Question: Disregard anything above Problem 3 Solution: 20 15 10 payoffr -10 0 10 20 30 40 60 70 80 90 100 50 ST (c) (5

Disregard anything above Problem 3

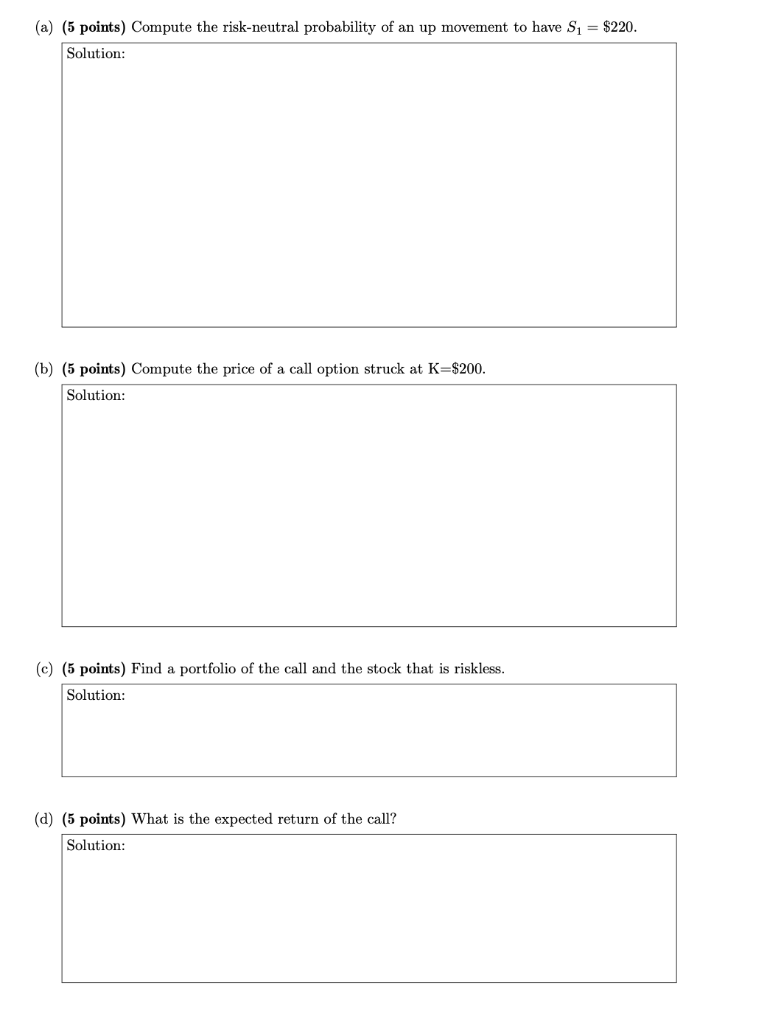

Solution: 20 15 10 payoffr -10 0 10 20 30 40 60 70 80 90 100 50 ST (c) (5 points) Suppose that the price of spread B is lower than the price of spread A. Explain how you can construct an arbitrage. Solution: Problem 3 Binomial Pricing Model. Suppose that a a stock is currently selling for So = $150 and next year will either rise to Su = $220 or fall to Sa = $120. So = 150 - Su = 220 Sd = 120 The one year interest rate is 5%/year (EAR). The cost of capital of the stock is 10%. (a) (5 points) Compute the risk-neutral probability of an up movement to have S1 = $220. Solution: (b) (5 points) Compute the price of a call option struck at K=$200. Solution: (c) (5 points) Find a portfolio of the call and the stock that is riskless. Solution: (d) (5 points) What is the expected return of the call? Solution: Solution: 20 15 10 payoffr -10 0 10 20 30 40 60 70 80 90 100 50 ST (c) (5 points) Suppose that the price of spread B is lower than the price of spread A. Explain how you can construct an arbitrage. Solution: Problem 3 Binomial Pricing Model. Suppose that a a stock is currently selling for So = $150 and next year will either rise to Su = $220 or fall to Sa = $120. So = 150 - Su = 220 Sd = 120 The one year interest rate is 5%/year (EAR). The cost of capital of the stock is 10%. (a) (5 points) Compute the risk-neutral probability of an up movement to have S1 = $220. Solution: (b) (5 points) Compute the price of a call option struck at K=$200. Solution: (c) (5 points) Find a portfolio of the call and the stock that is riskless. Solution: (d) (5 points) What is the expected return of the call? Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts