Question: Dividend discount model. Consider a firm with a current dividend of $1 per share. The company's dividends are expected to grow at 7% per year

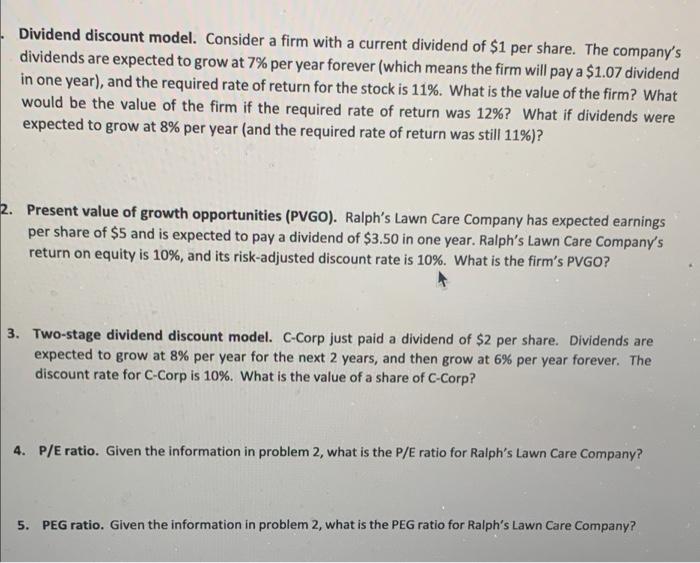

Dividend discount model. Consider a firm with a current dividend of $1 per share. The company's dividends are expected to grow at 7% per year forever (which means the firm will pay a $1.07 dividend in one year), and the required rate of return for the stock is 11%. What is the value of the firm? What would be the value of the firm if the required rate of return was 12%? What if dividends were expected to grow at 8% per year (and the required rate of return was still 11%)? 2. Present value of growth opportunities (PVGO). Ralph's Lawn Care Company has expected earnings per share of $5 and is expected to pay a dividend of $3.50 in one year. Ralph's Lawn Care Company's return on equity is 10%, and its risk-adjusted discount rate is 10%. What is the firm's PVGO? 3. Two-stage dividend discount model. C-Corp just paid a dividend of $2 per share. Dividends are expected to grow at 8% per year for the next 2 years, and then grow at 6% per year forever. The discount rate for C-Corp is 10%. What is the value of a share of C-Corp? 4. P/E ratio. Given the information in problem 2, what is the P/E ratio for Ralph's Lawn Care Company? 5. PEG ratio. Given the information in problem 2, what is the PEG ratio for Ralph's Lawn Care Company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts