Question: Distribution Planning for Red Dog Beer: Please start by reading Case 9: Red Dog Beer Company on pages 129-131 in the course pack. 2. {4

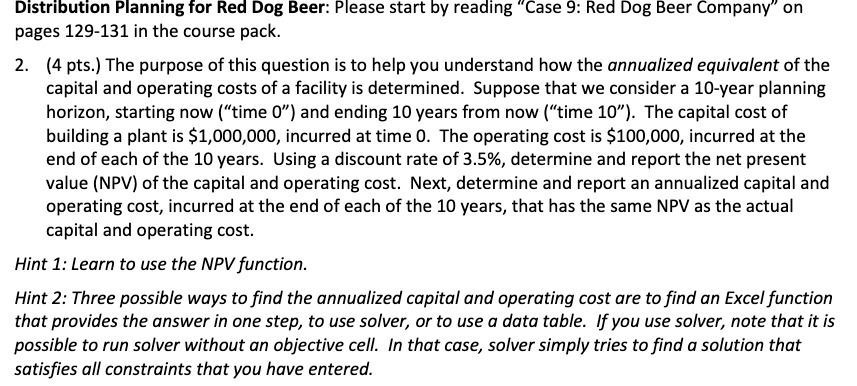

Distribution Planning for Red Dog Beer: Please start by reading "Case 9: Red Dog Beer Company\" on pages 129-131 in the course pack. 2. {4 pts.) The purpose of this question is to help you understand how the annualized equivalent of the capital and operating costs of a facility is determined. Suppose that we consider a 10-year planning horizon, starting now (\"time 0\"} and ending 10 years from now {\"time 10\"). The capital cost of building a plant is $1,000,000, incurred at time 0. The operating cost is $100,000, incurred at the end of each of the 10 years. Using a discount rate of 3.5%, determine and report the net present value [NPV} ofthe capital and operating cost. Next, determine and report an annualized capital and operating cost, incurred at the end of each of the 10 years, that has the same NW as the actual capital and operating cost. Hint 1: Learn to use the NPV function. Hint 2.- Three possible ways to nd the annualized capital and operating cost are to find an Excel function that provides the answer in one step, to use solver; or to use a data table. if you use solver, note that it is possible to run solver without an objective cell. in that case, solver simplyr tries to nd a solution that satisfies all constraints that you have entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts