Question: disregard my writing Chapter 12 Homework Do the Math 12-2 Life Insurance Needs for a Young Married Couple Amy and Mack Holly from Rapid City,

disregard my writing

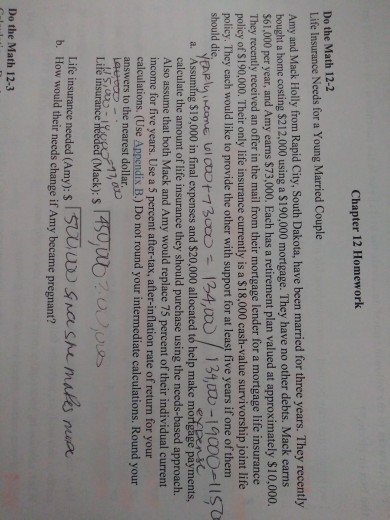

Chapter 12 Homework Do the Math 12-2 Life Insurance Needs for a Young Married Couple Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $61,000 per year, and Amy earns $73,000. Each has a retirement plan valued at approximately $10,000. They recently received an offer in the mail from their mortgage lender for a mortgage life insurance policy of S190,000. Their only life insurance currently is a $18,000 cash-value survivorship joint life policy. They each would like to provide the other with support for at least five years if one of them should die Yeply.com LICEO+1300 134,00 / 134,00 - 19000-1157 a. Assuming $19,000 in final expenses and $20,000 allocated to help make mortgage payments, calculate the amount of life insurance they should purchase using the needs-based approach. Also assume that both Mack and Amy would replace 75 percent of their individual current income for five years. Use a 5 percent after-tax, after-inflation rate of return for your calculations. (Use Appendix B.) Do not round your intermediate calculations. Round your answers to the nearest dollar Life insurance needed (Mack): S Resolue -12,00 Life insurance needed (Amy): 5000 Sa she males nua b. How would their needs change if Amy became pregnant? 1450,00? Oues Do the Math 12-3 Chapter 12 Homework Do the Math 12-2 Life Insurance Needs for a Young Married Couple Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $61,000 per year, and Amy earns $73,000. Each has a retirement plan valued at approximately $10,000. They recently received an offer in the mail from their mortgage lender for a mortgage life insurance policy of S190,000. Their only life insurance currently is a $18,000 cash-value survivorship joint life policy. They each would like to provide the other with support for at least five years if one of them should die Yeply.com LICEO+1300 134,00 / 134,00 - 19000-1157 a. Assuming $19,000 in final expenses and $20,000 allocated to help make mortgage payments, calculate the amount of life insurance they should purchase using the needs-based approach. Also assume that both Mack and Amy would replace 75 percent of their individual current income for five years. Use a 5 percent after-tax, after-inflation rate of return for your calculations. (Use Appendix B.) Do not round your intermediate calculations. Round your answers to the nearest dollar Life insurance needed (Mack): S Resolue -12,00 Life insurance needed (Amy): 5000 Sa she males nua b. How would their needs change if Amy became pregnant? 1450,00? Oues Do the Math 12-3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts