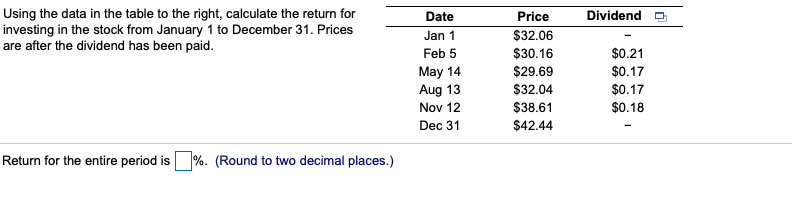

Question: Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices

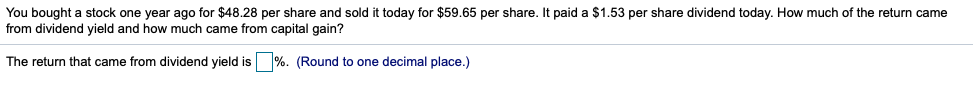

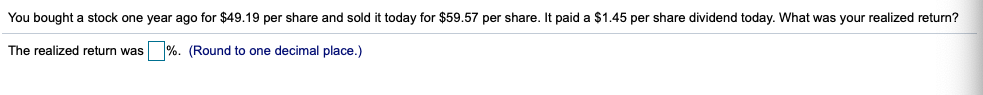

Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. Date Jan 1 Feb 5 May 14 Aug 13 Nov 12 Dec 31 Price $32.06 $30.16 $29.69 $32.04 $38.61 $42.44 $0.21 $0.17 $0.17 $0.18 Return for the entire period is %. (Round to two decimal places.) You bought a stock one year ago for $48.28 per share and sold it today for $59.65 per share. It paid a $1.53 per share dividend today. How much of the return came from dividend yield and how much came from capital gain? The return that came from dividend yield is %. (Round to one decimal place.) You bought a stock one year ago for $49.19 per share and sold it today for $59.57 per share. It paid a $1.45 per share dividend today. What was your realized return? The realized return was %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts