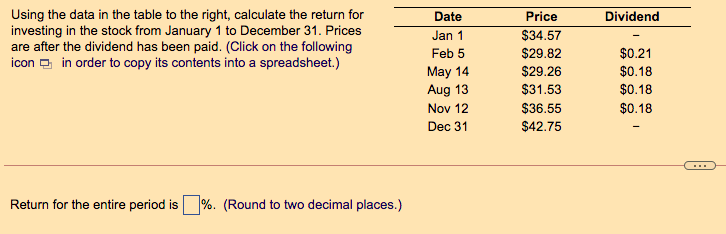

Question: Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices

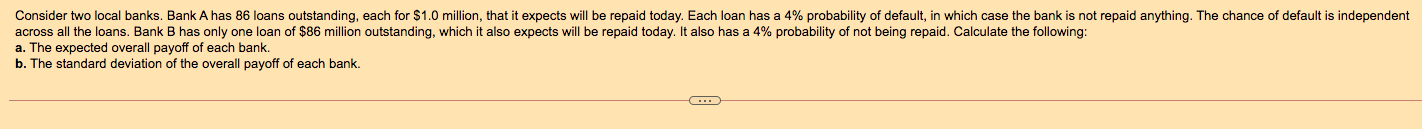

Dividend Using the data in the table to the right, calculate the return for investing in the stock from January 1 to December 31. Prices are after the dividend has been paid. (Click on the following icon e in order to copy its contents into a spreadsheet.) Date Jan 1 Feb 5 May 14 Aug 13 Nov 12 Dec 31 Price $34.57 $29.82 $29.26 $31.53 $36.55 $42.75 $0.21 $0.18 $0.18 $0.18 Return for the entire period is %. (Round to two decimal places.) Consider two local banks. Bank A has 86 loans outstanding, each for $1.0 million, that it expects will be repaid today. Each loan has a 4% probability of default, in which case the bank is not repaid anything. The chance of default is independent across all the loans. Bank B has only one loan of $86 million outstanding, which it also expects will be repaid today. It also has a 4% probability of not being repaid. Calculate the following: a. The expected overall payoff of each bank. b. The standard deviation of the overall payoff of each bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts