Question: Dividends Problem 1. ABC Corp (ABC) was formed 15 years ago by Able & Body (2 individuals). ABC uses the cash method of accounting and

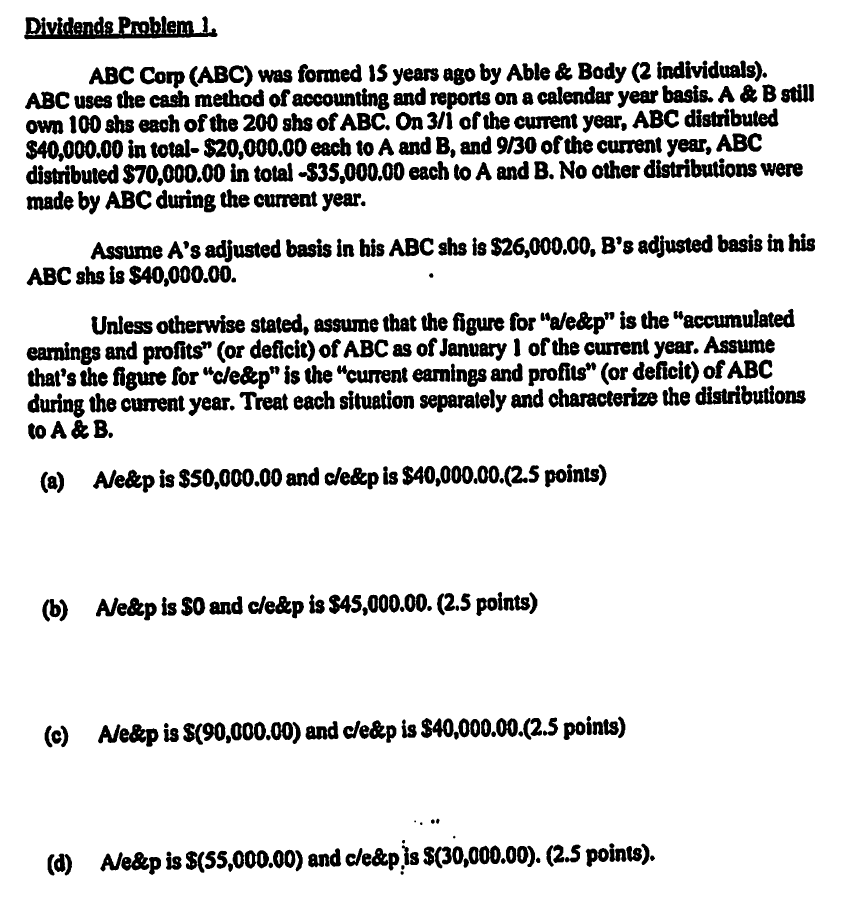

Dividends Problem 1. ABC Corp (ABC) was formed 15 years ago by Able & Body (2 individuals). ABC uses the cash method of accounting and reports on a calendar year basis. A & B still own 100 shs each of the 200 shs of ABC. On 3/1 of the current year, ABC distributed $40,000.00 in total- $20,000.00 each to A and B, and 9/30 of the current year, ABC distributed $70,000.00 in total -$35,000.00 each to A and B. No other distributions were made by ABC during the current year. Assume A's adjusted basis in his ABC shs is $26,000.00, B's adjusted basis in his ABC she is $40,000.00. Unless otherwise stated, assume that the figure for "a/edp" is the "accumulated earnings and profits" (or deficit) of ABC as of January 1 of the current year. Assume that's the figure for "cledep" is the "current earnings and profits" (or deficit) of ABC during the current year. Treat each situation separately and characterize the distributions to A & B. (a) A/edp is $50,000.00 and cledep is $40,000.00.(2.5 points) (b) Aleap is $0 and cleap is $45,000.00. (2.5 points) (c) A/edcp is $(90,000.00) and cleap is $40,000.00.(2.5 points) (d) A/e&p is $(55,000.00) and cleatp is $(30,000.00). (2.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts