Question: Discussion Question 6 By using long-term financing to finance part of temporary current assets, a firm may have less risk but lower returns than a

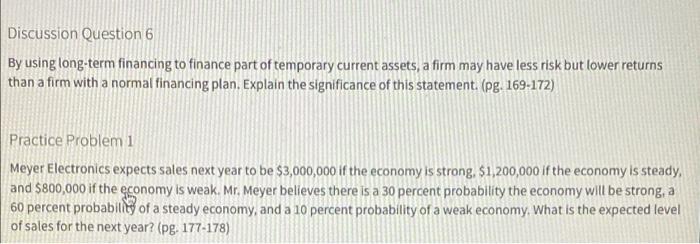

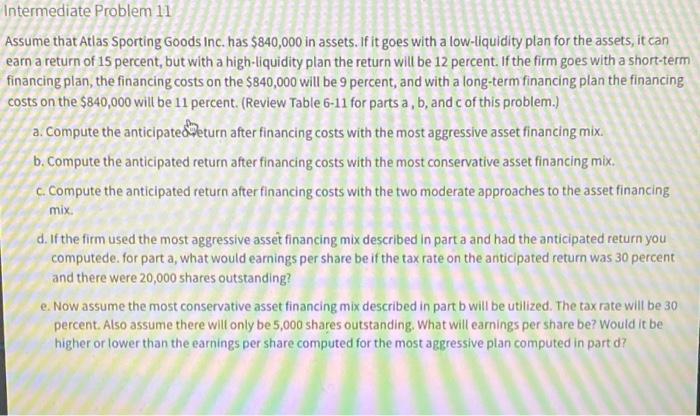

Discussion Question 6 By using long-term financing to finance part of temporary current assets, a firm may have less risk but lower returns than a firm with a normal financing plan. Explain the significance of this statement. (pg. 169-172) Practice Problem 1 Meyer Electronics expects sales next year to be $3,000,000 if the economy is strong, $1,200,000 if the economy is steady, and $800,000 if the economy is weak. Mr. Meyer believes there is a 30 percent probability the economy will be strong, a 60 percent probability of a steady economy, and a 10 percent probability of a weak economy. What is the expected level of sales for the next year? (pg. 177-178) Intermediate Problem 11 Assume that Atlas Sporting Goods Inc. has $840,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 15 percent, but with a high-liquidity plan the return will be 12 percent. If the firm goes with a short-term financing plan, the financing costs on the $840,000 will be 9 percent, and with a long-term financing plan the financing costs on the $840,000 will be 11 percent. (Review Table 6-11 for parts a, b, and c of this problem.) a. Compute the anticipatesteturn after financing costs with the most aggressive asset financing mix. b. Compute the anticipated return after financing costs with the most conservative asset financing mix. c. Compute the anticipated return after financing costs with the two moderate approaches to the asset financing mix d. If the firm used the most aggressive asset financing mix described in parta and had the anticipated return you computede for part a, what would earnings per share be if the tax rate on the anticipated return was 30 percent and there were 20,000 shares outstanding? e. Now assume the most conservative asset financing mix described in part b will be utilized. The tax rate will be 30 percent. Also assume there will only be 5,000 shares outstanding. What will earnings per share be? Would it be higher or lower than the earnings per share computed for the most aggressive plan computed in part d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts