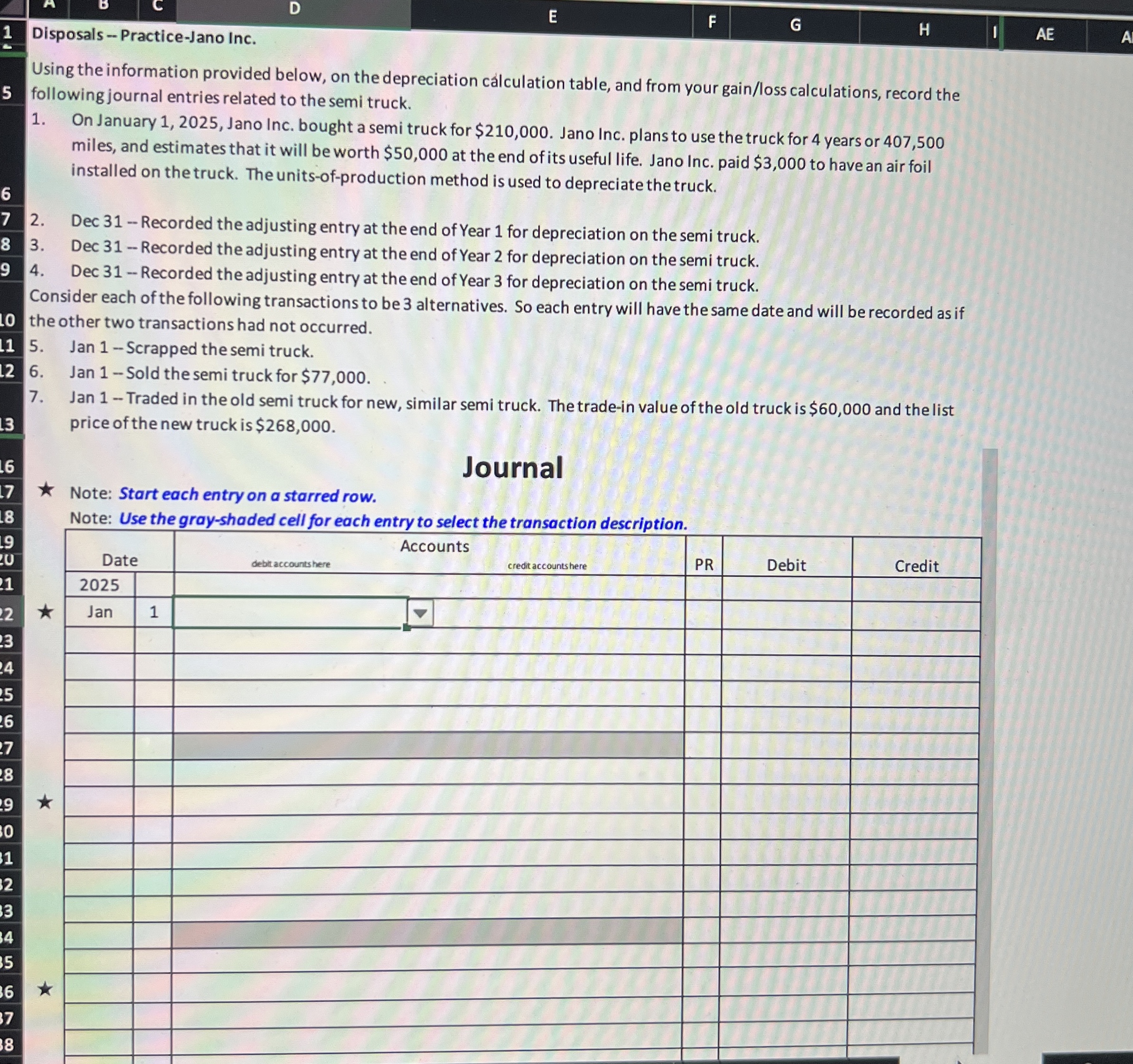

Question: Disposals - - Practice - Jano Inc. Using the information provided below, on the depreciation calculation table, and from your gain / loss calculations, record

Disposals PracticeJano Inc.

Using the information provided below, on the depreciation calculation table, and from your gainloss calculations, record the

following journal entries related to the semi truck.

On January Jano Inc. bought a semi truck for $ Jano Inc. plans to use the truck for years or

miles, and estimates that it will be worth $ at the end of its useful life. Jano Inc. paid $ to have an air foil

installed on the truck. The unitsofproduction method is used to depreciate the truck.

Dec Recorded the adjusting entry at the end of Year for depreciation on the semi truck.

Dec Recorded the adjusting entry at the end of Year for depreciation on the semi truck.

Dec Recorded the adjusting entry at the end of Year for depreciation on the semi truck.

Consider each of the following transactions to be alternatives. So each entry will have the same date and will be recorded as if

the other two transactions had not occurred.

Jan Scrapped the semi truck.

Jan Sold the semi truck for $

Jan Traded in the old semi truck for new, similar semi truck. The tradein value of the old truck is $ and the list

price of the new truck is $

Journal

Note: Start each entry on a starred row.

Note: Use the grayshaded cell for each entry to select the transaction description.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock