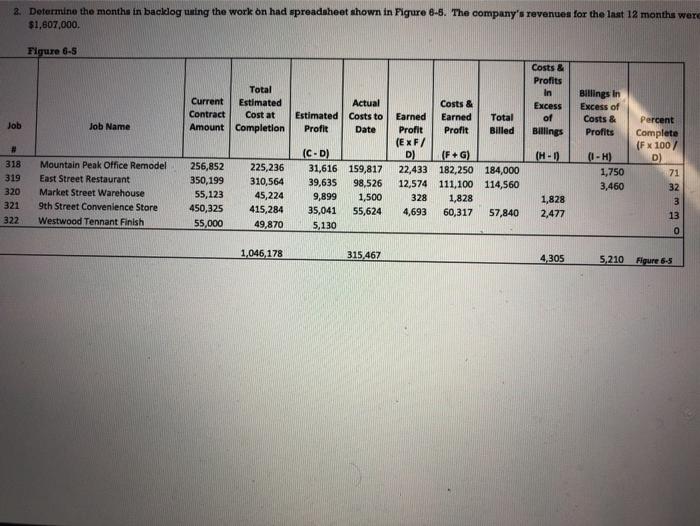

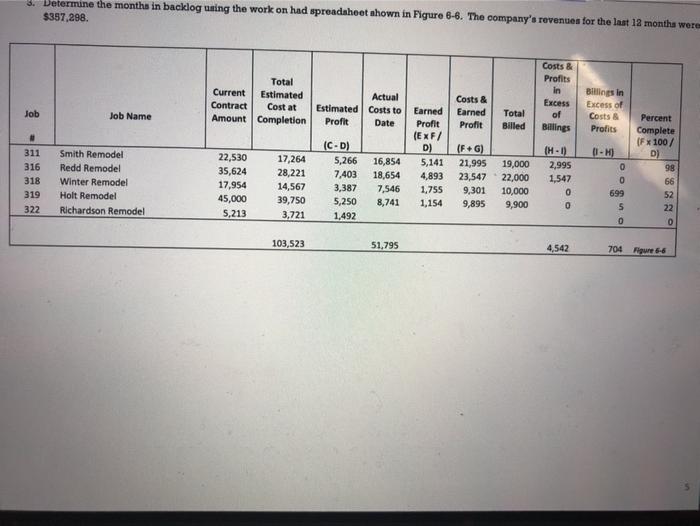

DISCUSSION - Please answer the following using complete sentences. (2 points each) 1. How does the method of depreciation affect financial analynia? 2. How does retention affect the financial ratios? What ratios does it affect? SOLVE - Please solve the following. (2 points each) 1. Determine the following ratios for the commercial construction company in Figures 6-1 and 6-2. What insight do each give you into the company's financial operationa? a. Ouick ratio b. Current ratio c. Current liabilities to net worth ratio d. Debt to equity ratio e Fixed assets to net worth ratio 1 Current asset to total assete ratio 9 The collection period with retention h. Ansets to revenues ratios i. Determine the gross profit margin. j. Determine the general overhead ratio k. Determine the pretax and after-tax profit margins. 1. Determine the degree of newness. Name Notes: MONTHS IN BACKLOG Months in backlog is a ratio that can be useful in determining the financial health of a company and is a measure of how many months of work the company has if they were to perform work at the average rate that they performed work during the last 12 months Months in backlog in calculated by dividing the dollar volume of work that has been signed, but has yet to be performed (uncompleted work on hand) by the average revenue for the last 12 months, and is calculated as shown below: I Mucho - Mesurement of work on her - Arrected by depreciation method - Mein AGRIOS - LOCO Work on end 12 ROVONLIOS for 12 m Total The uncompleted work on hand = uncompleted work for projects in progress AND the work for projects under contract but not yet started. In other words, SUBTRACT the actual costs to date for all projects for the work on hand FROM the total estimated cost at completion for all projects then, ADD any projects under contract but not yet started. Here's an example: Determine the months in backlog for the company below. The company has signed a construction project with construction costs of $217,000, which is yet to begin. The company's revenues for the most recent 12 months were $620,235. Costs & Billings Current Estimated Actual Costs & Profits in in Excess Contract Cost at Estimated costs to Earned Earned Total Excess of of Costs Percent Job Job Name Amount Completion Profit Date Profit Profit Billed Billings & Profits Complete (ExF/ [Fx 100 / (C-D) D) (EG) [1-H) 3300 122,500 Henderson Remodel 101,256 21,244 95,265 19,987 115,252 110,687 4,565 0 94 3400 Weston Offices 25,265 18,000 7,265 11,542 4,658 16,200 17,253 Johnson Warehouse 3500 255,202 229,564 25,638 35,264 3,938 39,202 41,200 15 1,998 348,820 142,071 4,565 3,050 SOLUTION: The total estimated cost at completion = $348,820 and the actual costs to date for all projects = $142,071. The cost to complete the projects (the uncompleted work on hand) = $348,820 - 5142,071 = $206,749. Then ADD the costs of the new projects $217,000, bringing the total of the work to be performed to $423,749. The months in backlog equals (Uncompleted Work on Hand / Revenues for Past 12 Months)) X 12 Months = $423,749/5620,235 X 12 = 8.2 months . 0 1,053 0 2. Determine the months in backlog using the work on had spreadsheet shown in Figure 8-5. The company's revenues for the last 12 months were $1,607,000. Figure 6-8 Total Current Estimated Contract Cost at Amount Completion Actual Estimated costs to Profit Date Costs & Profits In Excess of Billings Billings in Excess of Costs & Profits Job Job Name # 318 319 320 321 Mountain Peak Office Remodel East Street Restaurant Market Street Warehouse 9th Street Convenience Store Westwood Tennant Finish Costs & Earned Earned Total Profit Profit Billed (ExF/ D) (F+G) 22,433 182,250 184,000 12,574 111,100 114,560 328 1,828 4,693 60,317 57,840 (C-D) 31,616 159,817 39,635 98,526 9,899 1,500 35,041 55,624 5,130 (1-1) 1,750 3,460 256,852 350,199 55,123 450,325 55,000 225,236 310,564 45,224 415,284 49,870 Percent Complete (F x 100 / D 71 32 3 13 1,828 2,477 322 0 1,046,178 315,467 4,305 5,210 Figure 6-5 3. Determine the months in backlog using the work on had spreadsheet shown in Figure 8-6. The company's revenues for the last 12 months were $397,298 Total Current Estimated Contract Cost at Amount Completion Actual Estimated Costs to Profit Date Job Costs & Profits in Excess of Balings Costs & Earned Profit Job Name Billings in Excess of Costs & Profits Total Billed # 311 316 318 319 322 Smith Remodel Redd Remodel Winter Remodel Holt Remodel Richardson Remodel 22,530 35,624 17,954 45,000 5,213 17,264 28,221 14,567 39,750 3,721 (C-D) 5,266 7,403 3,387 5,250 1.492 16,854 18,654 7,546 8,741 Earned Profit (ExF/ D) 5,141 4,893 1.755 1,154 (F+G) 21,995 23,547 9,301 9,895 19,000 22,000 10,000 9,900 ( H1) 2,995 1,547 0 0 0 0 699 5 Percent Complete (Fx100/ D) 98 66 52 22 0 0 103,523 51,795 4,542 70456

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts