Question: Do 5&6 only, 4 is decrease to 1600 Question 5 (1 point) How will the incidence of the tax be split between the firm and

Do 5&6 only, 4 is decrease to 1600

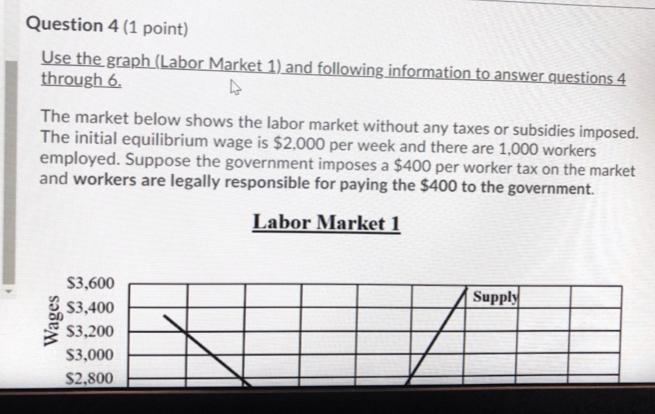

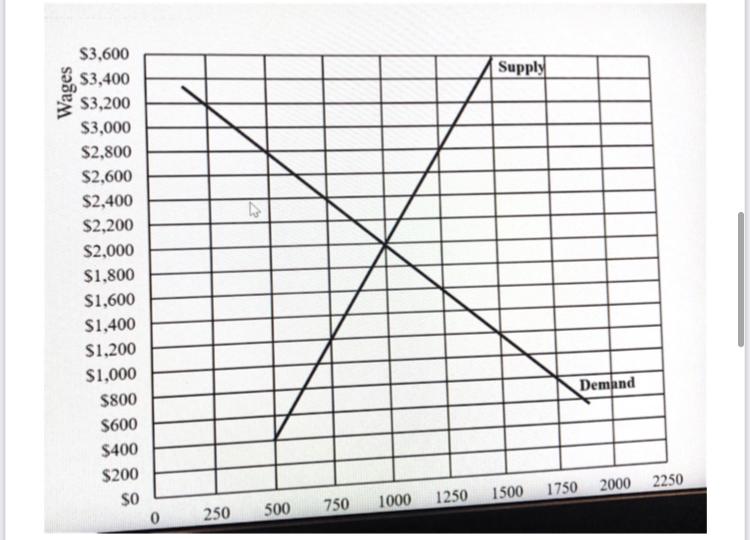

Question 5 (1 point) How will the incidence of the tax be split between the firm and workers? Workers' tax incidence will be the full $400 of the tax. Firms' tax incidence will be the full $400 of the tax. Workers' tax incidence will be $133 and firms' tax incidence will be $367. Workers' tax incidence will be $367 and firms' tax incidence will be $133. Question 6 (1 point) What will happen to employment as a result of the tax? It will decrease to 750 workers It will increase to 1.250 workers It will decrease to 920 workers It will remain at 1,000 workers It will increase to 1.080 workers Question 4 (1 point) Use the graph (Labor Market 1) and following information to answer questions 4 through 6. The market below shows the labor market without any taxes or subsidies imposed. The initial equilibrium wage is $2,000 per week and there are 1,000 workers employed. Suppose the government imposes a $400 per worker tax on the market and workers are legally responsible for paying the $400 to the government. Labor Market 1 Supply $3,600 $3,400 $3,200 $3,000 $2,800 Supply $3,600 $3,400 $3,200 $3,000 $2,800 $2,600 $2,400 $2,200 $2,000 $1,800 $1,600 $1,400 $1,200 $1,000 $800 S600 $400 $200 SO 0 Demand 1750 2000 2250 1500 1000 750 1250 500 250 Attempt 1 S400 $200 SO 0 250 500 750 1000 1250 1500 1750 2000 2250 Number of Workers What will be the impact of the tax on the quilibrium wage in this market? It will remain at $2,000 It will decrease to $1,733 It will increase to $2,400 It will decrease to $1,600 It will increase to $2,133Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock