Question: Do 11 and 13 with steps plz Problem 3: Late Deliveries Lead time (days) = 13 Price per unit = $130 Net cost per unit

Do 11 and 13 with steps plz

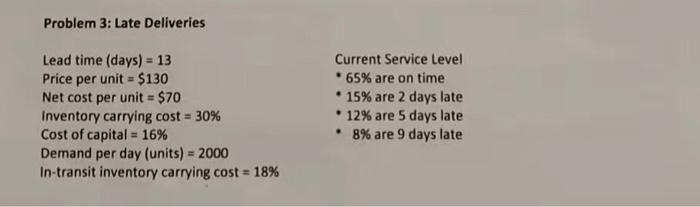

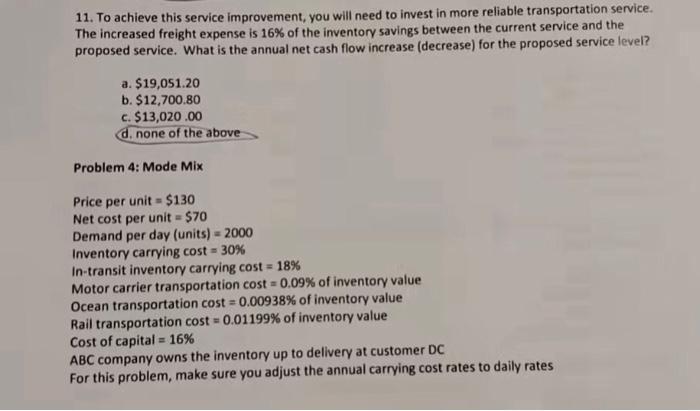

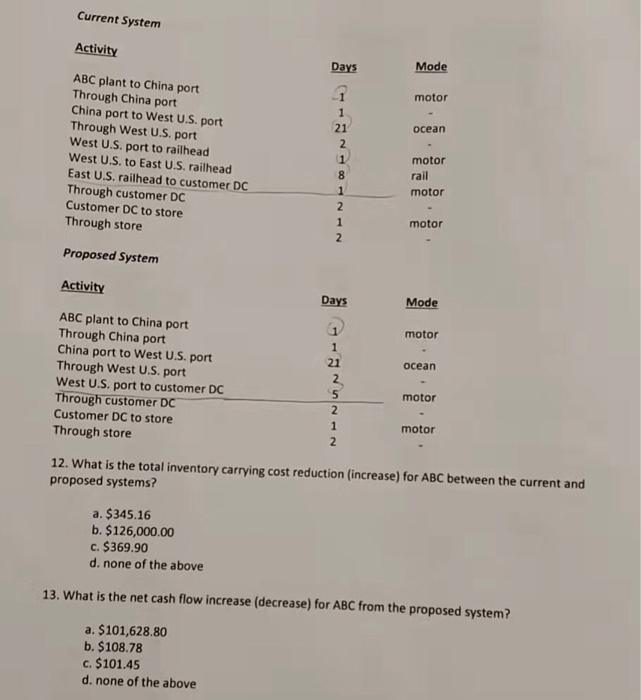

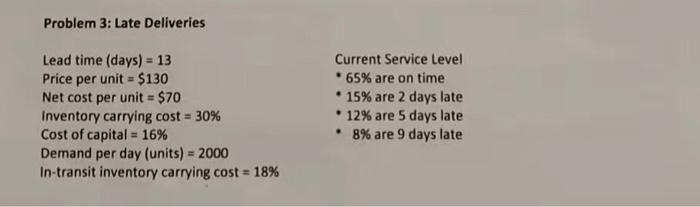

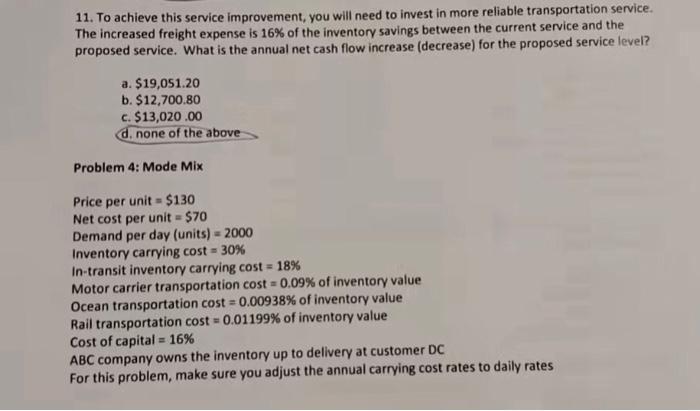

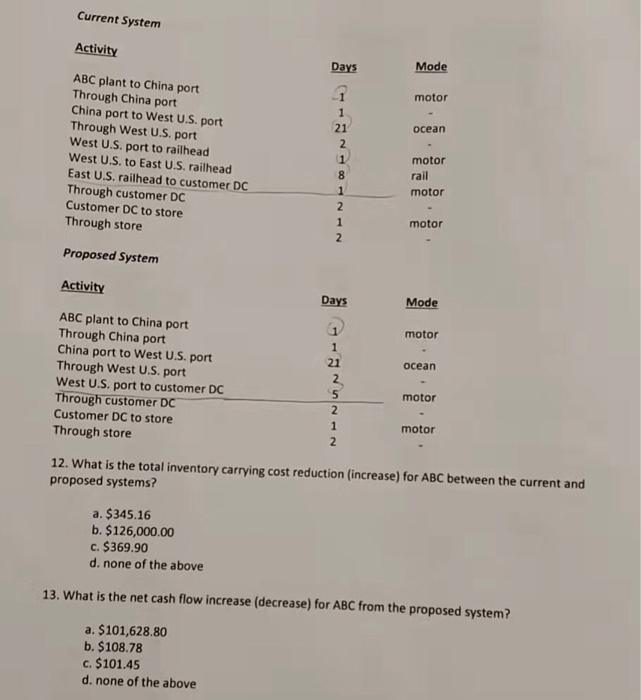

Problem 3: Late Deliveries Lead time (days) = 13 Price per unit = $130 Net cost per unit = $70 Inventory carrying cost = 30% Cost of capital = 16% Demand per day (units) - 2000 In-transit inventory carrying cost = 18% Current Service Level 65% are on time 15% are 2 days late 12% are 5 days late 8% are 9 days late 11. To achieve this service improvement, you will need to invest in more reliable transportation service. The increased freight expense is 16% of the inventory savings between the current service and the proposed service. What is the annual net cash flow increase (decrease) for the proposed service level? a. $19,051.20 b. $12,700.80 c. $13,020.00 d. none of the above Problem 4: Mode Mix Price per unit $130 Net cost per unit = $70 Demand per day (units) - 2000 Inventory carrying cost -30% In-transit inventory carrying cost = 18% Motor carrier transportation cost = 0.09% of inventory value Ocean transportation cost=0.00938% of inventory value Rail transportation cost=0.01199% of inventory value Cost of capital = 16% ABC company owns the inventory up to delivery at customer DC For this problem, make sure you adjust the annual carrying cost rates to daily rates Current System Activity Days Mode 1 motor 21 ocean ABC plant to China port Through China port China port to West U.S. port Through West U.S. port West U.S. port to railhead West U.S. to East U.S. railhead East U.S. railhead to customer DC Through customer DC Customer DC to store Through store NON- motor rail motor 1 2 motor Proposed System Activity Days Mode motor ocean ABC plant to China port Through China port China port to West U.S. port Through West U.S. port West U.S. port to customer DC Through customer DC Customer DC to store Through store 1 21 2 5 2 1 2 motor motor 12. What is the total inventory carrying cost reduction (increase) for ABC between the current and proposed systems? a. $345.16 b. $126,000.00 c. $369.90 d. none of the above 13. What is the net cash flow increase (decrease) for ABC from the proposed system? a. $101,628.80 b. $108.78 c. $101.45 d. none of the above Problem 3: Late Deliveries Lead time (days) = 13 Price per unit = $130 Net cost per unit = $70 Inventory carrying cost = 30% Cost of capital = 16% Demand per day (units) - 2000 In-transit inventory carrying cost = 18% Current Service Level 65% are on time 15% are 2 days late 12% are 5 days late 8% are 9 days late 11. To achieve this service improvement, you will need to invest in more reliable transportation service. The increased freight expense is 16% of the inventory savings between the current service and the proposed service. What is the annual net cash flow increase (decrease) for the proposed service level? a. $19,051.20 b. $12,700.80 c. $13,020.00 d. none of the above Problem 4: Mode Mix Price per unit $130 Net cost per unit = $70 Demand per day (units) - 2000 Inventory carrying cost -30% In-transit inventory carrying cost = 18% Motor carrier transportation cost = 0.09% of inventory value Ocean transportation cost=0.00938% of inventory value Rail transportation cost=0.01199% of inventory value Cost of capital = 16% ABC company owns the inventory up to delivery at customer DC For this problem, make sure you adjust the annual carrying cost rates to daily rates Current System Activity Days Mode 1 motor 21 ocean ABC plant to China port Through China port China port to West U.S. port Through West U.S. port West U.S. port to railhead West U.S. to East U.S. railhead East U.S. railhead to customer DC Through customer DC Customer DC to store Through store NON- motor rail motor 1 2 motor Proposed System Activity Days Mode motor ocean ABC plant to China port Through China port China port to West U.S. port Through West U.S. port West U.S. port to customer DC Through customer DC Customer DC to store Through store 1 21 2 5 2 1 2 motor motor 12. What is the total inventory carrying cost reduction (increase) for ABC between the current and proposed systems? a. $345.16 b. $126,000.00 c. $369.90 d. none of the above 13. What is the net cash flow increase (decrease) for ABC from the proposed system? a. $101,628.80 b. $108.78 c. $101.45 d. none of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock