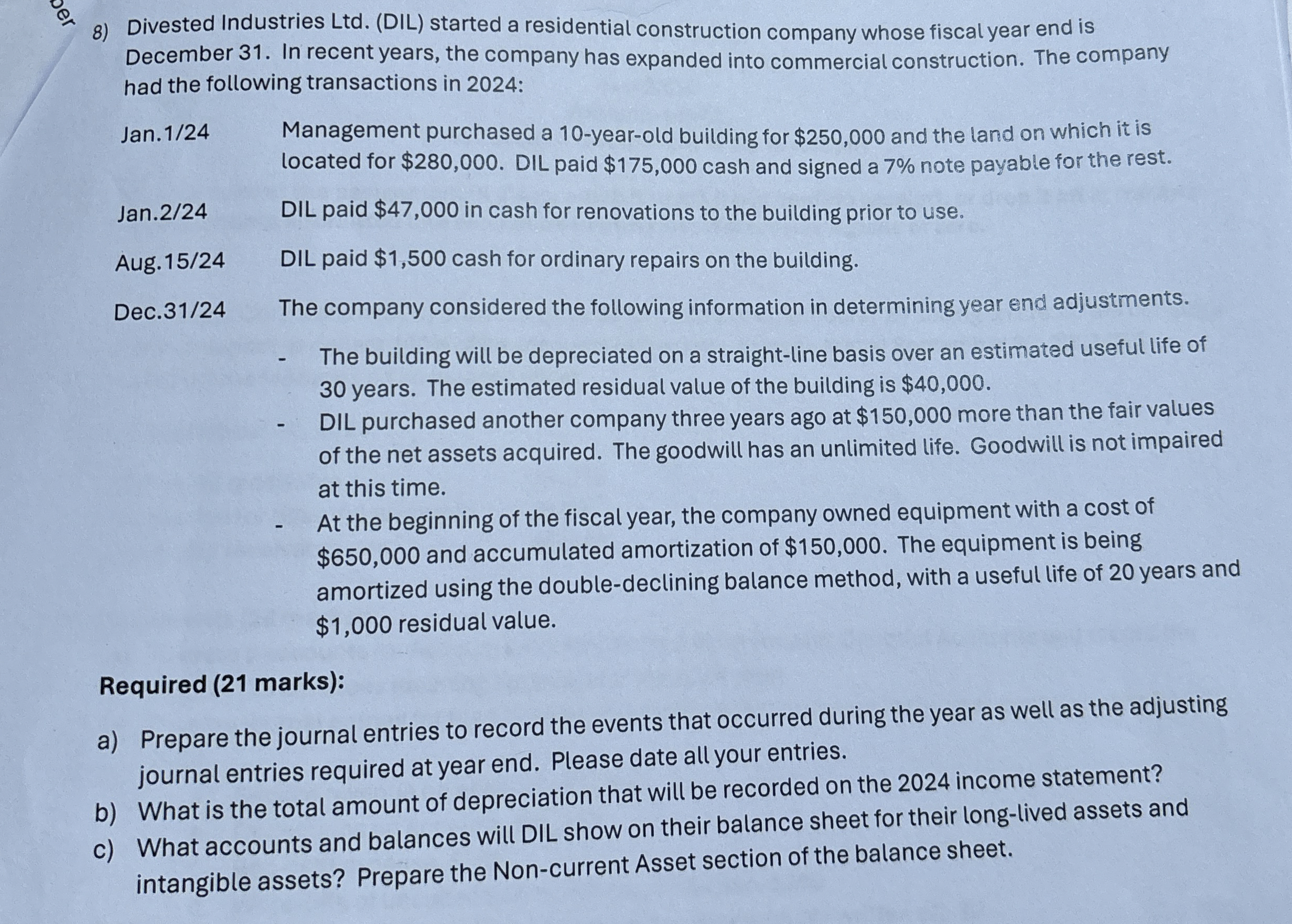

Question: Divested Industries Ltd . ( DIL ) started a residential construction company whose fiscal year end is December 3 1 . In recent years, the

Divested Industries LtdDIL started a residential construction company whose fiscal year end is December In recent years, the company has expanded into commercial construction. The company had the following transactions in :

Jan Management purchased a yearold building for $ and the land on which it is located for $ DIL paid $ cash and signed a note payable for the rest.

Jan. DIL paid $ in cash for renovations to the building prior to use.

Aug. DIL paid $ cash for ordinary repairs on the building.

Dec The company considered the following information in determining year end adjustments.

The building will be depreciated on a straightline basis over an estimated useful life of years. The estimated residual value of the building is $

DIL purchased another company three years ago at $ more than the fair values of the net assets acquired. The goodwill has an unlimited life. Goodwill is not impaired at this time.

At the beginning of the fiscal year, the company owned equipment with a cost of $ and accumulated amortization of $ The equipment is being amortized using the doubledeclining balance method, with a useful life of years and $ residual value.

Required marks:

a Prepare the journal entries to record the events that occurred during the year as well as the adjusting journal entries required at year end. Please date all your entries.

b What is the total amount of depreciation that will be recorded on the income statement?

c What accounts and balances will DIL show on their balance sheet for their longlived assets and intangible assets? Prepare the Noncurrent Asset section of the balance sheet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock