Question: Discussion Question 2 8 - 1 4 ( LO . 8 ) Regarding the Statements on Standards for Tax Services that apply to CPAs, complete

Discussion Question LO

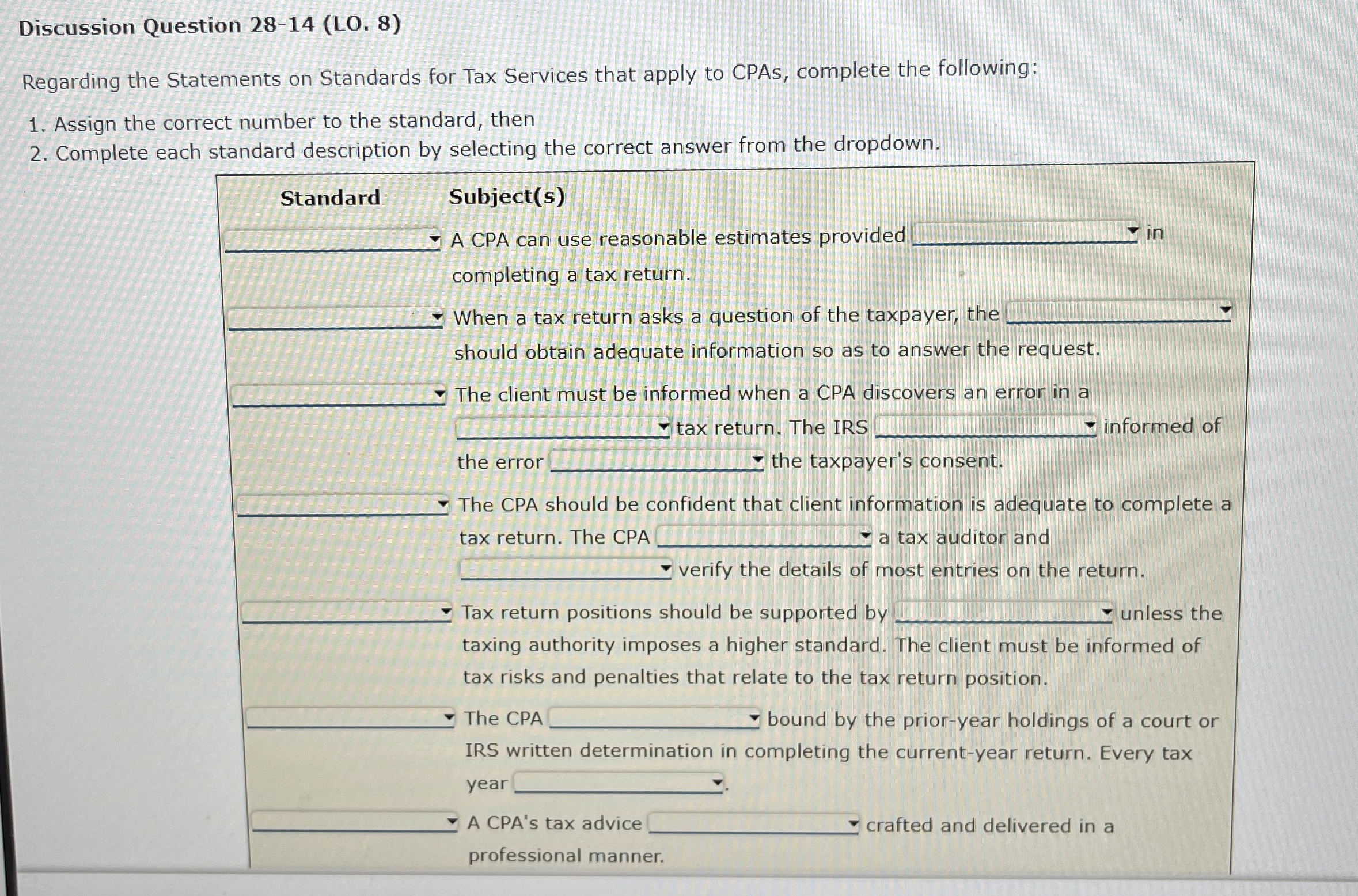

Regarding the Statements on Standards for Tax Services that apply to CPAs, complete the following:

Assign the correct number to the standard, then

Complete each standard description by selecting the correct answer from the dropdown.

Standard Subjects

A CPA can use reasonable estimates provided in completing a tax return.

: When a tax return asks a question of the taxpayer, the should obtain adequate information so as to answer the request.

The client must be informed when a CPA discovers an error in a

tax return. The IRS informed of the error the taxpayer's consent.

The CPA should be confident that client information is adequate to complete a tax return. The CPA a tax auditor and

: verify the details of most entries on the return.

Tax return positions should be supported by unless the taxing authority imposes a higher standard. The client must be informed of tax risks and penalties that relate to the tax return position.

: The CPA : bound by the prioryear holdings of a court or IRS written determination in completing the currentyear return. Every tax year

A CPA's tax advice crafted and delivered in a professional manner.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock