Question: Distinct Performance Obligations Floyd Corporation is a large engineering and construction company that designs and builds office buildings, apartment buildings, distribution warehouses and other structures

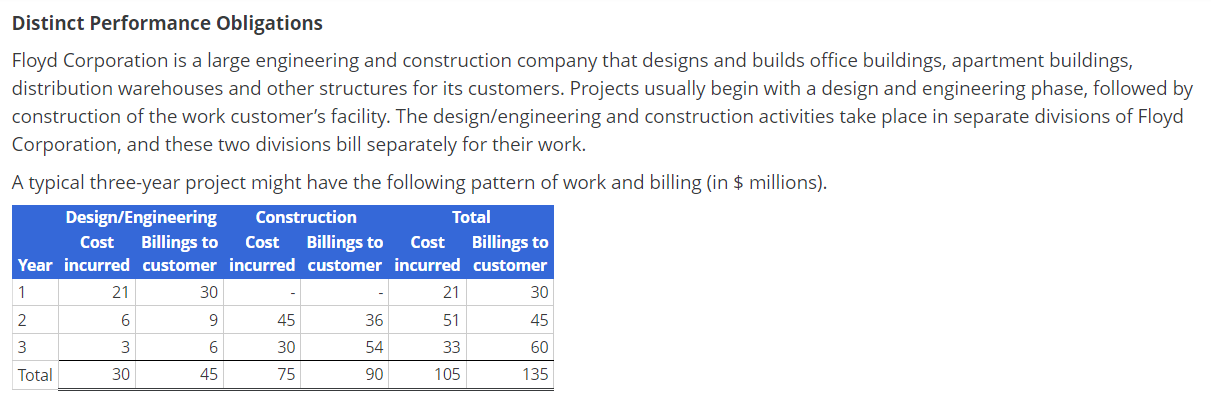

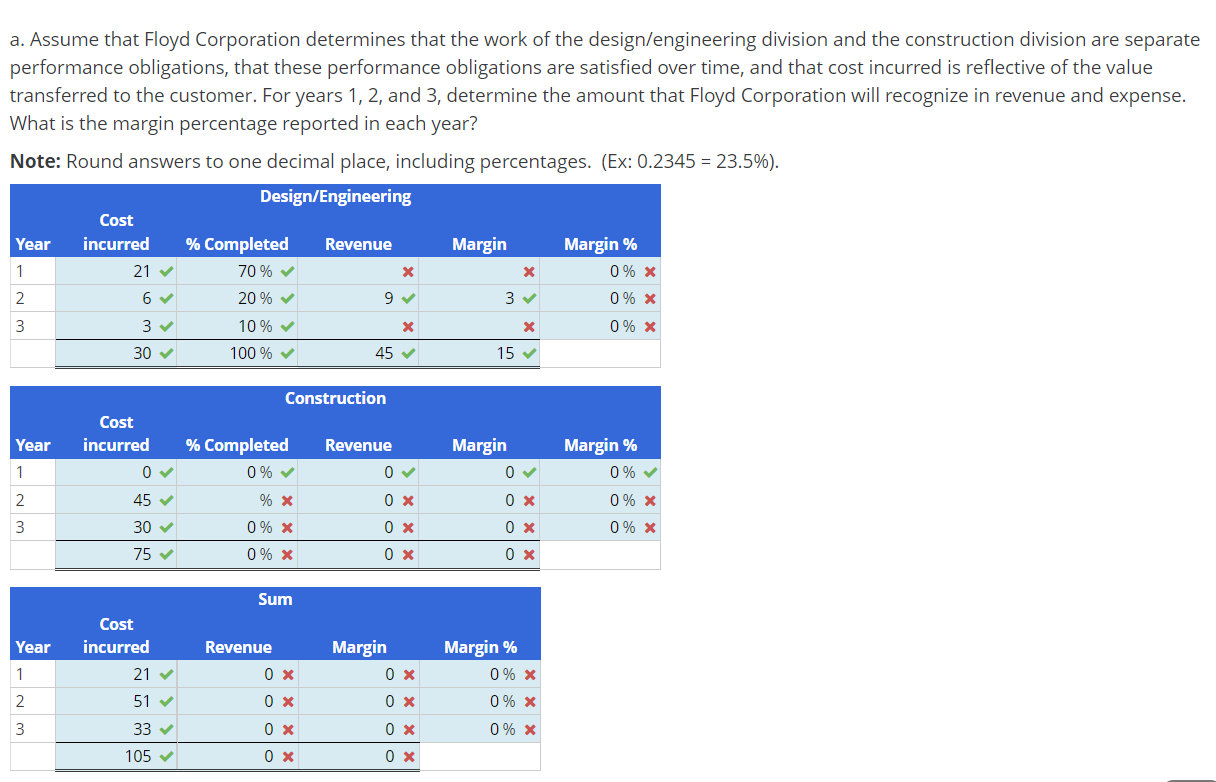

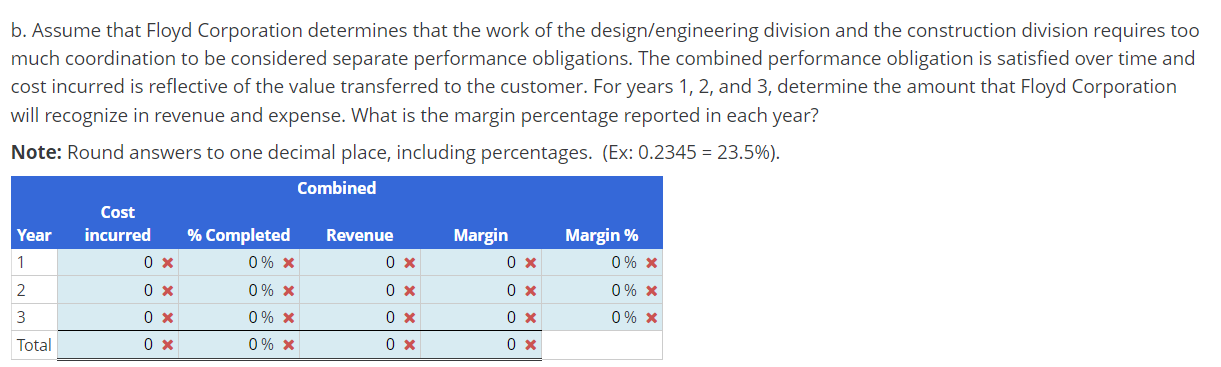

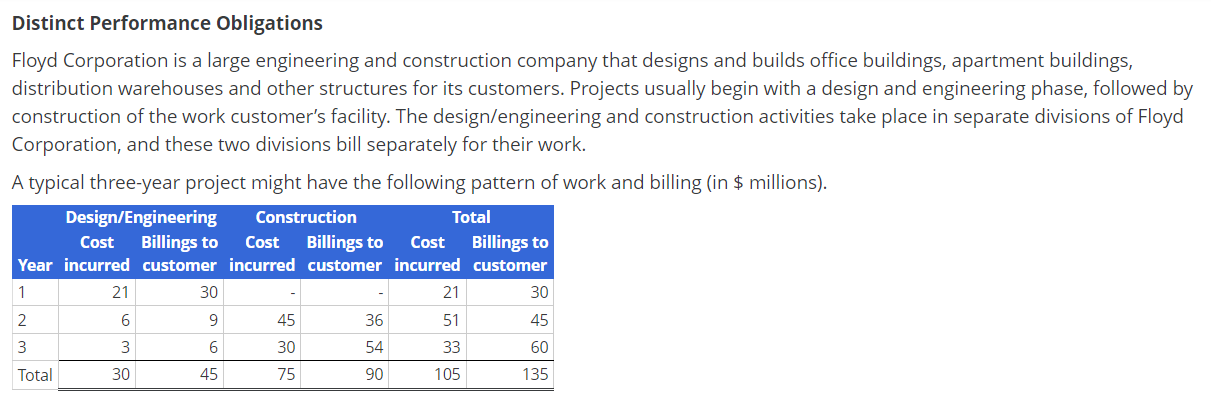

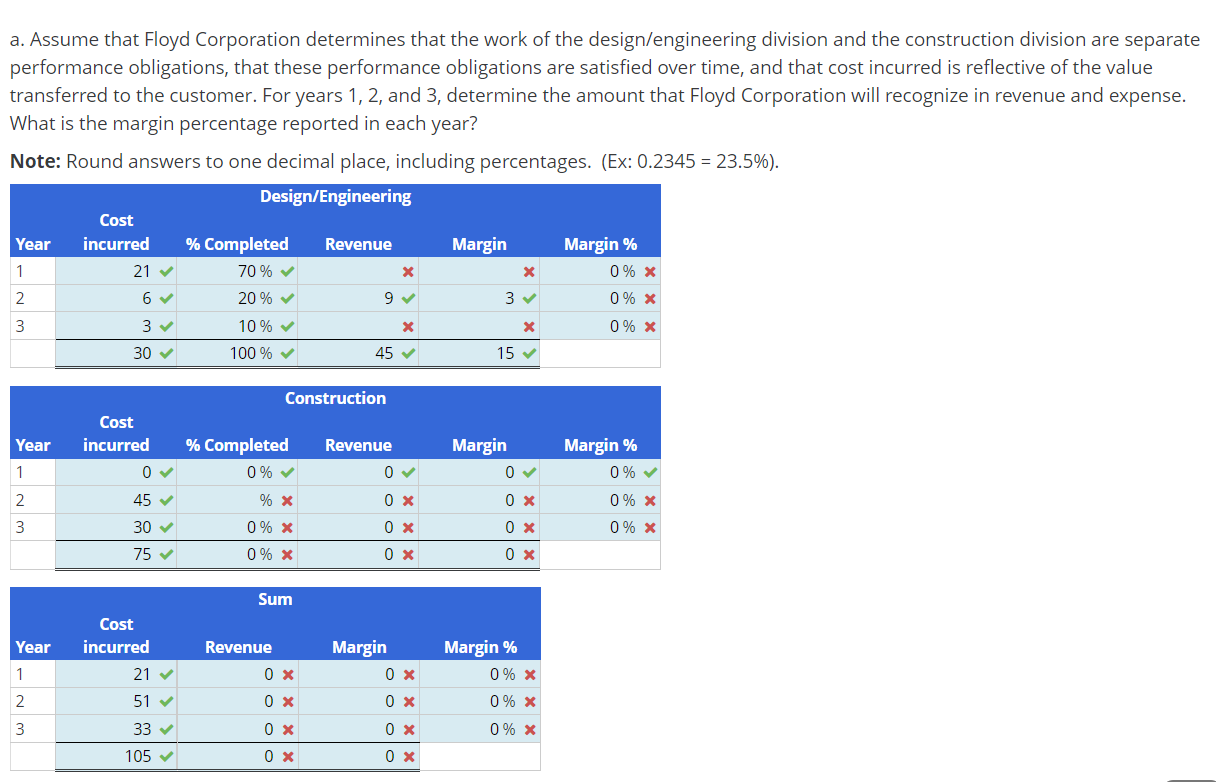

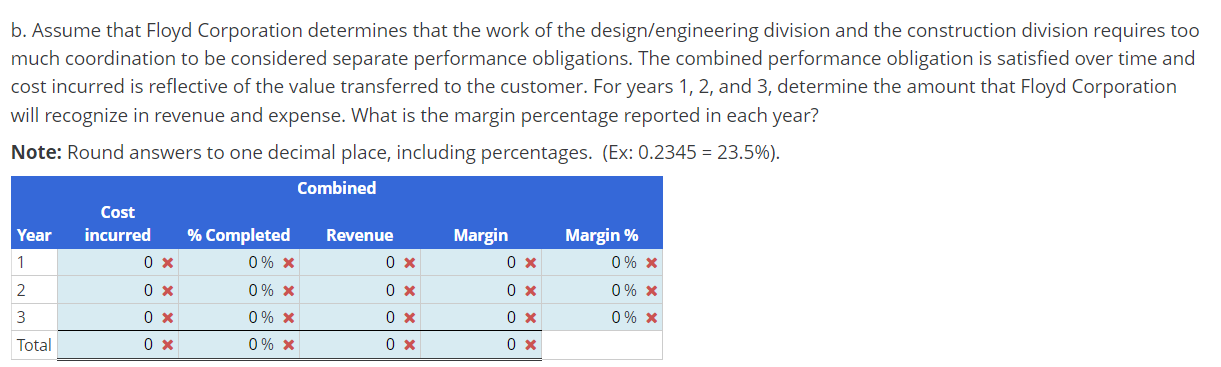

Distinct Performance Obligations Floyd Corporation is a large engineering and construction company that designs and builds office buildings, apartment buildings, distribution warehouses and other structures for its customers. Projects usually begin with a design and engineering phase, followed by construction of the work customer's facility. The design/engineering and construction activities take place in separate divisions of Floyd Corporation, and these two divisions bill separately for their work. A typical three-year project might have the following pattern of work and billing (in $ millions). Design/Engineering Construction Total Cost Billings to Cost Billings to Cost Billings to Year incurred customer incurred customer incurred customer 1 21 30 21 30 2 6 9 45 36 51 45 3 3 30 54 33 60 Total 30 45 75 90 105 135a, Assume that Floyd Corporation determines that the work of the designfengineering division and the construction division are separate performance obligations, that these performance obligations are satised over time, and that cost incurred is reflective of the value transferred to the customer. For years i, 2, and 3, determine the amount that Floyd Corporation will recognize in revenue and expense. What is the margin percentage reported in each year? Note: Round answers to one decimal place, including percentages. (Ex: 0.2345 = 23.5%). DesigniEngineering Cost incurred % Completed Revenue Margin % \"I 21 J ?0% J X X 0% X 2 6 J 20% J 9 J 3 J 0% X 3 3 J 10% J X X 0% X 30 J 100% J 45 J '|5 J Construction incurred % Completed Revenue Margin % \"I 0 J 0% J 0 J 0 J 0% J 2 45 J % X 0 X 0 X 0% X 3 30 J 0% X 0 X 0 X 0% X 15 J 0% X 0 X 0 X Cost incurred Margin % \"I 21 J 0 X 0 X 0% X 2 51 J 0 X 0 X 0% X 3 33 J 0 X 0 X 0% X 105 J 0 X 0 X b. Assume that Floyd Corporation determines that the work ofthe design/engineering division and the construction division requires too much coordination to be considered separate performance obligations. The combined performance obligation is satisfied over time and cost incurred is reflective of the value transferred to the customer. For years 'I, 2, and 3, determine the amount that Floyd Corporation will recognize in revenue and expense. What is the margin percentage reported in each year? Note: Round answers to one decimal place, including percentages. (Ex: 0.2345 : 23.5%). Combined Cost Year incurred % Completed Revenue 1 0 X 0% 8 0 8 0 X 0% 8 2 0 X 0% 8 0 8 0 X 0% 8 3 0 8 0% 8 0 8 0 8 0% 8 Total 0 x 0% x U x D x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts