Question: Discussion Question 2 2 - 7 ( LO . 1 0 ) Answer the following questions regarding the optional adjustment - to - basis election

Discussion Question LO

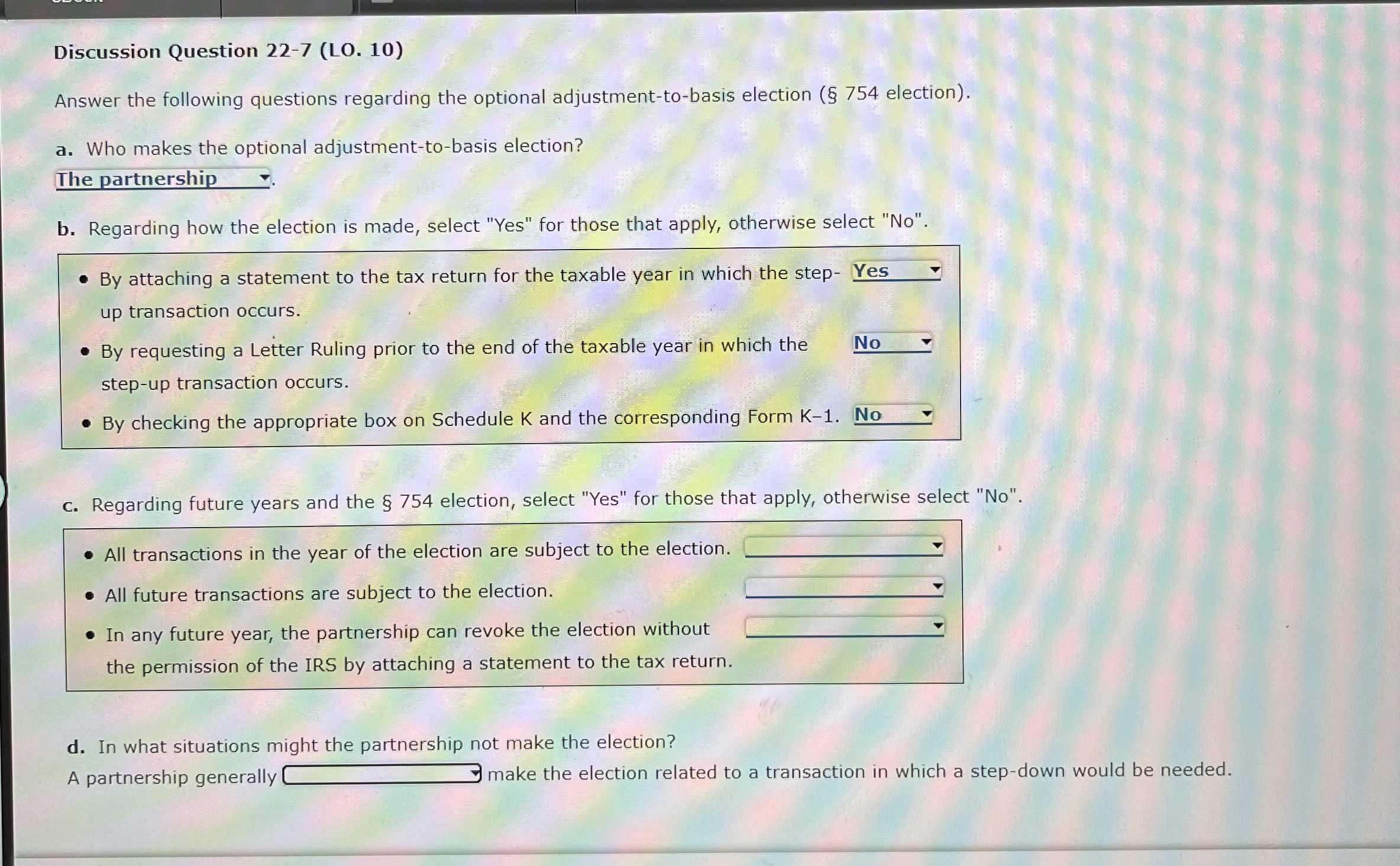

Answer the following questions regarding the optional adjustmenttobasis election election

a Who makes the optional adjustmenttobasis election?

The partnership

b Regarding how the election is made, select "Yes" for those that apply, otherwise select No

By attaching a statement to the tax return for the taxable year in which the step up transaction occurs.

By requesting a Letter Ruling prior to the end of the taxable year in which the stepup transaction occurs.

By checking the appropriate box on Schedule K and the corresponding Form

c Regarding future years and the election, select "Yes" for those that apply, otherwise select No

All transactions in the year of the election are subject to the election.

All future transactions are subject to the election.

In any future year, the partnership can revoke the election without

the permission of the IRS by attaching a statement to the tax return.

d In what situations might the partnership not make the election?

A partnership generally make the election related to a transaction in which a stepdown would be needed.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock