Question: DISPLAY VISUAL BASIC CODE SCREENSHOT and APPLICATION ON VISUAL BASIC. Clearly Visual Basic: Programming with Microsoft Visual Basic 2012, Chapter 8, #12 Please Answer and

DISPLAY VISUAL BASIC CODE SCREENSHOT and APPLICATION ON VISUAL BASIC.

DISPLAY VISUAL BASIC CODE SCREENSHOT and APPLICATION ON VISUAL BASIC.

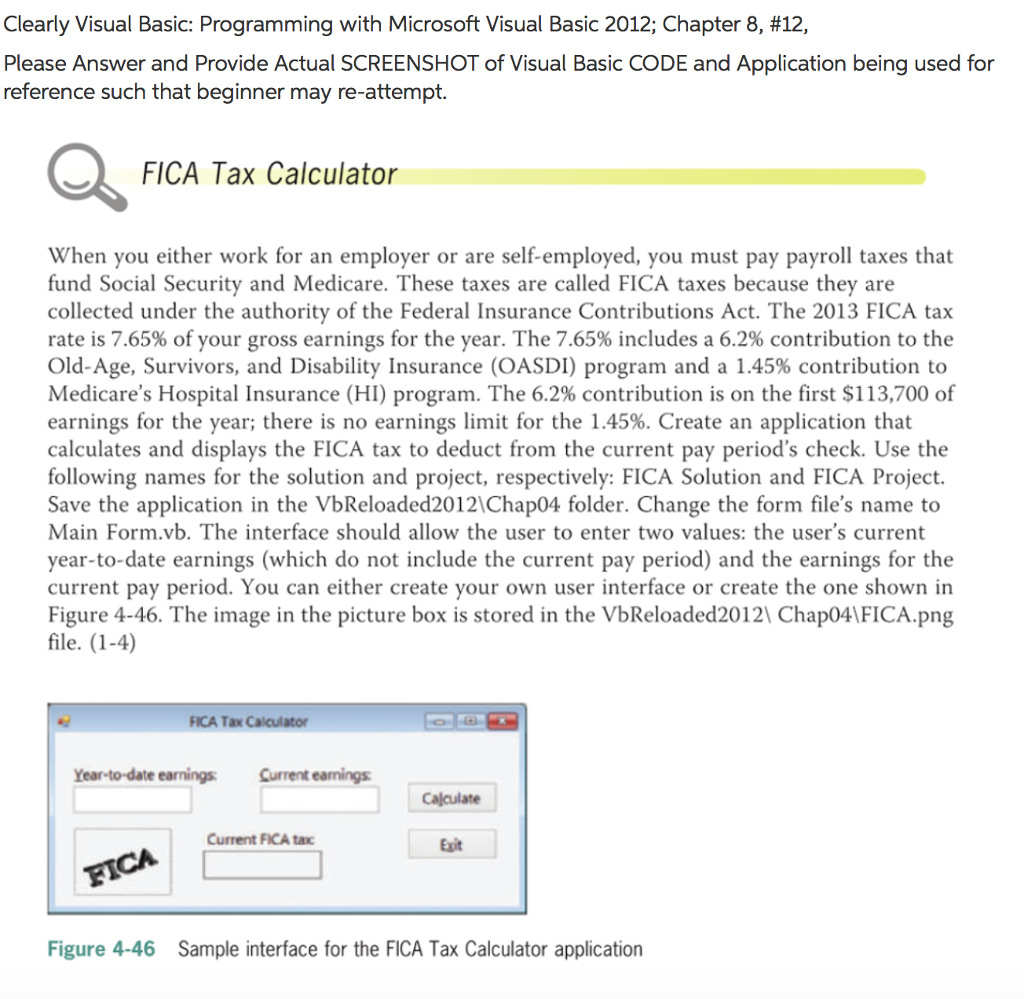

Clearly Visual Basic: Programming with Microsoft Visual Basic 2012, Chapter 8, #12 Please Answer and Provide Actual SCREENSHOT of Visual Basic CODE and Application being used for reference such that beginner may re-attempt. FICA Tax Calculator When you either work for an employer or are self-employed, you must pay payroll taxes that fund Social Security and Medicare. These taxes are called FICA taxes because they are collected under the authority of the Federal Insurance Contributions Act. The 2013 rate is 7.65% of your gross earnings for the year. The 7.65% includes a 6.2% contribution to the Old-Age, Survivors, and Disability Insurance (OASDI) program and a 1.45% contribution to Medicare's Hospital Insurance (HI) program. The 6.2% contribution is on the first $113,700 of earnings for the year; there is no earnings limit for the 1.45%. Create an application that calculates and displays the FICA tax to deduct from the current pay period's check. Use the following names for the solution and project, respectively: FICA Solution and FICA Project. Save the application in the VbReloaded20121Chap04 folder. Change the form file's name to Main Form.vb. The interface should allow the user to enter two values: the user's current year-to-date earnings (which do not include the current pay period) and the earnings for the current pay period. You can either create your own user interface or create the one shown in Figure 4-46. The image in the picture box is stored in the VbReloaded20121 Chap041FICA.png file. (1-4) FICA tax FICA Tax Calculator Year-to-date earnings Current earnings Cajculate Current FICA tac Exit Figure 4-46 Sample interface for the FICA Tax Calculator application

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts