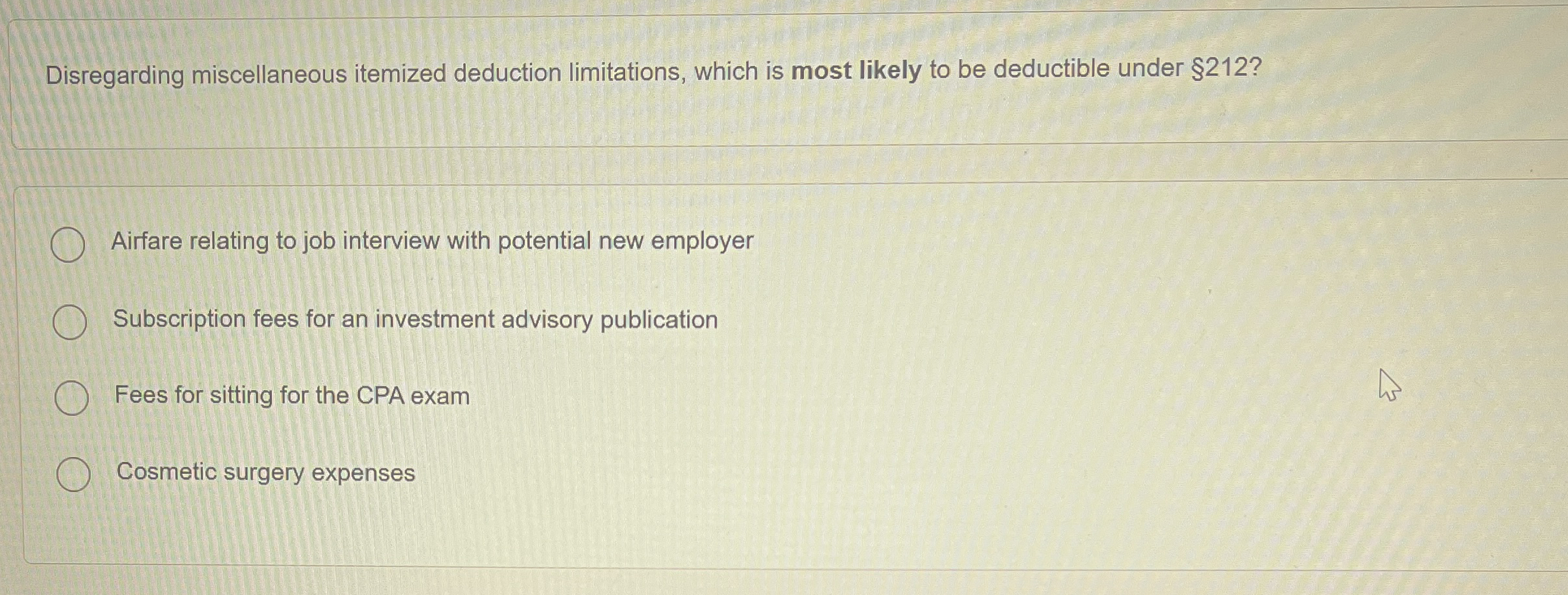

Question: Disregarding miscellaneous itemized deduction limitations , which is most likely to be deductible under 2 1 2 ? Airfare relating to job interview with potential

Disregarding miscellaneous itemized deduction limitations which is most likely to be deductible under

Airfare relating to job interview with potential new employer

Subscription fees for an investment advisory publication

Fees for sitting for the CPA exam

Cosmetic surgery expenses

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock