Question: DNA Storage, Inc. ( { } ^ { 1 } ) Transaction Analysis and Financial Statements Two scientists have established a DNA Storage,

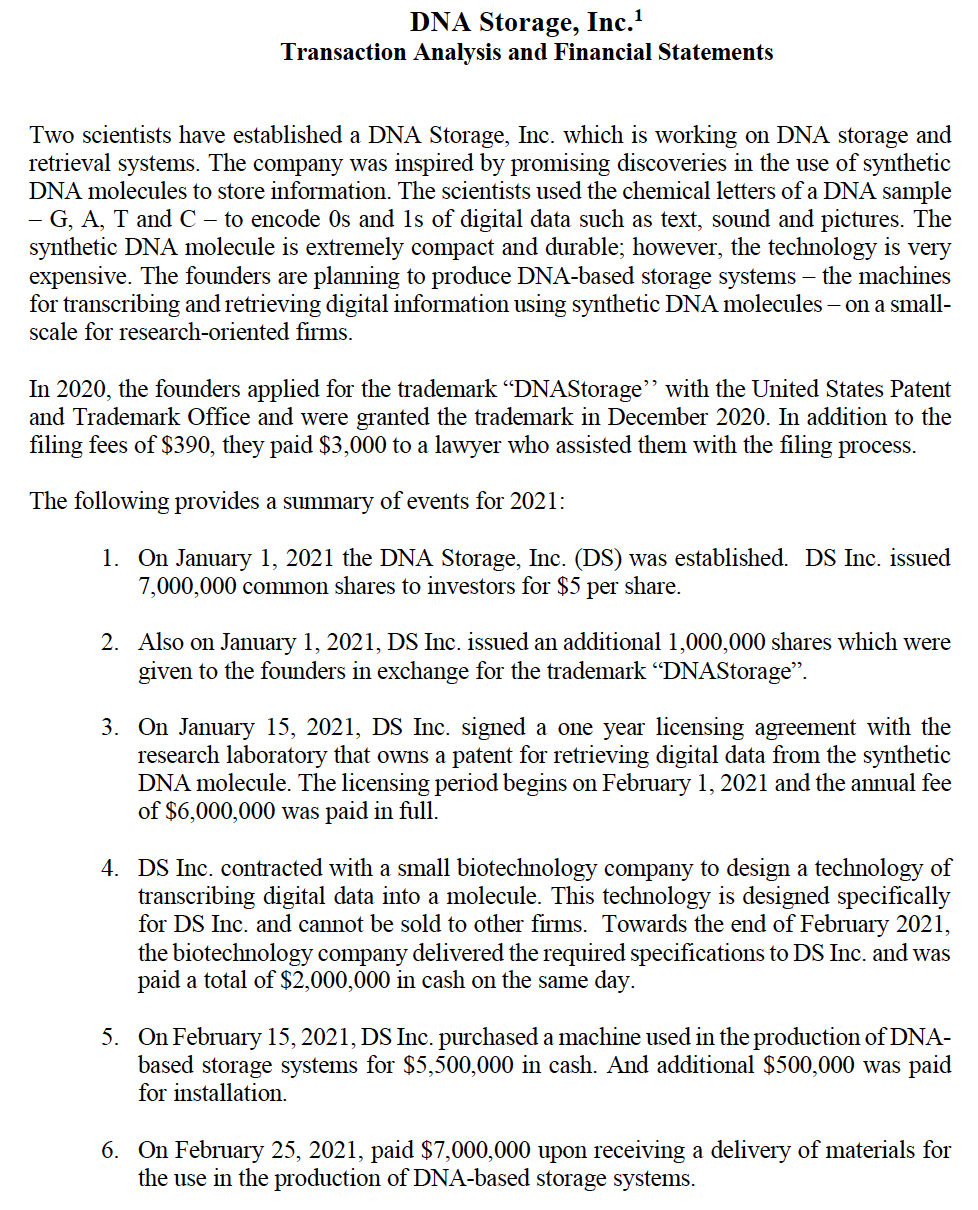

DNA Storage, Inc.

Transaction Analysis and Financial Statements

Two scientists have established a DNA Storage, Inc. which is working on DNA storage and retrieval systems. The company was inspired by promising discoveries in the use of synthetic DNA molecules to store information. The scientists used the chemical letters of a DNA sample G A T and C to encode s and s of digital data such as text, sound and pictures. The synthetic DNA molecule is extremely compact and durable; however, the technology is very expensive. The founders are planning to produce DNAbased storage systems the machines for transcribing and retrieving digital information using synthetic DNA molecules on a smallscale for researchoriented firms.

In the founders applied for the trademark "DNAStorage" with the United States Patent and Trademark Office and were granted the trademark in December In addition to the filing fees of $ they paid $ to a lawyer who assisted them with the filing process.

The following provides a summary of events for :

On January the DNA Storage, Inc. DS was established. DS Inc. issued common shares to investors for $ per share.

Also on January DS Inc. issued an additional shares which were given to the founders in exchange for the trademark "DNAStorage".

On January DS Inc. signed a one year licensing agreement with the research laboratory that owns a patent for retrieving digital data from the synthetic DNA molecule. The licensing period begins on February and the annual fee of $ was paid in full.

DS Inc. contracted with a small biotechnology company to design a technology of transcribing digital data into a molecule. This technology is designed specifically for DS Inc. and cannot be sold to other firms. Towards the end of February the biotechnology company delivered the required specifications to DS Inc. and was paid a total of $ in cash on the same day.

On February DS Inc. purchased a machine used in the production of DNAbased storage systems for $ in cash. And additional $ was paid for installation.

On February paid $ upon receiving a delivery of materials for the use in the production of DNAbased storage systems. On July DS Inc. paid $ for salaries of corporate officers and employees for the JanuaryJune period

On July DS Inc. borrowed $ from a bank for five years with the annual interest rate of which is paid semiannually.

Additional materials for the production of DNAbased storage systems were purchased for the total of $ Under the terms of suppliers, DS Inc. will make no payments until February

During the six months ended December the company paid $ for insurance for the JulyDecember period and other general expenses such as utilities.

An additional $ in cash was paid for corporate salaries and other corporate expenses for the JulyDecember period

DS Inc. spent $ in cash on advertising in The advertising was mostly done through scientific popular journals, marketing materials and presentations at biotech conferences.

Towards the end of orders for DNAbased storage systems started to arrive. DS Inc. completed and shipped a total of $ of its orders. As of the end of the year, a total of $ of these sales had still not yet been collected. The largest single receivable was due from a reputable company that is expected to pay with certainty at some future date. Most of the other receivables were on transactions that have been made close to year end, and are expected to be collected in January

On December DS Inc. signed a contract with another researchoriented firm for a delivery of a sample DNAbased storage system. The selling price specified in a contract is $ DS Inc. promised to deliver the machine on March A research company has up to days after the delivery to pay.

At the end of the year DS Inc. paid $ in interest on their bank loan.

DS Inc. received $ in interest on its cash account.

The following additional information was gathered in the process of preparing DS Inc.s inancial reports for :

The licensing agreement with the research laboratory is due to expire on January As of December DS Inc. was still negotiating the terms of an extension of the licensing agreement.

As of December there was still $ worth of materials. There were no finished or partially finished storage systems. The machine used in the production of DNAbased storage systems is expected to last for approximately five years one year of which has already passed DS Inc. does not expect the machine to have any remaining value after five years.

The trademark "DNAStorage" is initially valid for years and may be renewed indefinitely for year periods. The filing fee for a trademark renewal is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock