Question: DO A COST-BENEFIT ANALYSIS USING A NET PRESENT VALUE ANALYSIS. ASSUME THE COMPANY USES A DISCOUNT RATE OF 15% PER ANNUM A firm of consultants

DO A COST-BENEFIT ANALYSIS USING A NET PRESENT VALUE ANALYSIS. ASSUME THE COMPANY USES A DISCOUNT RATE OF 15% PER ANNUM

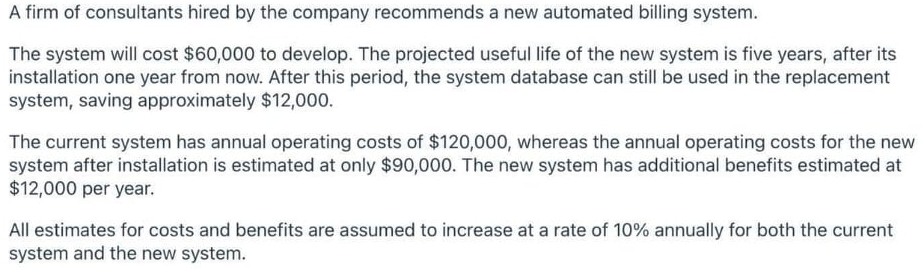

A firm of consultants hired by the company recommends a new automated billing system. The system will cost $60,000 to develop. The projected useful life of the new system is five years, after its installation one year from now. After this period, the system database can still be used in the replacement system, saving approximately $12,000. The current system has annual operating costs of $120,000, whereas the annual operating costs for the new system after installation is estimated at only $90,000. The new system has additional benefits estimated at $12,000 per year. All estimates for costs and benefits are assumed to increase at a rate of 10% annually for both the current system and the new system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts