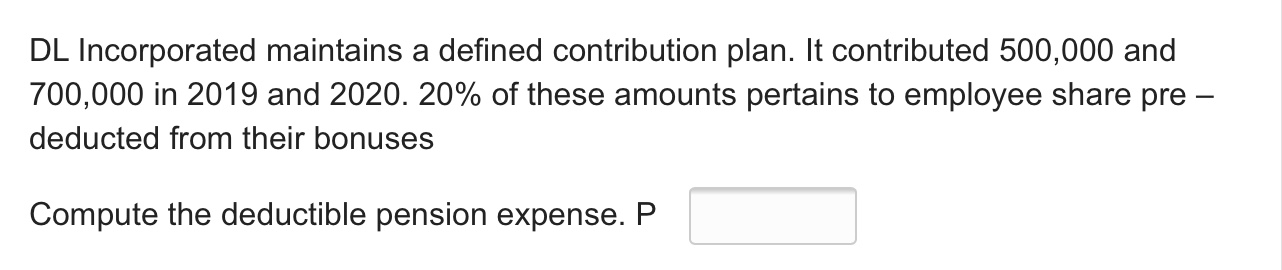

Question: DL Incorporated maintains a defined contribution plan. It contributed 500,000 and 700,000 in 2019 and 2020. 20% of these amounts pertains to employee share pre

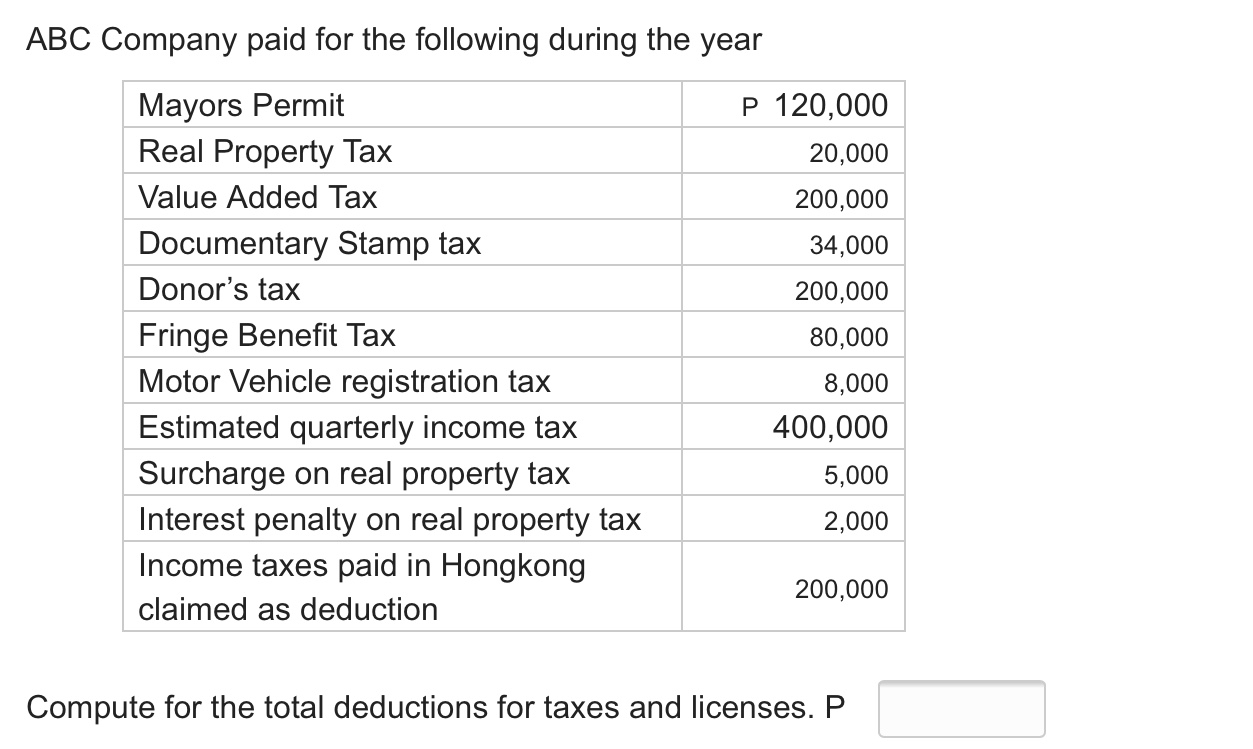

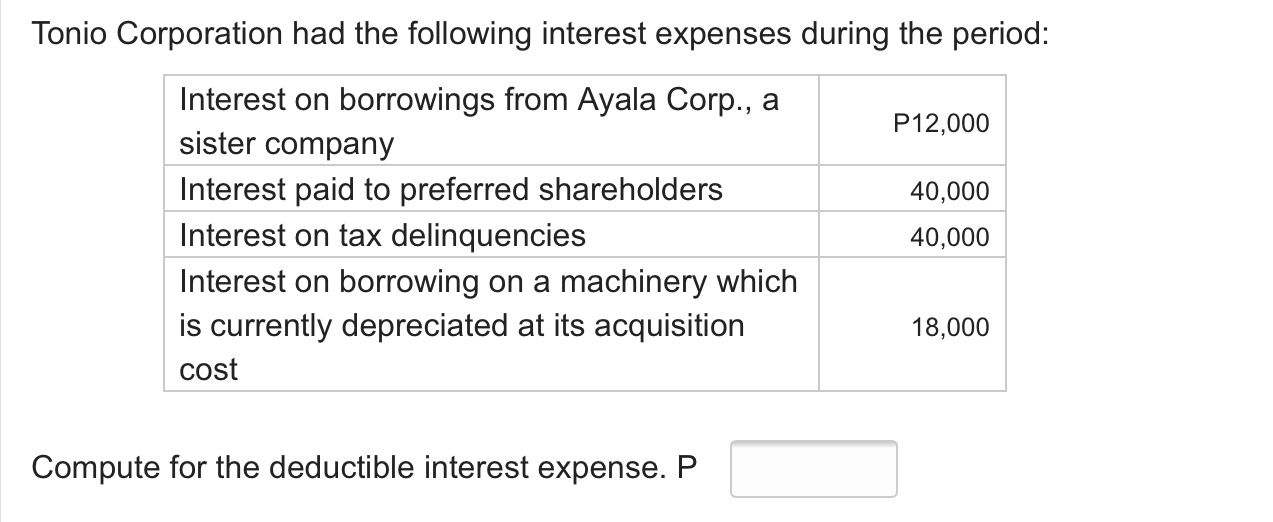

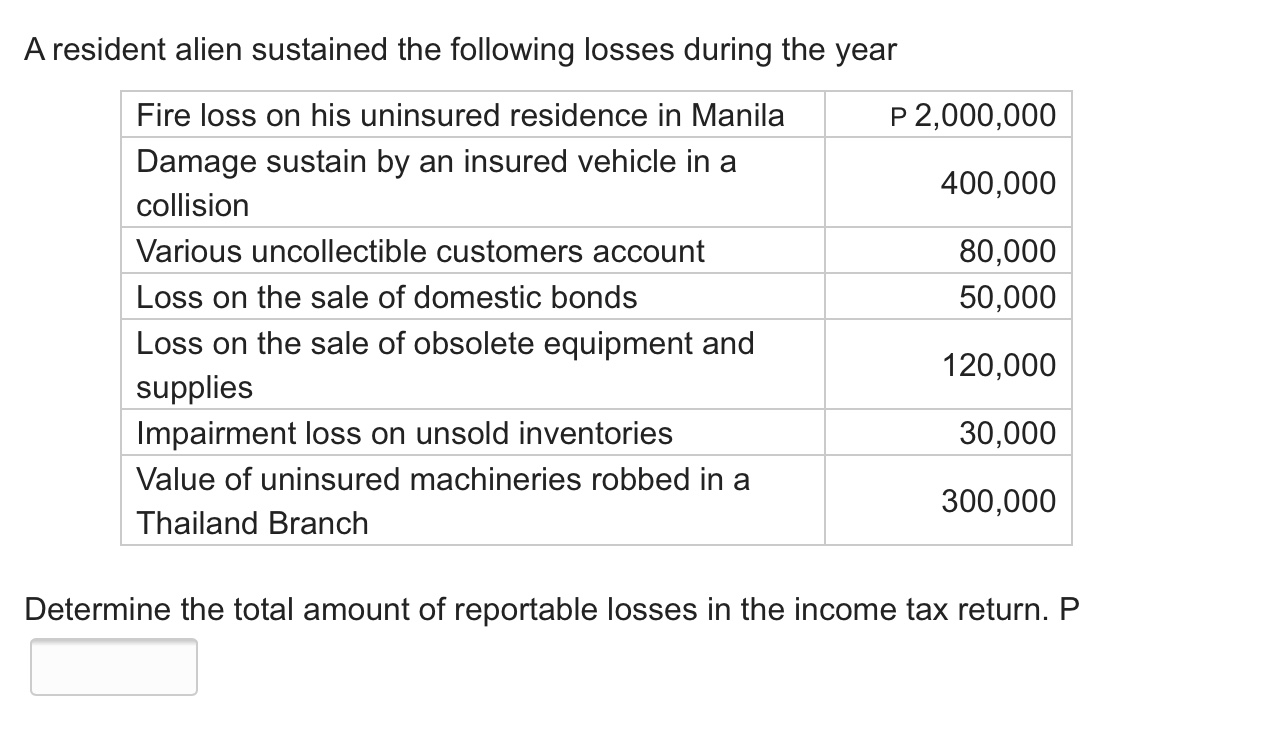

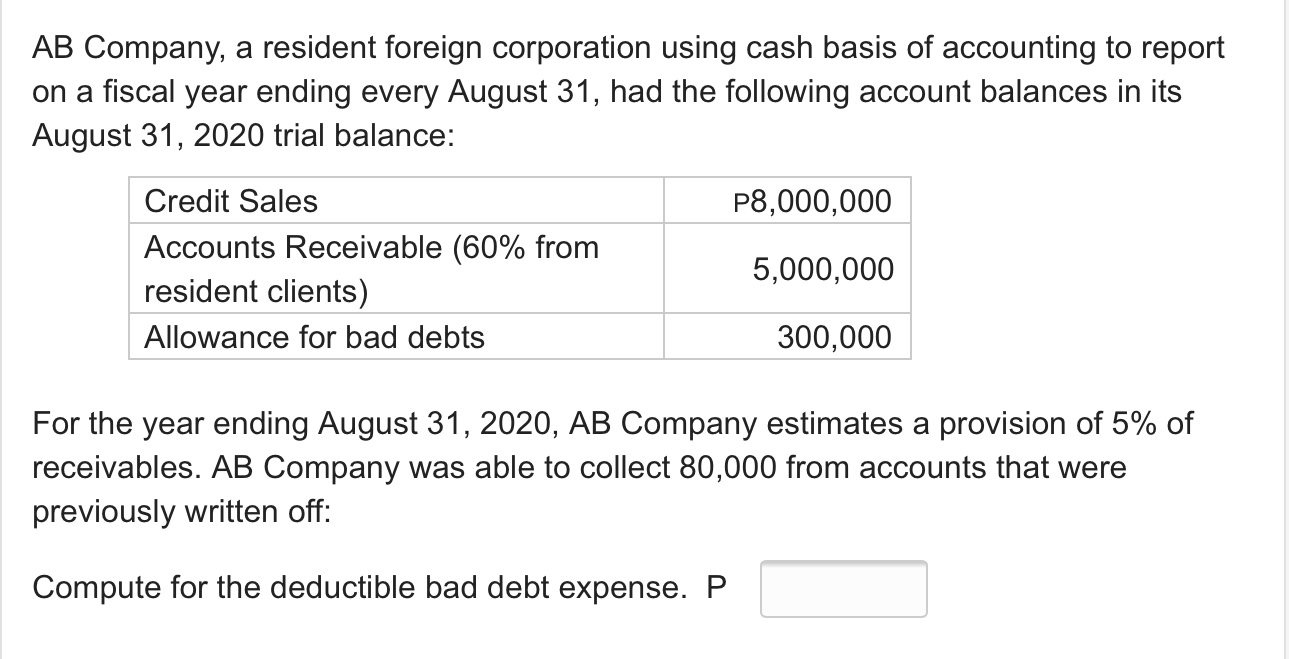

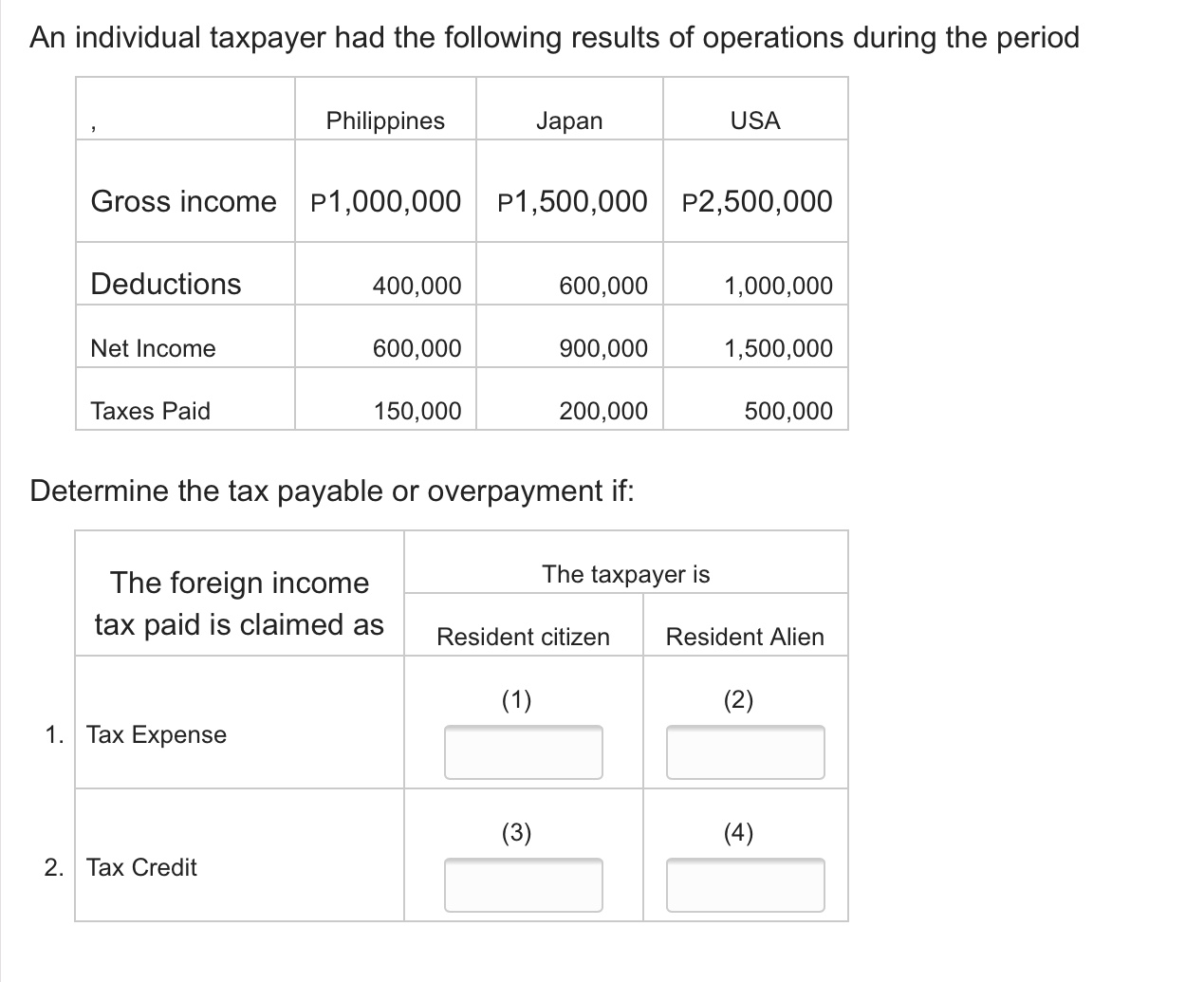

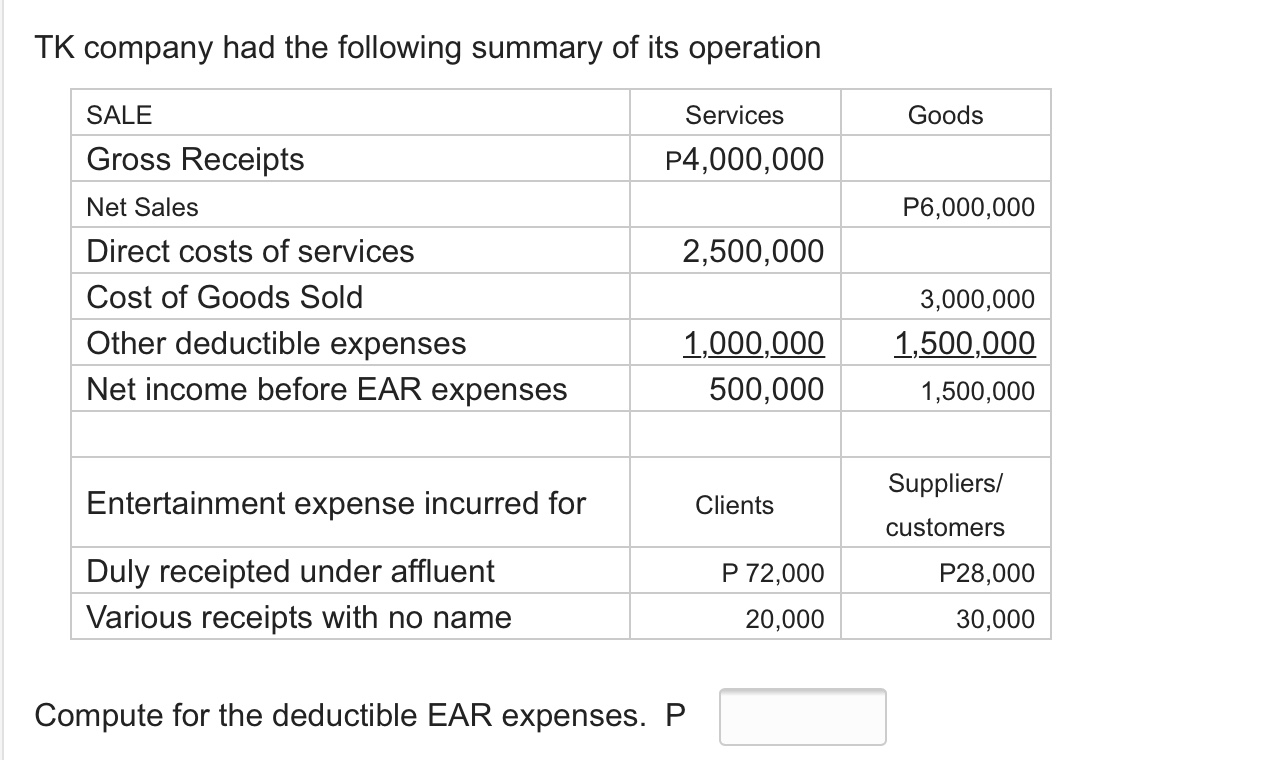

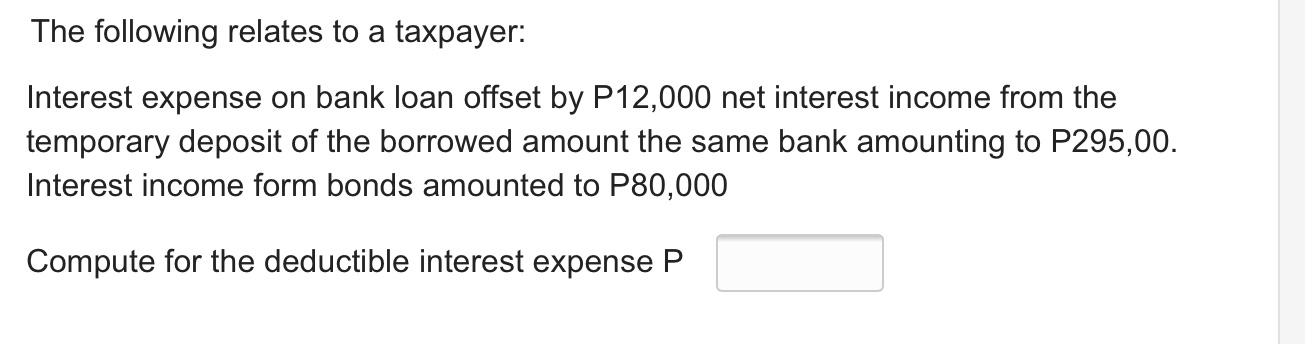

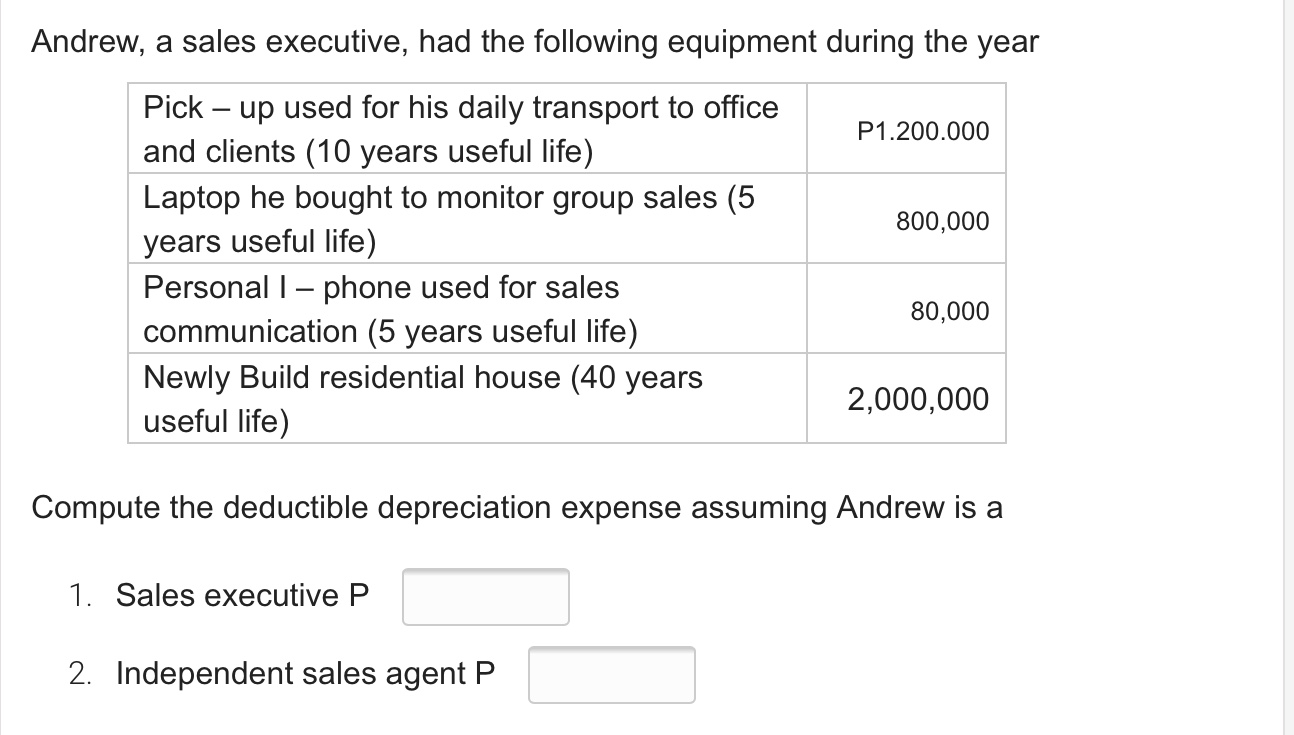

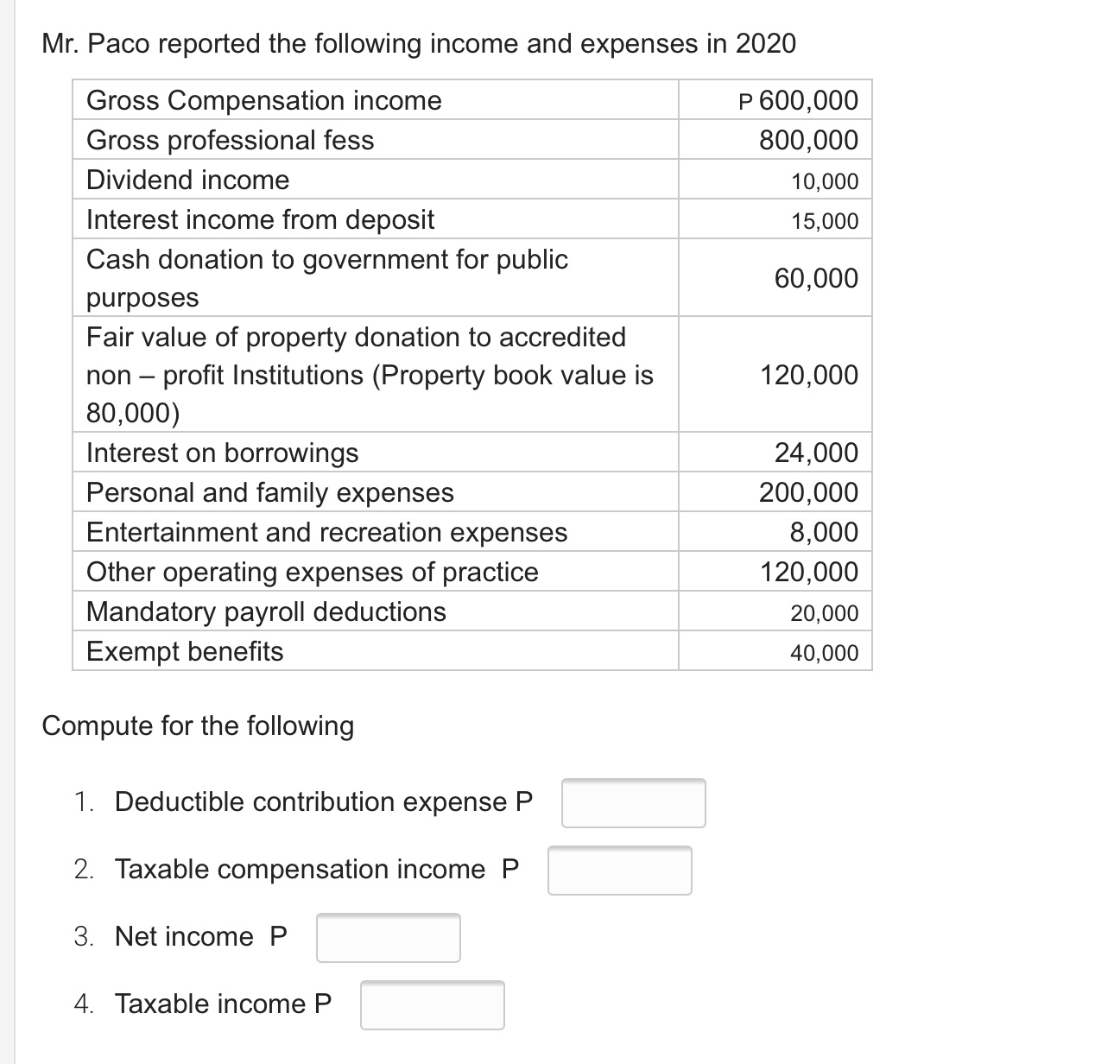

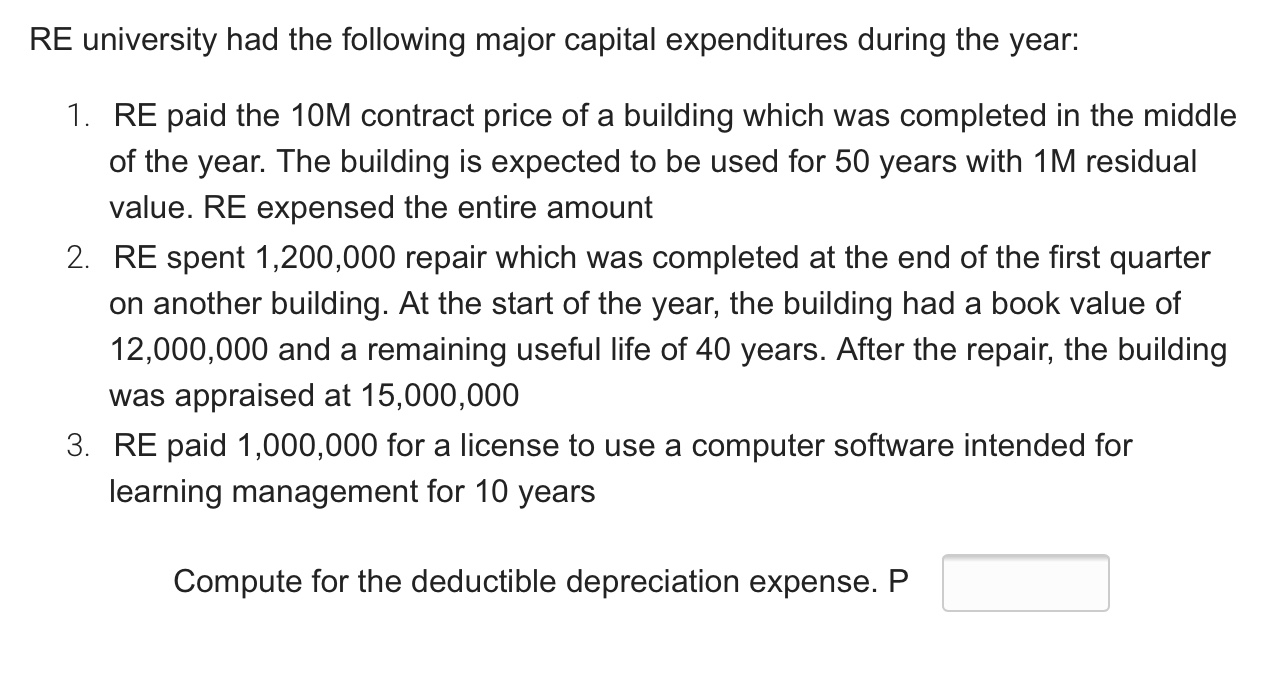

DL Incorporated maintains a defined contribution plan. It contributed 500,000 and 700,000 in 2019 and 2020. 20% of these amounts pertains to employee share pre deducted from their bonuses Compute the deductible pension expense. P ABC Company paid for the following during the year Mayors Permit P 120,000 Real Property Tax 20,000 Value Added Tax 200,000 Documentary Stamp tax 34,000 Donor's tax 200,000 Fringe Benefit Tax 80,000 Motor Vehicle registration tax 8,000 Estimated quarterly income tax 400,000 Surcharge on real property tax 5,000 Interest penalty on real property tax 2,000 Income taxes paid in Hongkong 200,000 claimed as deduction Compute for the total deductions for taxes and licenses. PTonio Corporation had the following interest expenses during the period: Interest on borrowings from Ayala Corp, a sister company P12'000 Interest paid to preferred shareholders 40,000 Interest on tax delinquencies 40,000 Interest on borrowing on a machinery which is currently depreciated at its acquisition 18,000 cost Compute for the deductible interest expense. P A resident alien sustained the following losses during the year Fire loss on his uninsured residence in Manila P 2,000,000 Damage sustain by an insured vehicle in a 400,000 collision Various uncollectible customers account 80,000 Loss on the sale of domestic bonds 50,000 Loss on the sale of obsolete equipment and 120,000 supplies Impairment loss on unsold inventories 30,000 Value of uninsured machineries robbed in a 300,000 Thailand Branch Determine the total amount of reportable losses in the income tax return. PAB Company, a resident foreign corporation using cash basis of accounting to report on a fiscal year ending every August 31, had the following account balances in its August 31, 2020 trial balance: Credit Sales P8,000,000 Accounts Receivable (60% from resident clients) Allowance for bad debts 300,000 5,000,000 For the year ending August 31, 2020, AB Company estimates a provision of 5% of receivables. AB Company was able to collect 80,000 from accounts that were previously written off: Compute for the deductible bad debt expense. P An individual taxpayer had the following results of operations during the period P1,000,000 P1,500,000 P2,500,000 400,000 600,000 1,000,000 600,000 900,000 1,500,000 150,000 200,000 500,000 Determine the tax payable or overpayment if: The foreign income The taXPayer is tax paid IS Cla'med as Resident citizen Resident Alien 1- 2. Tax Credit :| I: TK company had the following summary of its operation SALE Services Goods Gross Receipts P4,000,000 Net Sales P6,000,000 Direct costs of services 2,500,000 Cost of Goods Sold 3,000,000 Other deductible expenses 1,000,000 1,500,000 Net income before EAR expenses 500,000 1,500,000 Suppliers/ Entertainment expense incurred for Clients customers Duly receipted under affluent P 72,000 P28,000 Various receipts with no name 20,000 30,000 Compute for the deductible EAR expenses. PThe following relates to a taxpayer: Interest expense on bank loan offset by P12,000 net interest income from the temporary deposit of the borrowed amount the same bank amounting to P295,00. Interest income form bonds amounted to P80,000 Compute for the deductible interest expense P Andrew, a sales executive, had the following equipment during the year Pick - up used for his daily transport to office P1.200.000 and clients (10 years useful life) Laptop he bought to monitor group sales (5 800,000 years useful life) Personal I - phone used for sales 80,000 communication (5 years useful life) Newly Build residential house (40 years 2,000,000 useful life) Compute the deductible depreciation expense assuming Andrew is a 1. Sales executive P 2. Independent sales agent PMr. Paco reported the following income and expenses in 2020 Gross Compensation income Gross professional fess Dividend income Interest income from deposit Cash donation to government for public purposes Fair value of property donation to accredited non prot Institutions (Property book value is 80,000) Interest on borrowings Personal and family expenses Entertainment and recreation expenses Other operating expenses of practice Mandatory payroll deductions Exempt benefits Compute for the following i. Deductible contribution expense P 2. Taxable compensation income P 3. Net income P 4. Taxable income P P 600,000 800,000 10,000 15,000 60,000 120,000 24,000 200,000 8,000 120,000 20,000 40,000 RE university had the following major capital expenditures during the year: 1. RE paid the 10M contract price of a building which was completed in the middle of the year. The building is expected to be used for 50 years with 1M residual value. RE expensed the entire amount 2. RE spent 1,200,000 repair which was completed at the end of the first quarter on another building. At the start of the year, the building had a book value of 12,000,000 and a remaining useful life of 40 years. After the repair, the building was appraised at 15,000,000 3. RE paid 1,000,000 for a license to use a computer software intended for learning management for 10 years Compute for the deductible depreciation expense. P