Question: Disney is currently trading at $ 9 2 . 3 9 per share. It has 1 . 8 1 billion shares outstanding. Disney has $

Disney is currently trading at $ per share. It has billion shares outstanding. Disney has $ billion worth bonds outstanding in market values. The last class of bonds that Disney issued had a coupon rate of coupon payments are paid semiannual and have a face value. The bonds currently have years left to maturity and are currently trading at Disney does not have any preferred stock outstanding. The expected market risk premium is and the current Treasury bill rate is Disney has a tax rate of

A Calculate Disneys Beta. Use the sticker symbol VTI as your market return. use stockhistory to pull monthly data from to

B Use the Beta you calculated to calculate the cost of equity using CAPM.

C Given the above information, what is Disneys WACC? pts

D Disneys last year dividend was $ The dividend has been growing by each year and expected to continue to do so forever. What is Disneys WACC if you use the average of CAPM and the DCF dividends for Disneys cost of equity. pts

E Disney has the following coefficients on the FamaFrench factor model: b:use the beta you found in part A s: h:

The market risk premium is the size SMB risk premium is and the value premium HML is What is estimated cost of equity using the factor model? What will Disneys WACC be if only this estimated cost of equity is used? pts

chart

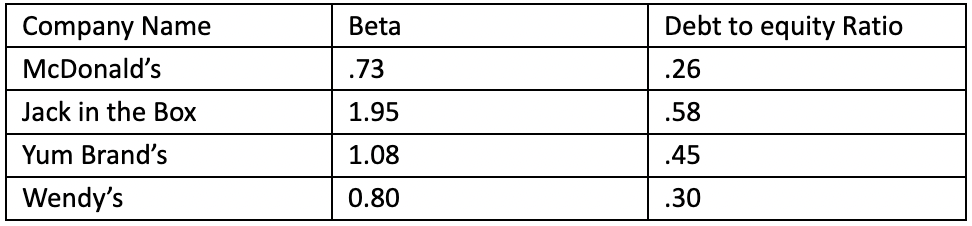

F Disney is thinking about opening up its own line of fastfood restaurants. To estimate the cost of equity, Disney is using the following Firms information to get an estimated cost of equity: begintabularlll

hline Company Name & Beta & Debt to equity Ratio

hline McDonald's & &

hline Jack in the Box & &

hline Yum Brand's & &

hline Wendy's & &

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock