Question: Discussion Questions: In this module, we are focusing on evaluating capital investments. For this discussion, you will first complete a mini case analysis, and then

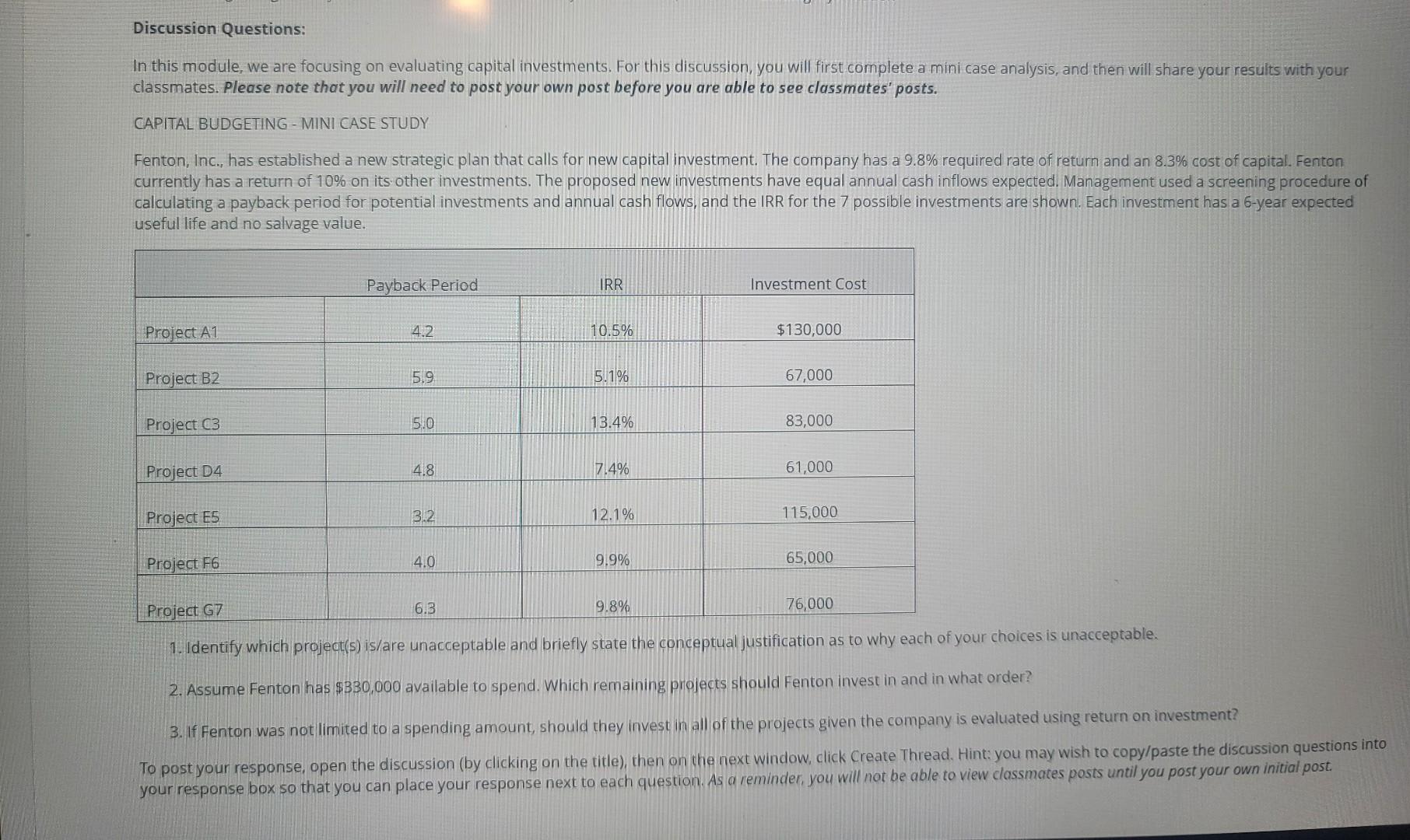

Discussion Questions: In this module, we are focusing on evaluating capital investments. For this discussion, you will first complete a mini case analysis, and then will share your results with your classmates. Please note that you will need to post your own post before you are able to see classmates' posts. CAPITAL BUDGETING - MINI CASE STUDY Fenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are shown. Each investment has a 6 -year expected useful life and no salvage value. \begin{tabular}{|lcc|c|} \hline & & & \\ & Payback Period & IRR & Investment Cost \\ \hline Project A1 & 4.2 & 10.5% & \\ \hline & 5.9 & & $130,000 \\ \hline Project B2 & 5.1% & 67,000 \\ \hline Project C3 & 5.0 & 13.4% & 83,000 \\ \hline Project D4 & 4.8 & 7.4% & 61,000 \\ \hline Project E5 & 3.2 & 12.1% & 115,000 \\ \hline Project F6 & 4.0 & 9.9% & 65,000 \\ \hline Project G7 & 6.3 & 9.8% & 76,000 \\ \hline \end{tabular} 1. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. 2. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? 3. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment? To post your response, open the discussion (by clicking on the title), then on the next window, click Create Thread. Hint: you may wish to copy/paste the discussion questions into your response box so that you can place your response next to each question. As a reminder, you will not be able to view classmates posts until you post your own initial post

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts