Question: Distributions to Shareholders - Dividends and Share Repurchases Graded Assignment | Read Chapter 14 | Back to Assignment Due Thursday 08.02.18 at 11:45 PM Attempts:

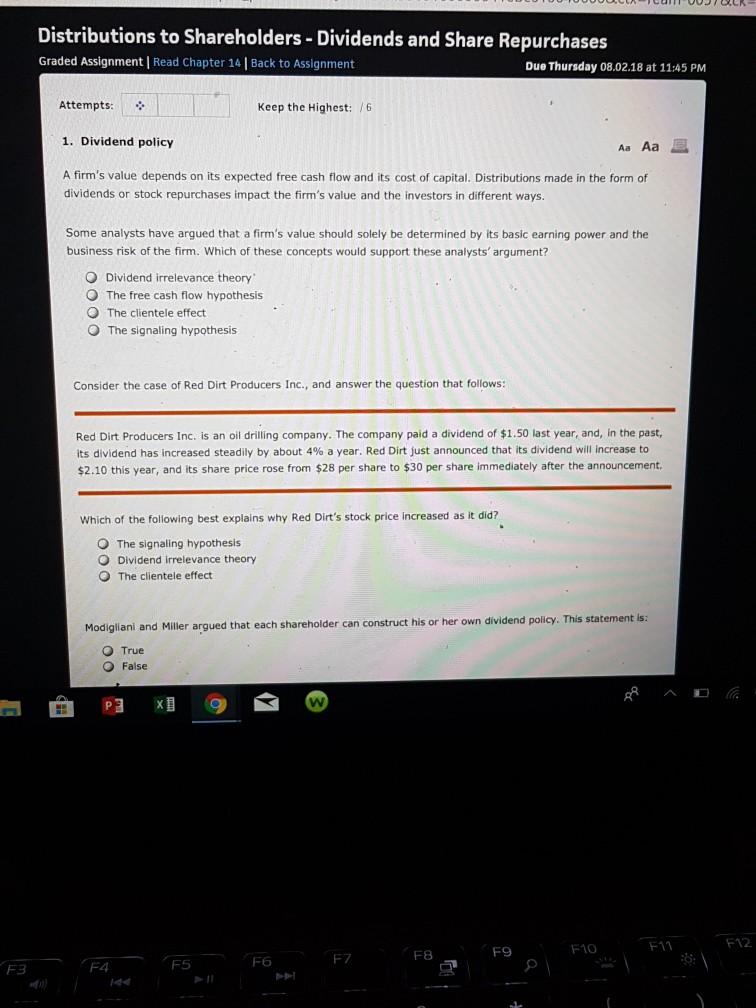

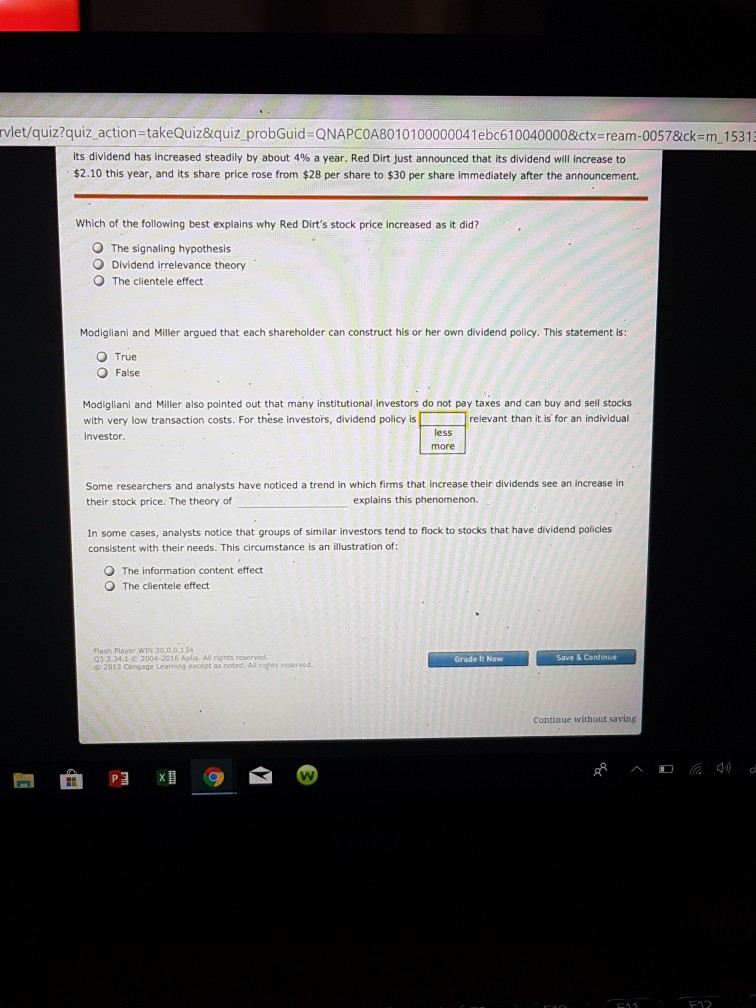

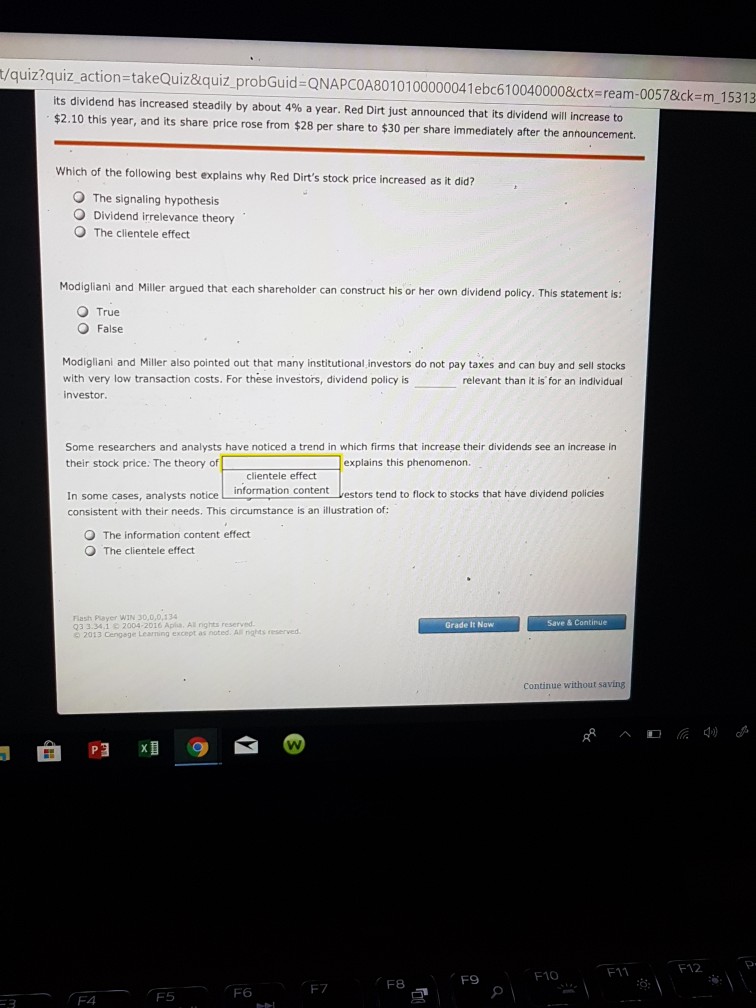

Distributions to Shareholders - Dividends and Share Repurchases Graded Assignment | Read Chapter 14 | Back to Assignment Due Thursday 08.02.18 at 11:45 PM Attempts: Keep the Highest: /6 1. Dividend policy A firm's value depends on its expected free cash flow and its cost of capital. Distributions made in the form of dividends or stock repurchases impact the firm's value and the investors in different ways. Some analysts have argued that a firm's value should solely be determined by its basic earning power and the business risk of the firm. Which of these concepts would support these analysts' argument? O Dividend irrelevance theory O The free cash flow hypothesis O The clientele effect O The signaling hypothesis Consider the case of Red Dirt Producers Inc., and answer the question that follows: Red Dirt Producers Inc. is an oil drilling company. The company paid a dividend of $1.50 last year, and, in the past, its dividend has increased steadily by about 4% a year. Red Dirt just announced that its dividend will increase to $2.10 this year, and its share price rose from $28 per share to $30 per share immediately after the announcement. Which of the following best explains why Red Dirt's stock price increased as it did? O The signaling hypothesls O Dividend irrelevance theory O The clientele effect Modigliani and Miller argued that each shareholder can construct his or her own dividend policy. This statement is True O False F10 F11 F12 F8 F9 F7 F3 F4 F5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts