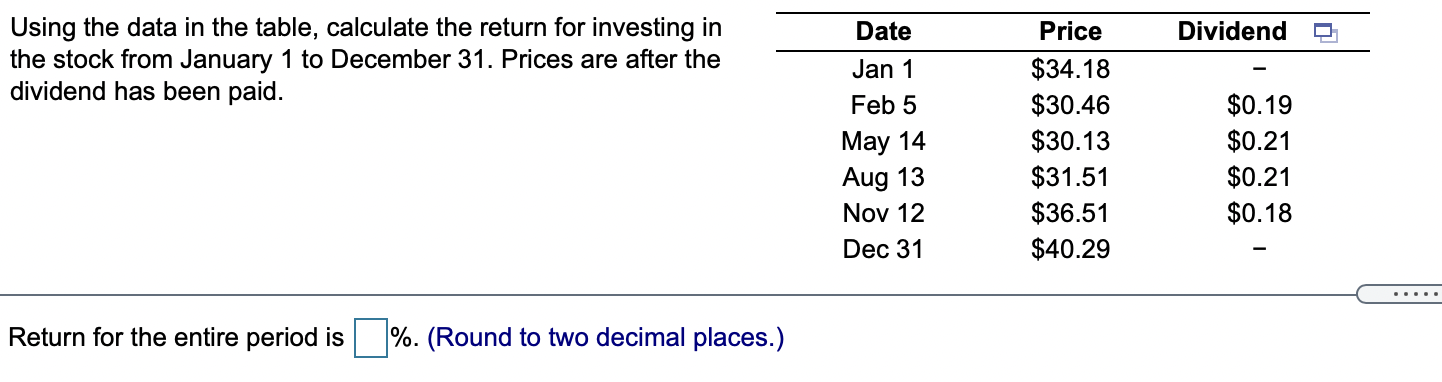

Question: Dividend Using the data in the table, calculate the return for investing in the stock from January 1 to December 31. Prices are after the

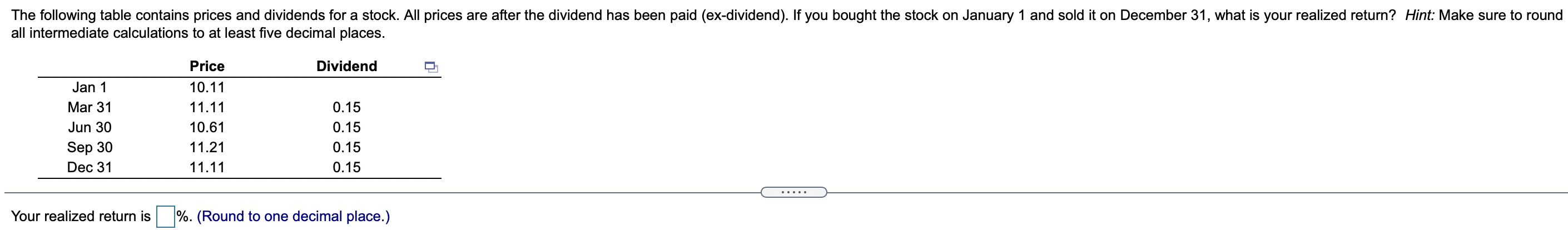

Dividend Using the data in the table, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. Date Jan 1 Feb 5 May 14 Aug 13 Price $34.18 $30.46 $30.13 $31.51 $36.51 $40.29 $0.19 $0.21 $0.21 $0.18 Nov 12 Dec 31 Return for the entire period is %. (Round to two decimal places.) The following table contains prices and dividends for a stock. All prices are after the dividend has been paid (ex-dividend). If you bought the stock on January 1 and sold it on December 31, what is your realized return? Hint: Make sure to round all intermediate calculations to at least five decimal places. Dividend Jan 1 Mar 31 Jun 30 Price 10.11 11.11 10.61 11.21 11.11 0.15 0.15 0.15 0.15 Sep 30 Dec 31 Your realized return is %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts