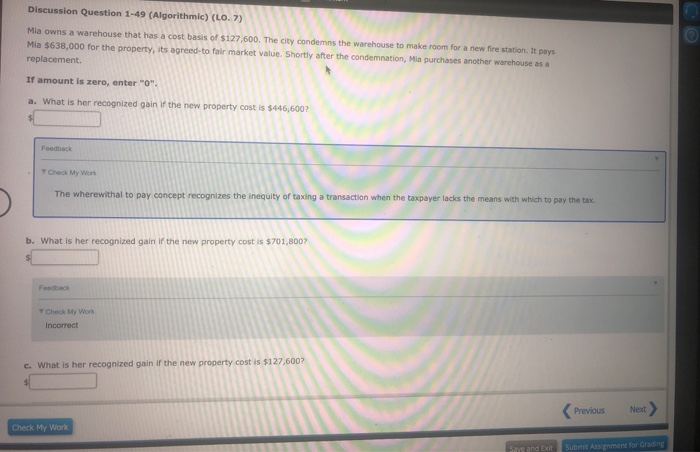

Question: Discussion Question 1-49 (Algorithmic) (0.7) Mia owns a warehouse that has a cost basis of $127,600. The city condemns the warehouse to make room for

Discussion Question 1-49 (Algorithmic) (0.7) Mia owns a warehouse that has a cost basis of $127,600. The city condemns the warehouse to make room for a new fire station. It pays Mia $638,000 for the property, its agreed to fair market value. Shortly after the condemnation, Mia purchases another warehouse as a replacement If amount is zero, enter "0". a. What is her recognized gain if the new property cost is $446,600? Feedback Check My Work The wherewithal to pay concept recognizes the inequity of taxing a transaction when the taxpayer lacks the means with which to pay the tax. b. What is her recognized gain if the new property cost is $701,800? Feedback Check My Work Incorrect c. What is her recognized gain if the new property cost is $127,6007 Previous Next > Check My Work Sous and Exit Submt Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts