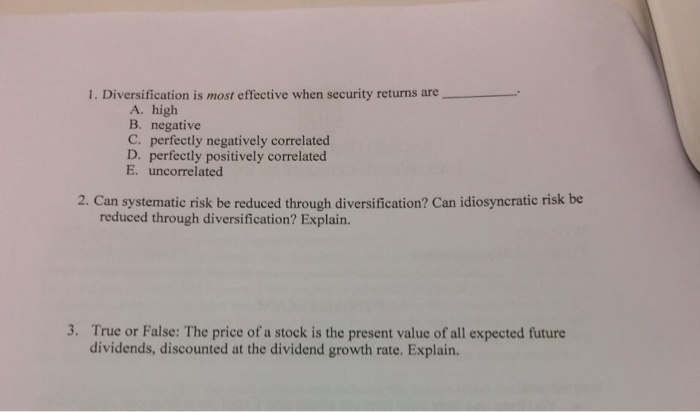

Question: Diversification is most effective when security returns are ____. A. high B. negative C. perfectly negatively correlated D. perfectly positively correlated E. uncorrelated Can systematic

Diversification is most effective when security returns are ____. A. high B. negative C. perfectly negatively correlated D. perfectly positively correlated E. uncorrelated Can systematic risk be reduced through diversification? Can idiosyncratic risk be reduced through diversification? Explain. True or False: The price of a stock is the present value of all expected future dividends, discounted at the dividend growth rate. Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts